What I learned making the Incentivized Ad Platform Database

Journal 9 Paul Bowen September 5

Here is the link to the original article.

A few weeks ago, I asked LinkedIn for feedback on an “Incentivized Ad Platform” database. I wanted to provide transparency to user acquisition managers and the free-to-play gaming ecosystem into the burgeoning incentivized ad provider space. The goal was to shed light on the lesser-known networks that operate in this space and help UA managers make more informed decisions.

Although AppsFlyer does a good job highlighting the top providers in the space on their AppsFlyer Performance Index, the focus is on the largest players. If you’re a network outside the top 4-5 incentivized providers, you’re not listed. Therefore, it’s difficult for UA managers to discover new opportunities if they find CPE campaigns work for them. This is especially challenging in a space where innovation is rampant and new platforms frequently emerge.

The response to my LinkedIn post was unexpected! I received a significant amount of feedback on the database, much of it very insightful, through direct messages. Many UA managers welcomed having a resource that offered more visibility into this fragmented market. Here are my top 3 takeaways from creating the database published here:

1. O&O product is the new ad network

The OGs of rewarded advertising, such as Tapjoy, Sponsorpay (now Fyber), and SupersonicAds (now Ironsource), originally built their businesses around an ad network model. They developed a network of gaming publishers that hosted their offerwalls, allowing players to engage with offers in exchange for virtual currency within the game they were playing.

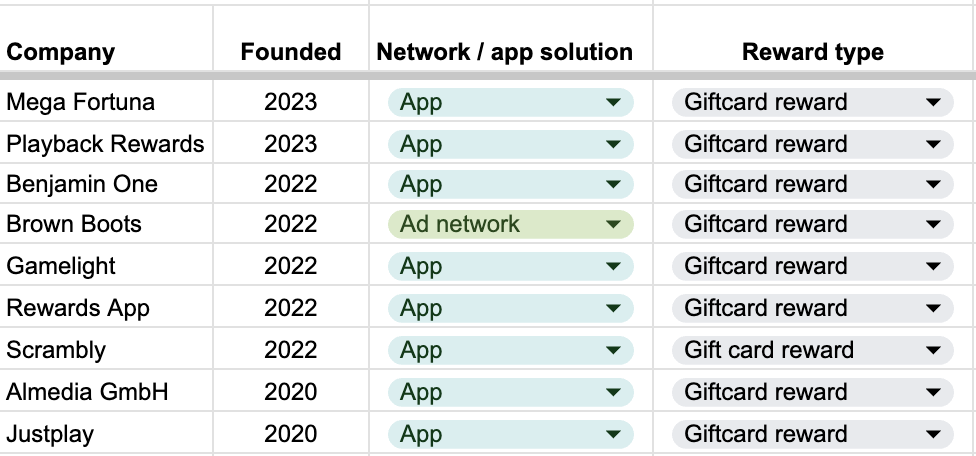

This innovative model scaled quickly but eventually faced growth challenges. To explore this further, let’s examine the founding dates of companies in the Incentivized Ad Platform database. Of the companies founded after 2020- the year Apple announced plans to deprecate the IDFA – 8 out of 9 are app-based, focusing on building their own & operated (O&O) products.

I’d suggest this shift from companies founded as Ad networks to companies founded as Apps is driven by two main factors:

- Easier to scale: O&O products provide a more streamlined scaling approach since companies are not solely reliant on external publisher networks. They’re not required to onboard and maintain relationships with external publishers and share margins, all of which have high costs.

- First-party data: Direct integration allows companies to collect and leverage first-party data, offering deeper insights into user behavior. This data is invaluable in optimizing offers and ensuring that ad experiences are personalized, relevant, and effective.

2. Gift cards are the new virtual currency

In the early days, virtual currency was the primary reward offered through incentivized ad platforms. Players would earn in-game currency for engaging with offers, which they could spend within the game. While this model remains popular amongst a specific cohort of game publishers, there’s been a noticeable shift towards offering gift cards as rewards.

This is likely because of several reasons:

- Gift cards provide a more tangible and universally appealing incentive. Players can use them across various stores, making the reward more flexible and valuable.

- The virtual currency model’s reliance on third-party publishers to show the offer wall to the end user is a significant limiting factor. Depending on how much the developer promotes it, only 2-5% of a game’s DAU views the offer.

3. Many of the companies listed buy/sell offers to each other

The incentivized ad ecosystem is highly interconnected. Many companies within this space buy and sell offers to one another to maximize their reach and keep their inventory full. I didn’t think it worthwhile to differentiate between platforms that broker single offers versus those that offer a full offer wall experience to their fellow service providers because, ultimately, it doesn’t make a ton of difference to the UA Manager.

Brokering campaigns could lead to complications, particularly around transparency. UA managers often struggle to trace the origin of traffic and offers (several have expressed their surprise to me that their campaign is on a specific provider), as the interconnected nature of these transactions can obscure where users are coming from. This lack of visibility can make it difficult to assess the quality of traffic, leading to potential issues with fraud, low engagement, or even non-compliance with advertising guidelines. UA Managers – do your due diligence! Always ask: Where is the traffic coming from? Who are the intermediaries? By doing so, you can better manage quality and mitigate risks associated with hidden traffic origins.

In Summary:

Overall, creating this database has highlighted the excitement of the incentivized ad space. As new players enter and existing networks evolve, transparency, data ownership, and the nature of reward types will continue to shape the future. It’s an exciting time that requires rigor and continued dialogue to ensure that all stakeholders—advertisers, platforms, and users —benefit from these innovations.