- arrow_back Home

- keyboard_arrow_right Highlights

Tripledot’s Big Gamble on nearly $1B Acquisition

HighlightsJournal 36 Phillip Black March 14

𝗗𝗜𝗚𝗘𝗦𝗧 𝗢𝗥 𝗗𝗜𝗘: 𝗧𝗿𝗶𝗽𝗹𝗲𝗱𝗼𝘁’𝘀 𝗕𝗶𝗴 𝗚𝗮𝗺𝗯𝗹𝗲 Tripledot’s nearly $1B acquisition of Applovin’s studios is a massive gamble but reflects the shrinking pool in the hyper-to-hybrid publisher game.

With this move, Tripledot radically shifts from 1% IAP to majority reliance. Meanwhile, peers like Voodoo and Homa slug through slow hyper-to-hybrid transitions. Rather than incremental growth, Tripledot opted for transformative growth overnight, betting they will learn, grow, and wield a zoo of studios and genres.

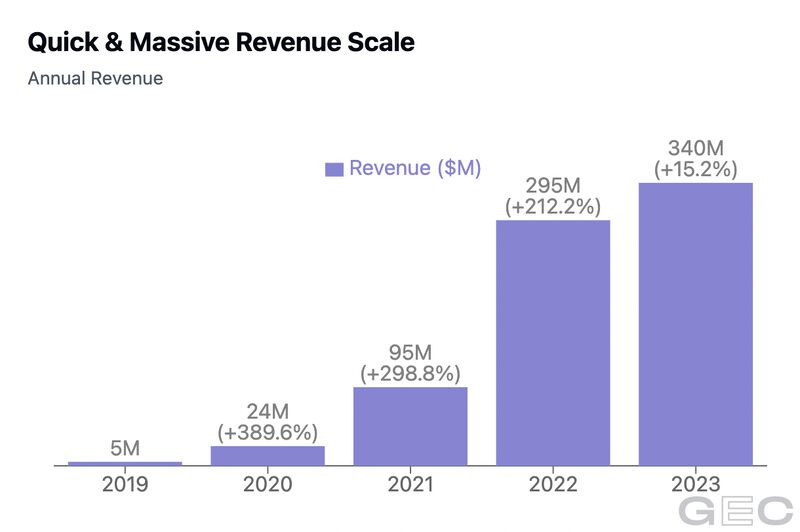

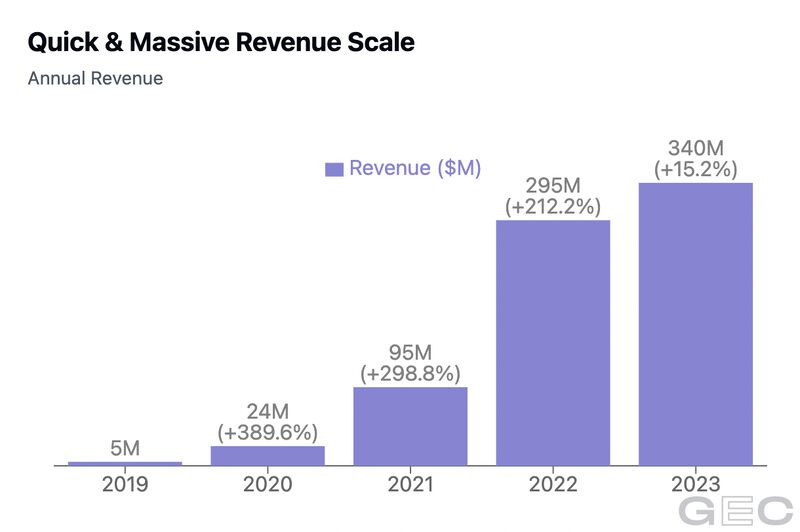

Tripledot’s filings reveal an astounding 98% ad revenue share, which brought in over $300M last year. Yet margins languished at a frustrating 15%, explaining the strategic necessity of shifting toward IAP and hybridcasual for better cost leverage and valuations. This is another reminder that gaming’s unique economics differ significantly from traditional subscription models like Netflix or even software more broadly.

Eric Seufert’s recent “Economics of Mobile Gaming” highlights how critical ads are to routing value into gaming ecosystems. “Fakeout” strategy titles such as Last War or Top Girl demonstrate opportunities for vertical integration of hypercasual’s routing power. Machine Zone’s expensive 4x engine offers intriguing company collaborations if appropriately leveraged.

Applovin’s robust social casino segment (25-30% revenue) presents fewer clear opportunities. And Project Makeover, comprising 15-20% of Applovin’s revenue, has already maximized aggressive ad tactics. Genre diversity complicates management, as domain-specific knowledge is essential. Likely, other suitors like Scopely passed due to management complexity, evident in the sub-1x valuation premium.

Typically, acquirers aggressively streamline headcount, but here, cuts risk losing critical expertise in specialized genres like 4x or social casino. Structured performance incentives, as Zynga demonstrates, provide stability.

Wiping its nearly $300M in cash reserves, Tripledot’s leveraged acquisition carries substantial operational risk—failure could be catastrophic. Yet, avoiding bold moves risks an equally painful hyper-to-hybrid stagnation.

Filings here.

Included admin costs because it appears that’s where UA spending went after becoming a holding company. Curious if there’s a good accounting explanation. Or someone has a different P&L read.