- arrow_back Home

- keyboard_arrow_right Highlights

Top 10 Hybridcasual Games in Q1 2025: The Great Puzzle Takeover

HighlightsJournalReports 18 Andrei Zubov April 23

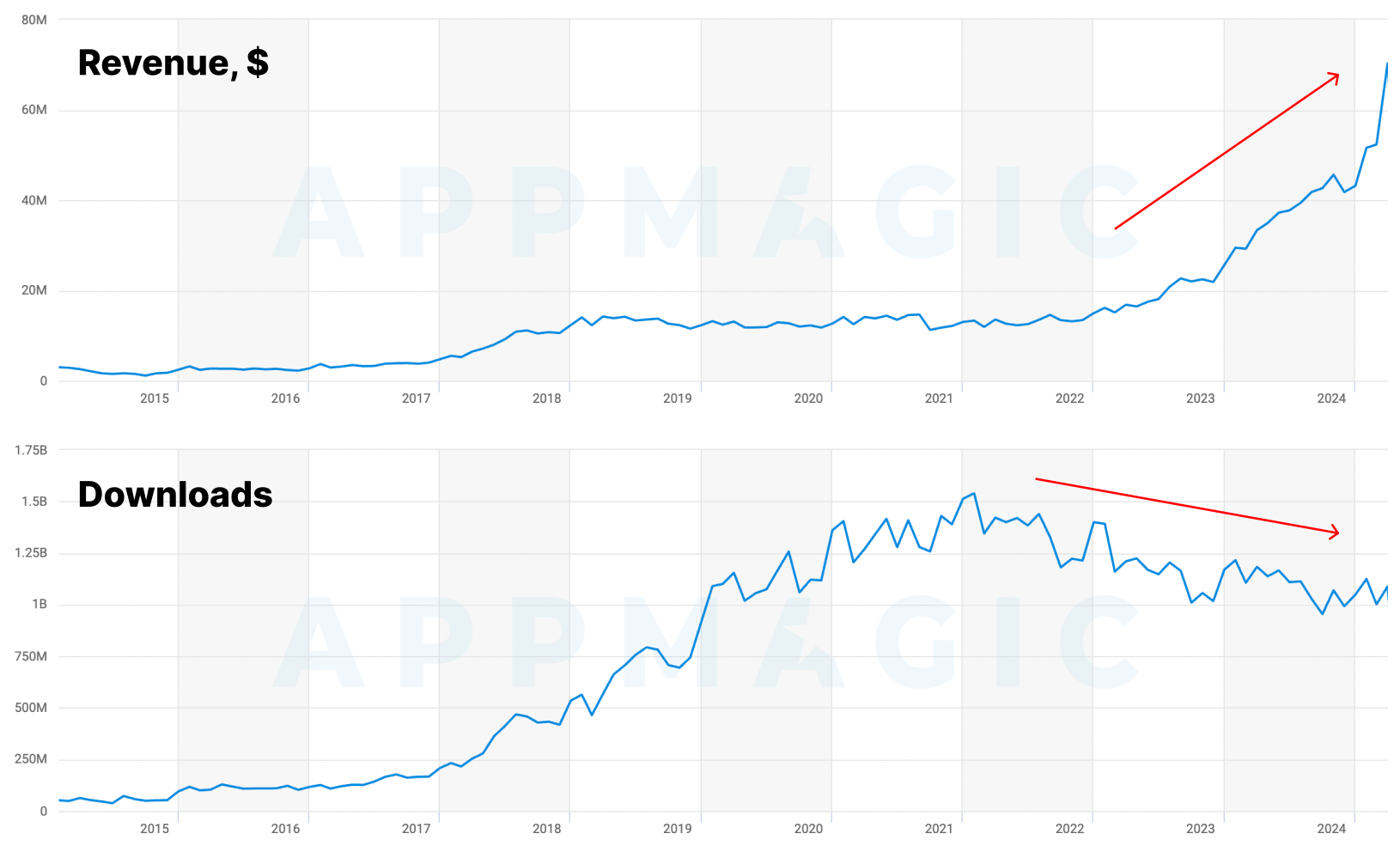

The Great Genre Shift: from Hyper to Hybrid

Last year was all about embracing Hybridcasual and adding depth to Hypercasual. Both large publishers and small studios took the simple, catchy cores of Hypercasual games and layered them with Casual features, adding boosters, meta systems, and more refined monetization. We covered this shift in detail in our Casual Games Report 2024!

This wave of change also led us to adjust our own approach. As developers enhanced their UA with LiveOps and monetization upgrades, we realized it was time to level up our reporting, too, which is why our quarterly Hypercasual Games reports are going Hybridcasual!

IAP growth of the Hypercasual market

IAP growth of the Hypercasual market

If you’re familiar with our navigation system (and if not, just have a quick look here), you might be wondering how we analyzed the Hybridcasual segment if there’s no dedicated tag for it (yet!).

We kept things simple: filtered the Hypercasual tag by top-grossing apps. That alone reveals a solid list of IAP-heavy titles that clearly lean toward Hybridcasual in both design and monetization.

To have a look at those titles yourself…

- Check out our Top Apps chart as a free user, or

- Watch the leaders trade positions over time with our Market Segment Dashboard as a premium user

Now that we’re done with methodology, let’s take a look at the Q1 2025 top grossers from the Hybridcasual segment!

📩 Want to stay on top of hybridcasual trends? We’re running an exclusive monthly digest with key insights, market data, and LiveOps trends. If you’re interested, message Stan on LinkedIn or by email: [email protected].

Top 10 Hybridcasual Games in Q1 2025

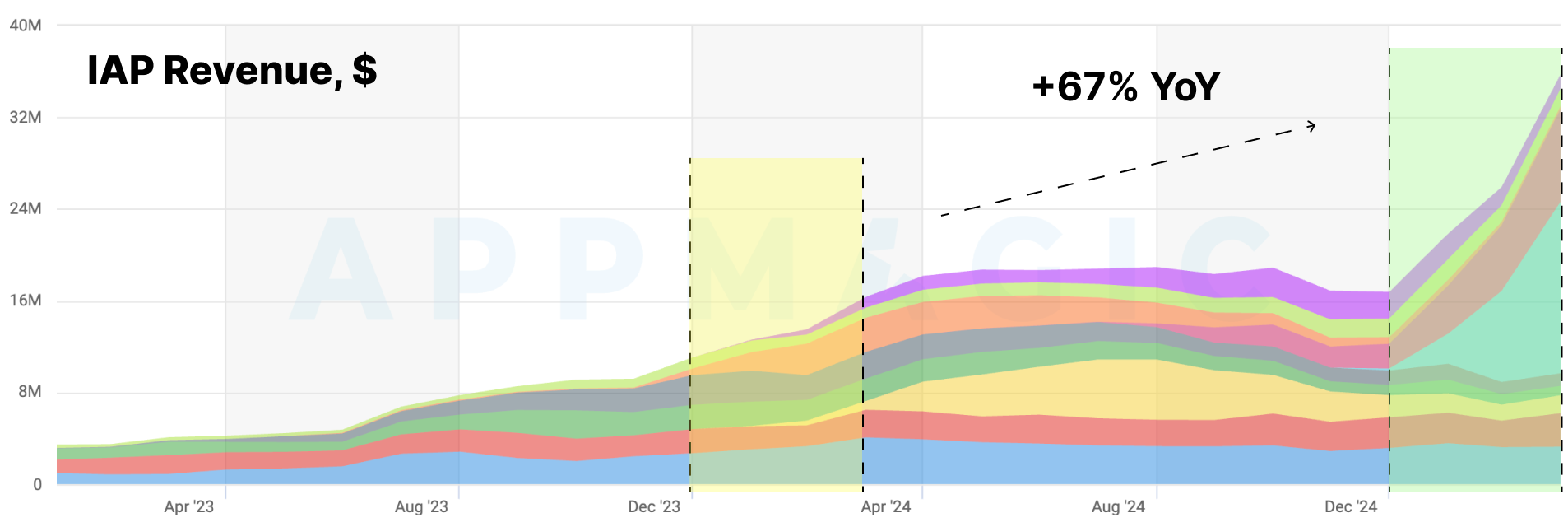

Recording a hefty 67% increase over Q1 2024, the top 10 Hybridcasual games generated $87M in total net IAP revenue in the opening quarter of 2025.

This growth highlights the ongoing shift within the Hypercasual space toward stronger monetization models and longer-term engagement. One of the key drivers behind this surge was Rollic’s Color Block Jam: a standout title we’ll cover in more detail later in the article.

Top 10 Hyper/Hybridcasual games as a trend

Top 10 Hyper/Hybridcasual games as a trend

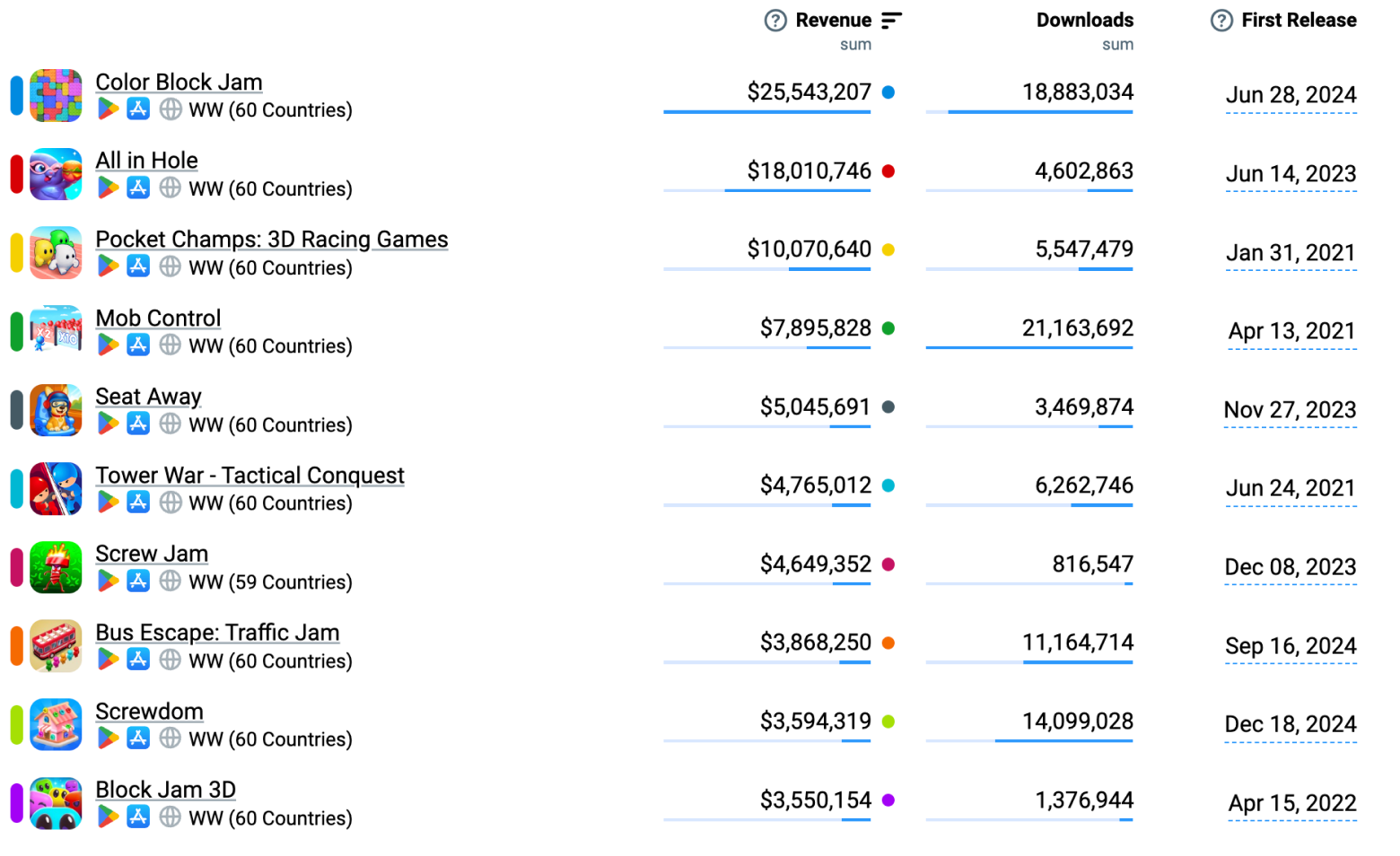

Looking at the charts, it is clear that Puzzle games dominated the top 10 this quarter, generating 48% of the total revenue. Not far behind, Arcade titles brought in 45%, leaving only a small share for other genres. When we break the list down further, the top-performing titles fall into five clear subgenres:

- Block Puzzle: Color Block Jam, Bus Escape

- Screw Puzzle: Screw Jam, Screwdom

- Sort Puzzle: Block Jam 3D

- Arcade: All in Hole, Pocket Champs, Mob Control, Alien Invasion

- Strategy: Tower War

Top 10 Hybridcasual games in Q1 2025

Top 10 Hybridcasual games in Q1 2025

Just two years ago, the picture looked very different. In Q1 2023, Arcade games made up 77% of the top 10’s revenue. Their share started slipping in Q1 2024, falling to 52%, and the trend continued into 2025.

Zooming in on the Puzzle category, we see three monetizing subgenres standing out. Block Puzzle leads the way, bringing in 71% of the total Puzzle revenue this quarter. Screw Puzzle follows with 20%, while Sort Puzzle contributes the remaining 9%.

Tiny but shiny, Sort Puzzle may be the smallest slice—but it’s also the fastest-growing. As we highlighted in our Casual Games Report 2024, this subgenre posted a x5.6 YoY revenue increase. So it’s definitely worth a go-over!

A Closer Look at the Biggest Hybridcasual Games of the Quarter

While many titles contributed to this quarter’s $87M revenue, we decided to spotlight just four of them. These games not only led the charts but also represent key patterns and innovation in Hybridcasual design, from different monetization approaches to genre evolution. Each one stands out for a specific reason, helping illustrate what’s shaping the market right now.

Color Block Jam by Rollic

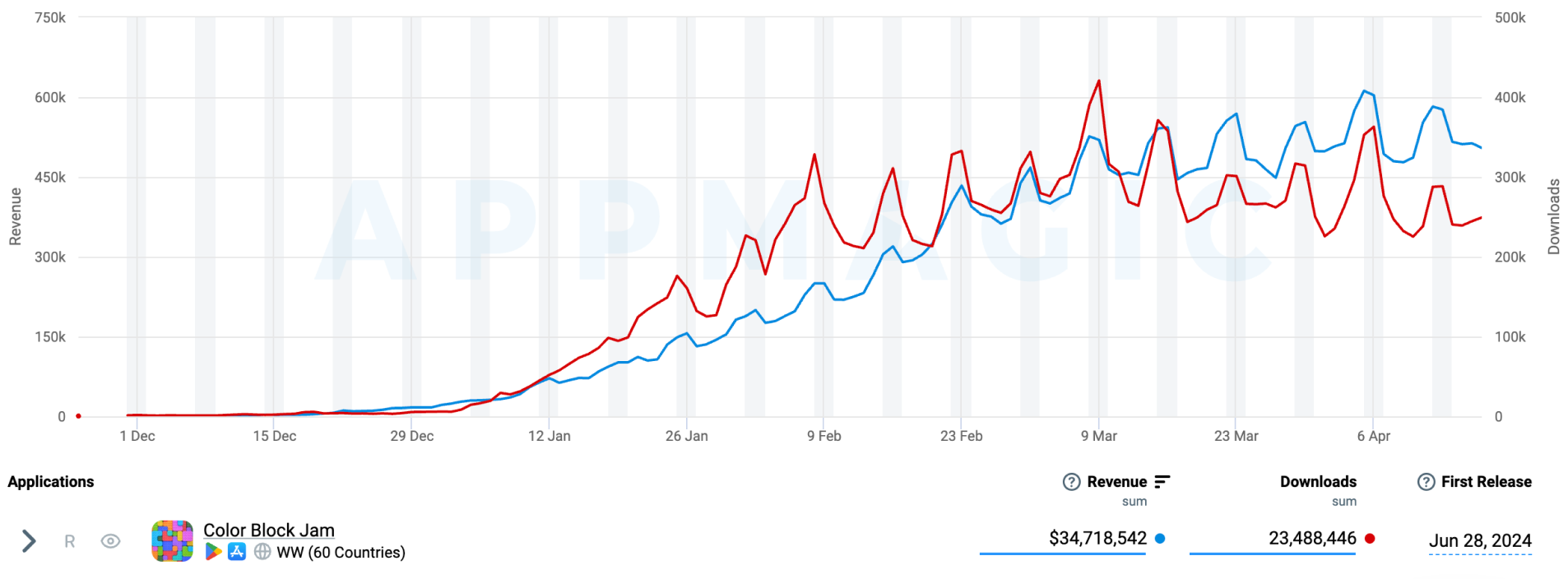

Color Block Jam revenue & downloads

Color Block Jam revenue & downloads

The first of the tops is Color Block Jam —in Q1 2025 alone, it generated a total of $25M. While we can’t compare it YoY, as the game wasn’t out there in Q1 2024, the leap from just $175K in Q4 2024 speaks for itself! That’s why we’ll dedicate a bit more time to this title; the scale alone makes it worth a closer look.

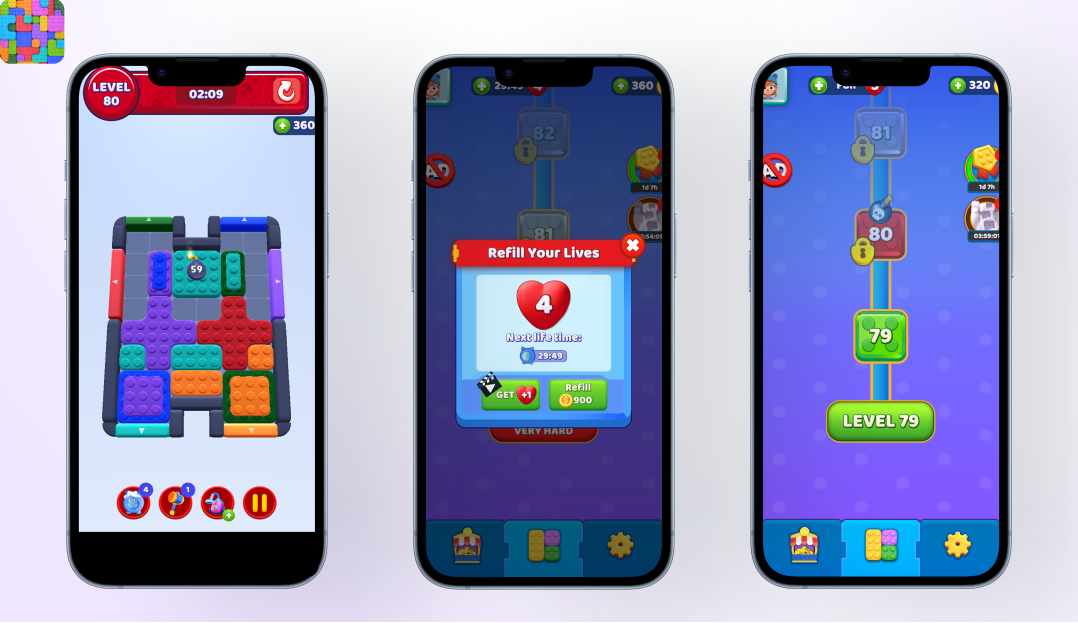

The game blends Block Puzzle and Parking Jam mechanics, where players clear colored blocks by moving them through matching gates on a tight, grid-based board. The game follows a deterministic puzzle format, meaning that level layouts remain the same across replays.

💡 Determined levels allow players to plan their moves, optimize strategies, and return with new approaches after failed attempts, which increases engagement and reduces churn as losses feel fair yet solvable.

One of the game’s strongest features is its carefully designed difficulty curve and timers. The first session keeps players engaged for 20–30 minutes. Meanwhile, starting from level 20–25, completion times shorten, and the challenge intensifies. This encourages the use of paid boosters and consumable coins—a common tactic in Hybridcasual design.

Monetization is thoughtfully staged: early levels are ad-free to ease players in, while banner and interstitial ads appear later—often after each level—to boost coin rewards. IAPs like the Failed Level Pack help players get through tougher stages, while they also manage a limited lives system that resets over time or can be refilled with hard currency. The shop features constant bundles only—there are no limited-time offers in the game.

Monetization is thoughtfully staged: early levels are ad-free to ease players in, while banner and interstitial ads appear later—often after each level—to boost coin rewards. IAPs like the Failed Level Pack help players get through tougher stages, while they also manage a limited lives system that resets over time or can be refilled with hard currency. The shop features constant bundles only—there are no limited-time offers in the game.

Notably, the game doesn’t rely on complex LiveOps or seasonal events. Its event grid includes just two repeating activities, and there are no social mechanics like team play. Still, the game maintains strong engagement thanks to its high difficulty, especially by Casual Puzzle standards, which gives players a strong sense of challenge and accomplishment.

Much of the game’s success comes from a powerful UA strategy. Alongside high-budget campaigns that successfully bring in paying users, Color Block Jam also benefits from viral gameplay clips circulating around social media—both in Western markets and in the CIS regions.

🎯 In short, it’s a case where a polished core loop, well-paced difficulty, and well-executed user acquisition do all the heavy lifting—and deliver exceptional results.

All in Hole by Homa

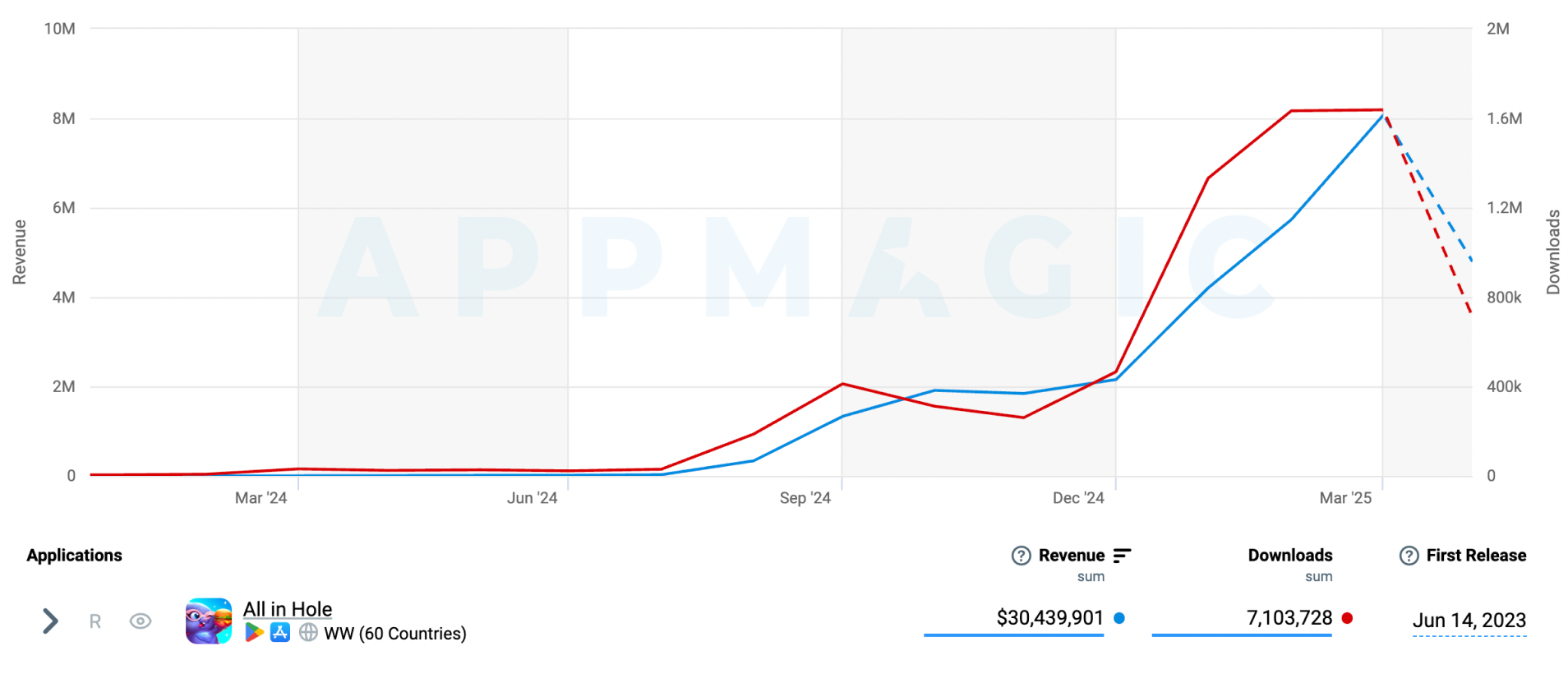

All in Hole revenue & downloads

All in Hole revenue & downloads

Another game that stood out in Q1 2025 is All in Hole, which tripled its revenue since Q4 2024, reaching $17.7M. It’s one of the first games in the Eat & Grow subgenre (where players control a hole that swallows objects in order to grow) that managed to break into the top-grossing segment.

The game builds on the classic Hole.io-style core loop but adds progression and retention layers: short, dynamic levels (3–5 minutes each), diverse level design, and clearly defined goals—like finding and consuming specific objects, rather than just clearing the field. These tweaks make the gameplay more varied and goal-driven.

The real leap, however, comes from both meta and monetization. The game throws in LiveOps features like limited-time events, boosters, cosmetic items, and a battle pass. These systems extend retention and drive spending.

💡 Many of these features are inspired by top performers like Royal Match and Monopoly GO!, which continue to shape Hybridcasual design today. Curious to learn more? Check out our breakdown of Monopoly GO! events.

The monetization model is predominantly IAP-focused, making it one of the more “mature” examples of Hybridcasual in Q1. And its success proves the power of pairing satisfying gameplay with short-term goals, clever event systems, and well-calibrated meta.

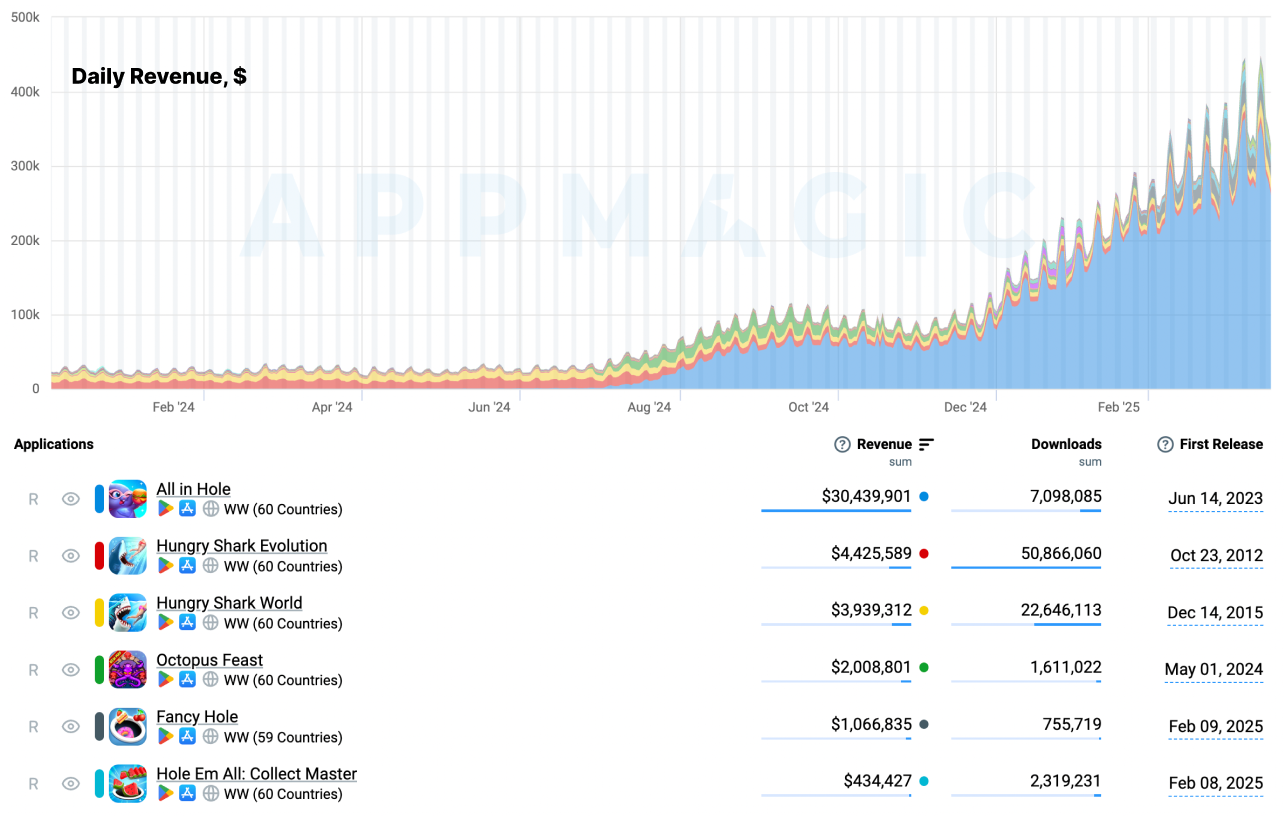

Eat & Grow Market Segment Dashboard

Eat & Grow Market Segment Dashboard

The success of All in Hole has reshaped the entire Eat & Grow subgenre, driving a x9 YoY revenue growth in Q1 2025. While the game itself accounts for 84% of that revenue, its influence extends far beyond just numbers—it’s already setting a new standard for the category.

Before its breakout, the subgenre was mostly led by shark-themed games. But today, we’re seeing more and more developers follow All in Hole’s lead, replacing sharks with holes and humans with colorful props, while wrapping it all in modern Hybridcasual design.

🎯 In short, All in Hole shows how a satisfying core loop, layered progression, and well-integrated LiveOps can turn a simple mechanic into a breakthrough hit—and set a new benchmark for its entire subgenre.

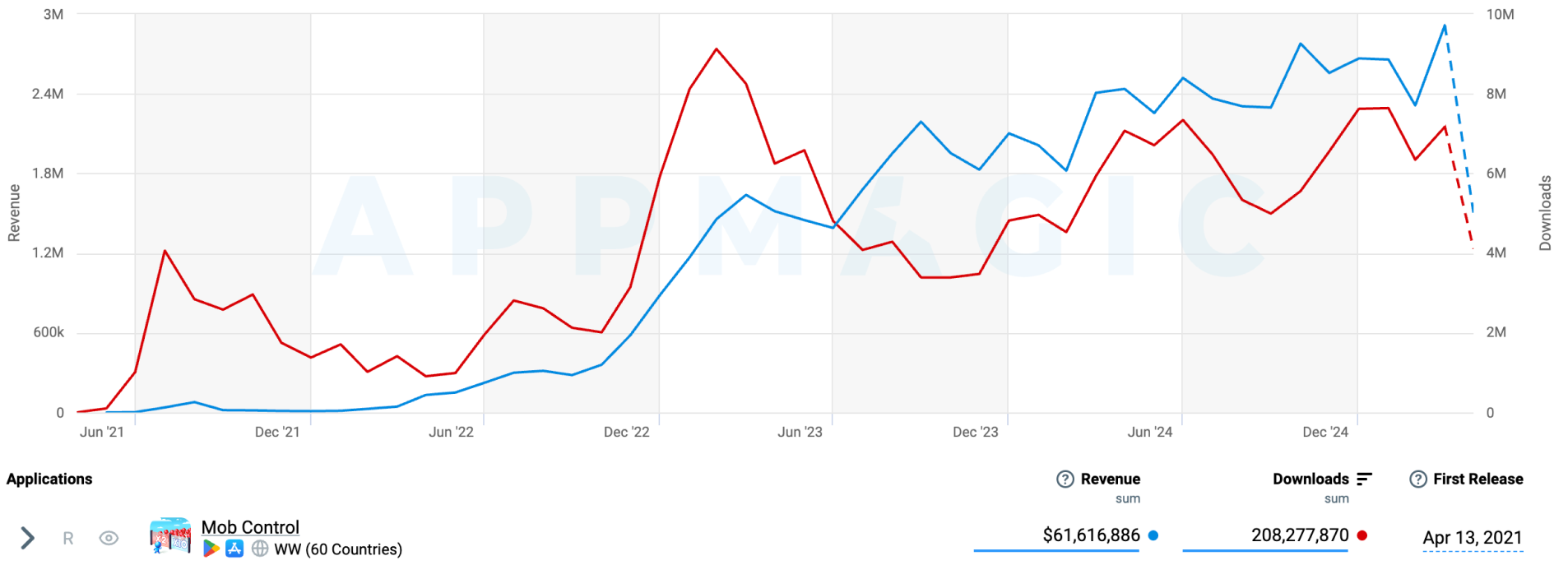

Mob Control by Voodoo

Mob Control revenue & downloads

Mob Control revenue & downloads

Mob Control by Voodoo first launched back in 2021, but the game still hasn’t lost its momentum. In fact, it reached an all-time monthly revenue high in March 2025! Looking at the full quarter, Mob Control generated $7.9M in IAP revenue and over 21M downloads in Q1 2025—marking a +27% YoY revenue growth and a +37% growth in downloads compared to Q1 2024.

While the gameplay itself remains simple and familiar, built around the classic “multiplying gates” mechanic, Mob Control shines in how it monetizes its audience. The game gives players a clear incentive to make their first purchase: any IAP, including a subscription, removes interstitial and banner ads. This significantly lowers the friction for first-time spenders.

But what makes the monetization model stand out is how it handles rewarded ads. Rather than eliminating them entirely, Mob Control introduces “skip tickets” (called Skip’its)—a system that lets players skip watching rewarded ads while still receiving the associated benefits. Skip’its can be earned or purchased and are also included in the subscription. Once they run out, players can either return to watching ads or buy more tickets. This keeps both IAA and IAP monetization streams healthy.

But what makes the monetization model stand out is how it handles rewarded ads. Rather than eliminating them entirely, Mob Control introduces “skip tickets” (called Skip’its)—a system that lets players skip watching rewarded ads while still receiving the associated benefits. Skip’its can be earned or purchased and are also included in the subscription. Once they run out, players can either return to watching ads or buy more tickets. This keeps both IAA and IAP monetization streams healthy.

💡 Such an approach solves a common Hybridcasual problem: how to monetize paying users without killing off ad revenue. With skip tickets, Mob Control makes spending feel optional but convenient—an approach other developers may want to consider.

The subscription model also adds value without cannibalizing IAA. It removes forced ads, offers a limited number of Skip’its, and introduces players to a premium experience that may convert them into long-term players.

🎯In short, Mob Control proves that smart monetization can be as strategic as gameplay. With light meta, valuable rewarded ads, and a clever skipping system, it’s a strong blueprint for sustainable hybridcasual revenue without hurting the player experience.

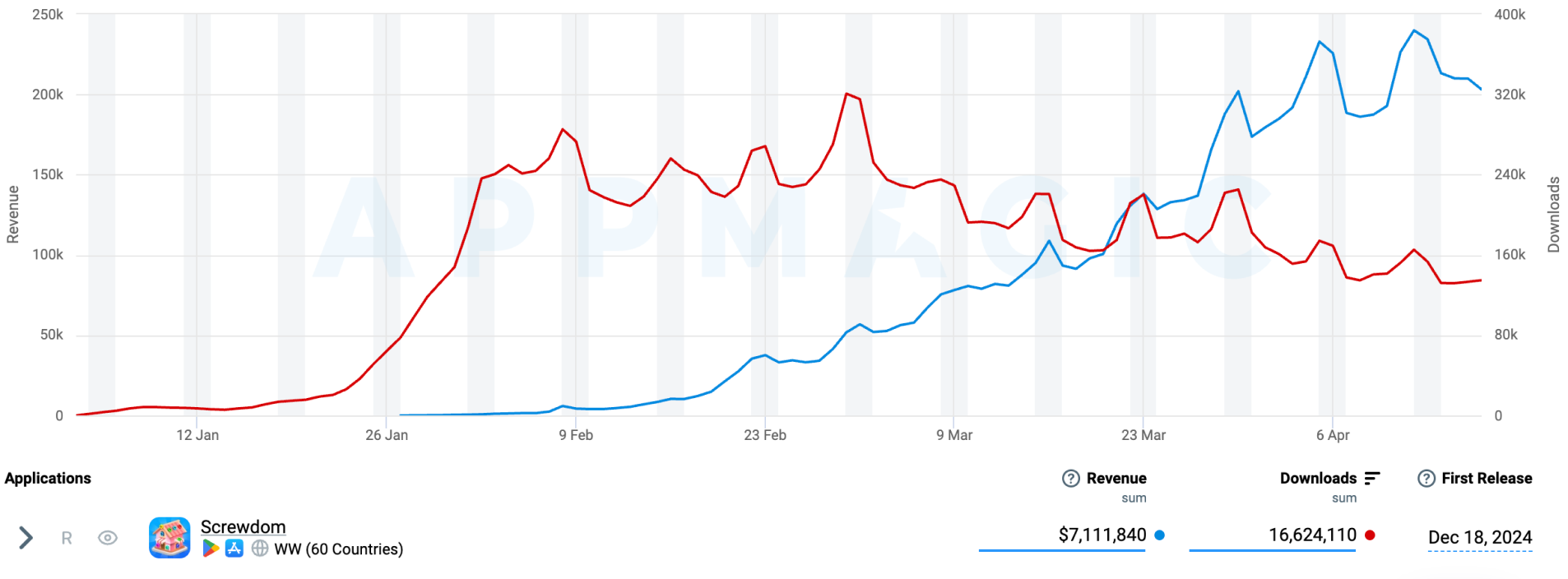

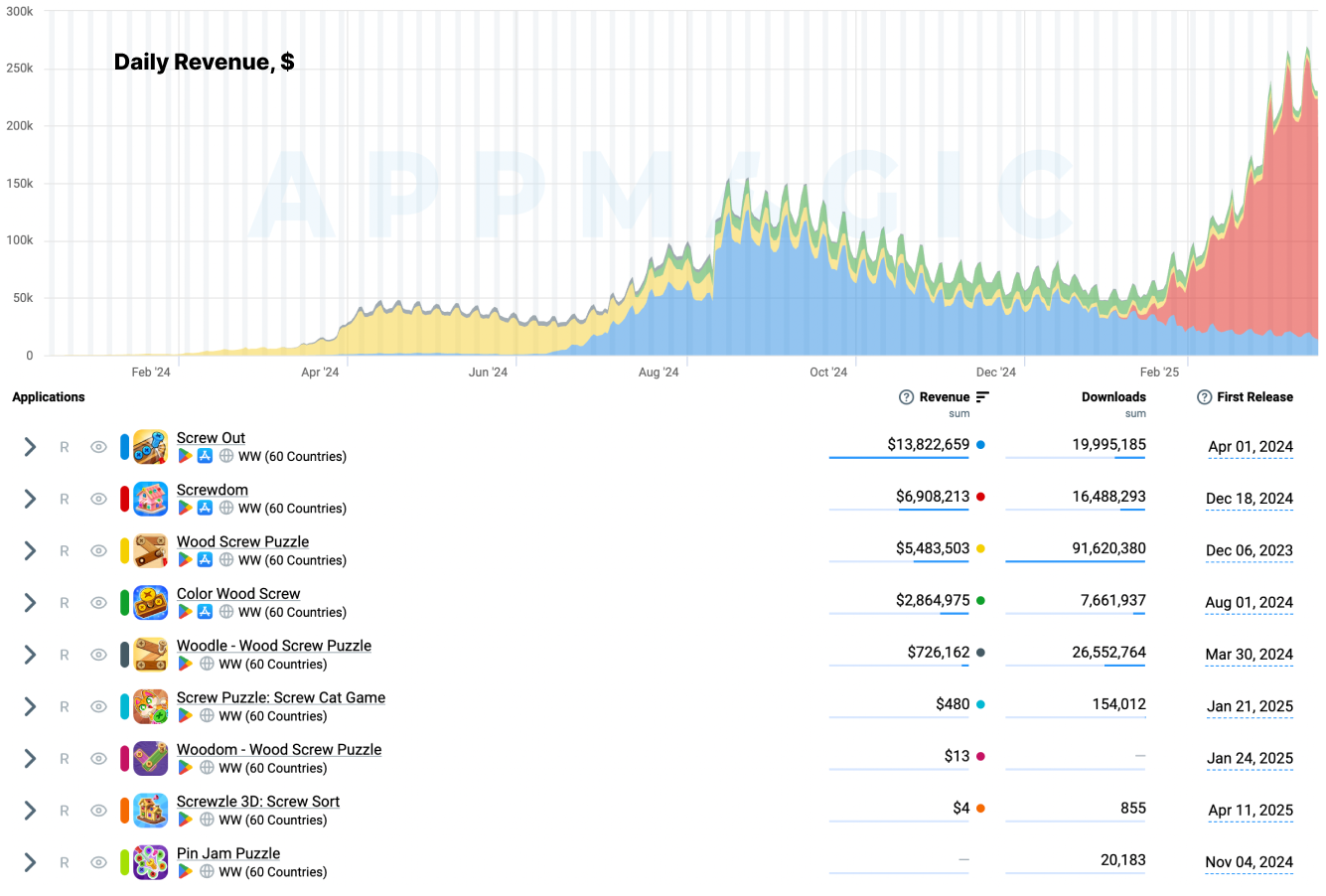

Screwdom by iKame Games – Zego Studio

In Q1 2025, Screwdom generated a sweet $3.6M in revenue. However, it is only the beginning of the rise, as in April 2025, the title has already earned more than in the entire previous quarter. As of now, it’s the highest-grossing Screw Puzzle game on the market.

Screw Puzzles—along with Block and Sort Puzzles—perfectly illustrate what Hybridcasual is all about: simple, satisfying Hypercasual mechanics paired with deeper meta and monetization systems borrowed from Casual games.

iKame Games has been steadily building expertise in the Screw Puzzle niche, launching a total of 9 titles in the genre. Their first major success, Screw Out (April 2024), generated nearly $14M in revenue and close to 20M downloads. That experience laid the groundwork for Screwdom—helping the team tune what resonates with players and turn the concept into a top-grossing title!

iKame Games – Zego Studio’s portfolio of Screw Puzzle titles

iKame Games – Zego Studio’s portfolio of Screw Puzzle titles

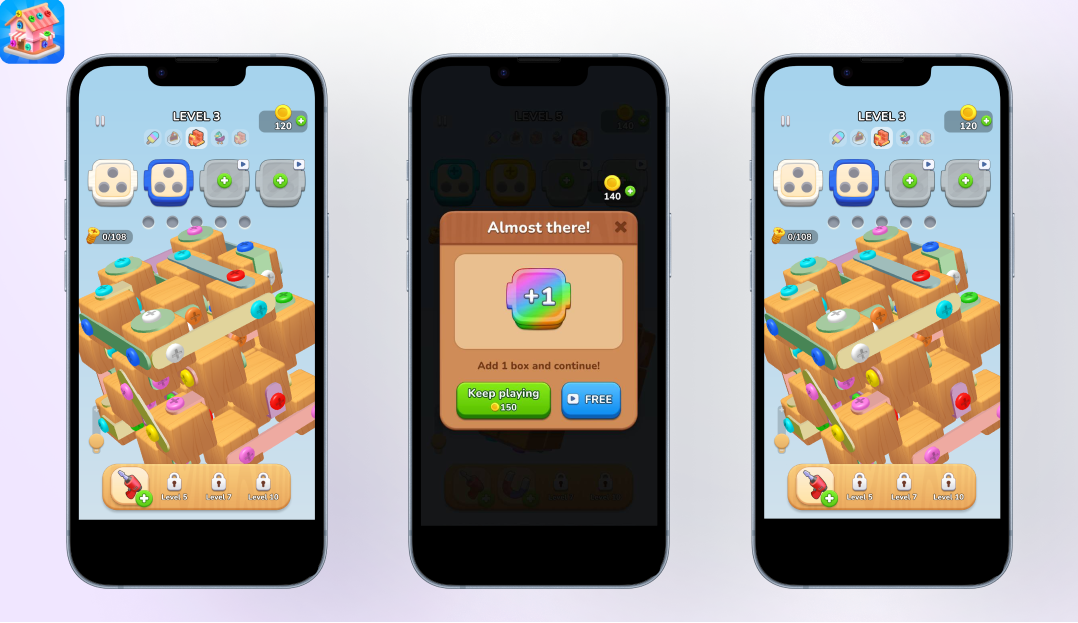

One of the key things that sets Screwdom apart is its move from 2D to 3D. While most Screw Puzzle games stick to flat designs, Screwdom adds visual and mechanical depth by rendering puzzles in 3D. This shift isn’t just cosmetic: it makes gameplay more tactile and challenging. With camera rotation, spatial awareness becomes part of the puzzle, and missteps feel more punishing.

💡 We’ve seen this approach succeed before in titles like Cube Master 3D, which took the Tile Puzzle to 3D. Now, Screwdom proves once again that adding a third dimension to familiar mechanics can drive engagement and boost monetization—when done right.

The more complex levels in Screwdom can take anywhere from 5 to 15 minutes to complete. This time investment makes failure feel costly—and that’s exactly the point. Players are strongly motivated to spend rather than start over, which is why coin packs have become the game’s main monetization driver. It’s a solid example of how well-calibrated fail states can boost IAP performance in Hybridcasual design.

The more complex levels in Screwdom can take anywhere from 5 to 15 minutes to complete. This time investment makes failure feel costly—and that’s exactly the point. Players are strongly motivated to spend rather than start over, which is why coin packs have become the game’s main monetization driver. It’s a solid example of how well-calibrated fail states can boost IAP performance in Hybridcasual design.

🎯 In short, Screwdom keeps growing its IAP revenue thanks to thoughtful progression, a 3D format that adds challenge and depth, and a monetization strategy refined through earlier iKame titles like Screw Out.

Conclusion and Key Takeaways

The Hybridcasual market isn’t just evolving—it’s maturing fast. In Q1 2025 alone, the top 10 Hybridcasual titles brought in $87M in IAP revenue, marking a 67% YoY growth. At the same time, the genre still relies on ad monetization, which makes it much more profitable than it might seem based on IAP revenue only. Puzzle and Arcade games continue to lead, accounting for over 90% of that total, with standout titles like Color Block Jam, All in Hole, Mob Control, and Screwdom pushing the boundaries of what Hybridcasual can be.

The first quarter of the year shows that one of the scenarios for success in 2025 is pairing the Hypercasual core with layered progression and smart monetization borrowed from Casual titles: — Color Block Jam showed how far a well-tuned difficulty curve and a polished core loop can go, even without advanced LiveOps. — All in Hole proved that blending a simple Eat & Grow mechanic with LiveOps and event systems can reshape an entire subgenre. — Mob Control brought in a fresh approach to hybrid monetization, using skip tickets to balance IAA and IAP without hurting player experience. — Screwdom reminded us how visual depth, well-calibrated fail states, and years of niche expertise can take the genre to distinctly new heights.

What we are not covering in this report is the UA side of Hybridcasual—yet it’s a crucial part of the equation. When a highly clickable core loop meets the latest user acquisition trends, the result is often lower CPIs and better scalability. It’s yet another reason why Hybridcasual titles have become so attractive to both indie teams and major publishers.

With developers constantly refining what works, from meta systems to monetization to marketing, the genre is evolving fast. But one thing is clear: in 2025, Hybridcasual is no longer a mere experiment—instead, it is a prominent trend setting a whole bunch of new standards.