- arrow_back Home

- keyboard_arrow_right Highlights

The State of Turkish Gaming Ecosystem: Invest in Türkiye

HighlightsJournalReports 117 Ömer Yakabagi February 19

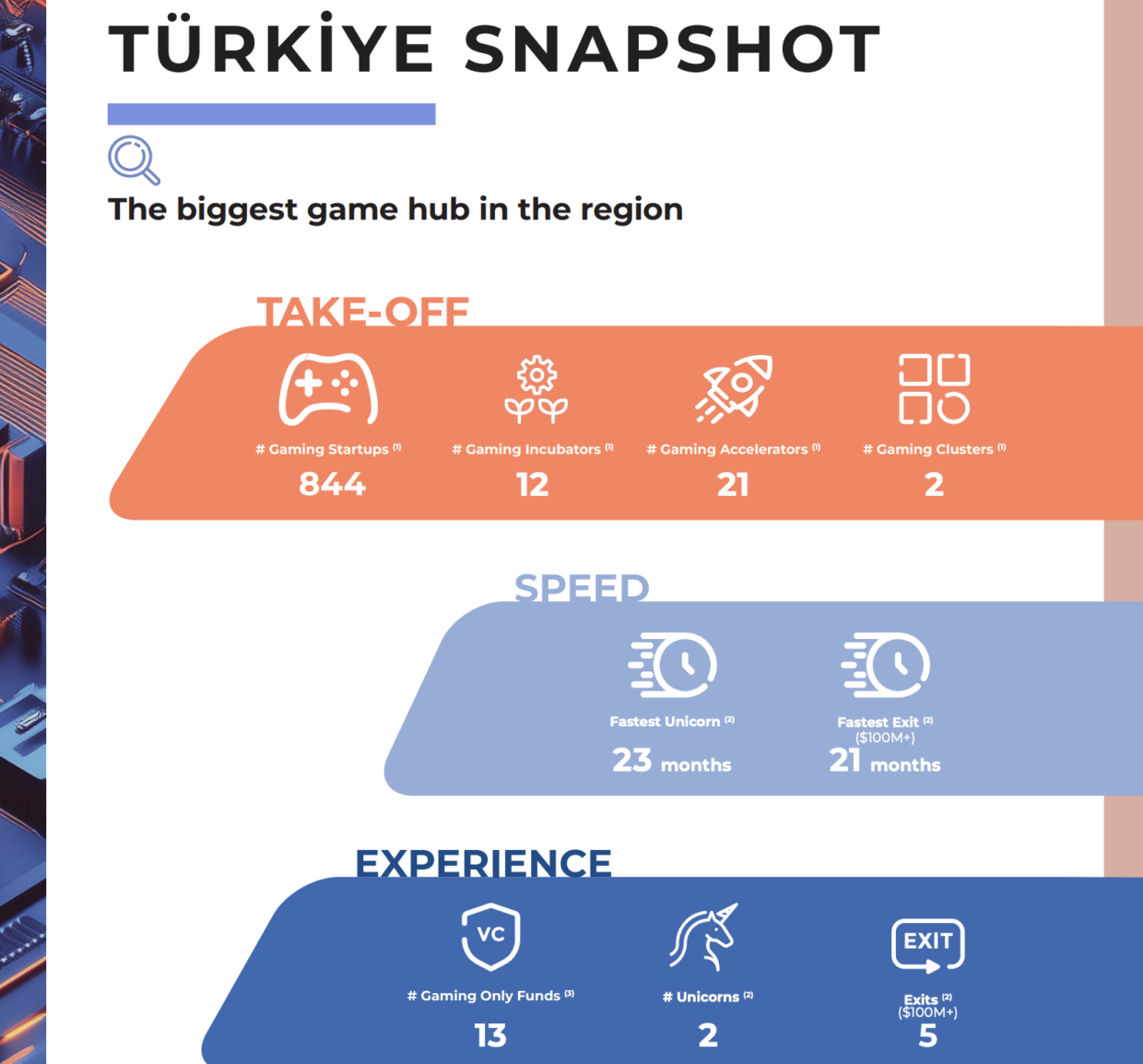

The Turkish gaming industry has emerged as a global force, particularly in mobile gaming. With Istanbul ranking as the second-largest gaming hub in Europe, following London, the region has demonstrated rapid growth, a strong investment climate, and a thriving startup culture. This article dives into the factors driving Turkey’s mobile gaming success, key acquisitions, and what’s next for this booming industry.

Published by Invest in Türkiye

A Thriving Hub for Mobile Gaming

Over the past decade, Turkey has evolved into a key mobile gaming market, attracting both local and international investors. The country has produced major success stories, including Peak Games (acquired by Zynga for $1.8 billion), Gram Games, and Rollic, which have set the stage for a new generation of game developers. Hyper-casual and hybrid-casual games have flourished, with Turkish studios leveraging efficient production cycles and data-driven decision-making to create global hits.

Key Success Stories and Acquisitions

Turkey’s gaming ecosystem has been shaped by a series of major exits and investments:

- Peak Games – Acquired by Zynga for $1.8 billion (2020)

- Rollic Games – Acquired (80%) by Zynga for $180 million (2020)

- Gram Games – Acquired by Zynga for $250 million (2018)

- Masomo – Acquired by Miniclip for an undisclosed sum (2019)

- Alictus – Acquired by SciPlay for $100 million (2022)

- Spyke Games – Raised $105 million in investment (2022)

- Dream Games – Raised over $468 million, making it one of the top-funded Turkish gaming startups

These exits have fuelled a new wave of gaming entrepreneurs, many of whom have left successful companies to establish their own studios. For example, after Peak Games’ acquisition, 108 former employees founded 82 new startups, with 37 focusing exclusively on gaming.

Investment Boom: Gaming-Specific Venture Funds

One of the biggest drivers of Turkey’s gaming growth is its strong investment ecosystem. The country now has 13 gaming-focused venture capital (VC) funds, including:

- Ludus Ventures

- WePlay Ventures

- Games United

- Joygame Pre-IPO GSYF

- Laton Ventures

These funds provide early-stage capital and strategic guidance, helping studios scale quickly and enter global markets. Additionally, government-backed incentives and incubators, such as ATOM, Digiage, and Game Factory, provide resources to help startups accelerate their growth.

Why Turkey & Why Now?

Several factors make Turkey an attractive location for mobile gaming startups:

1. Cost-Effective Talent Pool

Turkey offers a highly skilled workforce at a lower cost compared to Western Europe and North America. This gives local studios an edge in producing high-quality games with optimized user acquisition costs.

2. Focus on Mobile & Hyper-Casual Games

Hyper-casual games, which require fast development cycles and data-driven scaling, have thrived in Turkey. The average development time for a hyper-casual game is 10-15 days, allowing studios to test multiple concepts efficiently. Meanwhile, hybrid-casual games have emerged as the next major trend, combining deep monetization with mass appeal.

3. Strong Government Support & Incentives

Although there are no gaming-specific grants, Turkish studios benefit from export-oriented incentives, free trade zones, and R&D tax advantages. Institutions like TÜBİTAK and KOSGEB offer funding programs that further strengthen the ecosystem.

4. Expansion Beyond Mobile: PC & Console Growth

While Turkey has dominated the mobile gaming scene, new studios are expanding into PC and console development. Indie studios like Motion Blur Studio and Nokta Games are gaining traction, proving Turkey’s potential beyond mobile.

Challenges & Future Outlook

Despite rapid growth, Turkey’s gaming industry faces two key challenges:

- Retaining Skilled Talent – Many top developers leave to start their own studios, creating competition for experienced professionals.

- Post-Series A Funding Gap – While seed-stage funding is abundant, mid-to-late-stage investments are more difficult to secure.

However, 2024 marks a turning point, with new regulations making it easier for gaming startups to go public on the Istanbul Stock Exchange. This could drive the next generation of gaming unicorns.

Final Thoughts

Turkey’s gaming ecosystem has cemented itself as a global powerhouse, particularly in mobile gaming. With a strong investment landscape, government support, and a growing talent pool, the country is well-positioned to produce more unicorns and expand into new gaming genres. Whether you’re an investor, developer, or entrepreneur, Turkey is a market worth watching in 2025 and beyond.