- arrow_back Home

- keyboard_arrow_right Highlights

AppLovin Scandal: New Target of Short Sellers?

HighlightsJournal 1019 Ömer Yakabagi February 27

Are the reports Overblown or Misleading? Maybe, here are the details for you.

AppLovin’s CEO, Adam Foroughi, dismissed short-seller reports from Fuzzy Panda & Culper Research as “false and misleading,” accusing them of driving down the company’s stock for financial gain.

Inflating metrics and tracking users, including children, without consent?

- Auction Manipulation & Data Exploitation

- Click Fraud & UX Dark Patterns

- Targeting Minors & Illegal Tracking

Foroughi refuted the claims, stating they contain inaccuracies and insisting the company does not track children’s data or engage in financial misconduct. He emphasized AppLovin’s focus on strategy, cash flow, and share buybacks. Short-sellers profit from declining stock prices, as seen in a recent case involving Roblox.

Following their release, AppLovin’s shares dropped by up to 20%.

Both Fuzzy Panda and Culper are short AppLovin stock, which means that they have essentially bet the price of shares will fall.

- AppLovin Shares tumbled on Wednesday after the release of two short sellers’ reports about the company.

- The reports alleged various fraudulent and deceptive practices that the authors believe could get AppLovin’s services blocked by Apple, Meta Platforms, and Google.

- Wednesday’s stock plunge marked AppLovin’s seventh straight losing session.

More? AppLovin Monopoly in Mobile Gaming?

AppLovin to Sell Its Gaming Division for $900M to Strengthen Its Ad Tech Focus

Isn’t AppLovin the current Ad Tech Titan?

AppLovin was never just another player in mobile gaming. By 2023, its valuation skyrocketed, its machine-learning algorithm Axon 2.0 was hailed as revolutionary, and investors were treating it as the next big thing in mobile ad tech.

The Allegations: Fraud, Data Exploitation & Predatory Practices?

Fuzzy Panda Research and Culper Research painted a shocking picture of AppLovin’s business model.

What’s in that report?

1. Auction Manipulation & Data Exploitation

As the mediator of its MAX mediation platform, AppLovin was allegedly playing both sides of the fence—monitoring competitor bids and strategically placing its own bids to maximize profits. Since it controlled the auction, it didn’t need to disclose losing bid details, making it nearly impossible for advertisers to verify if they were getting fair pricing.

The company also reportedly reverse-engineered Meta’s advertising data, leveraging insights from its mediation platform to steal market share from the social media giant. By forcing advertisers to run the same campaigns on both Meta and AppLovin, the company could observe Meta’s successful ad strategies and replicate them for its own benefit.

2. Click Fraud & UX Dark Patterns

Many of AppLovin’s ad formats, according to researchers, relied on deceptive tactics to inflate engagement metrics:

- Fake close buttons that trick users into clicking ads.

- Auto-clicking ads that redirected users to app stores without their consent.

- Invisible ad impressions that artificially boosted campaign performance.

The result? AppLovin was allegedly making billions by generating “false engagement” and misleading advertisers into thinking their ads were performing better than they actually were.

3. Targeting Minors & Illegal Tracking

Perhaps the most damning revelation was that AppLovin had allegedly been tracking minors without consent. Their SDKs reportedly assigned unique identifiers to children’s devices, enabling persistent tracking across apps. A class-action lawsuit claimed that AppLovin collected up to 50 different data points on underage users, even when privacy settings were turned on.

Worse yet, investigators uncovered evidence of explicit, inappropriate ads being served to children—violating both COPPA (Children’s Online Privacy Protection Act) and Google and Apple’s app store policies. With such serious allegations, it was only a matter of time before regulatory bodies took notice.

Stocks Crumble, Investors Panic

The market reaction was swift and brutal. AppLovin’s stock ($APP) plunged over 20% in a single day following the reports, erasing billions in market value. Short sellers had been circling, and the reports only fueled the fire.

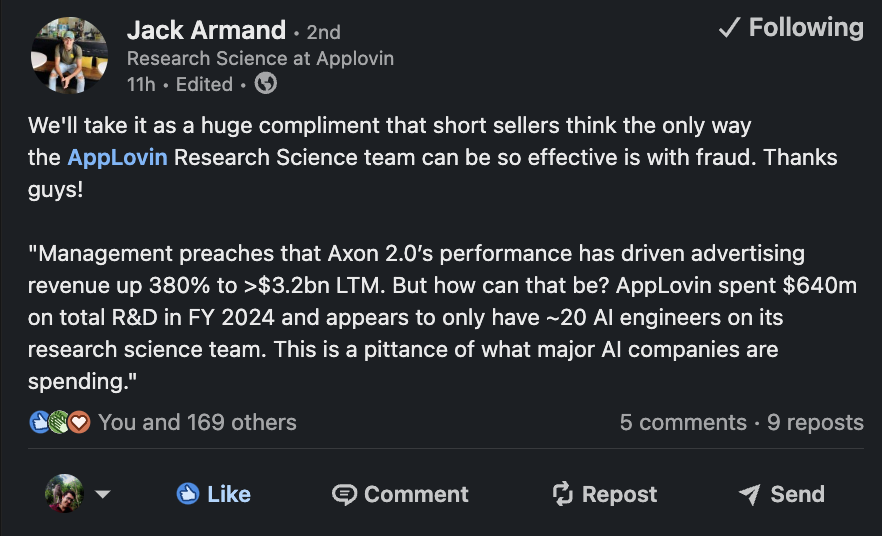

CEO Adam Foroughi called the accusations “false and misleading,” arguing that short sellers were manipulating the market for their own gain. Yet, history has shown that ad tech companies accused of fraud rarely escape unscathed. With potential regulatory action from the FTC, Apple, and Google looming, investors began fleeing in droves.

Meta, meanwhile, was rumored to be preparing legal action, accusing AppLovin of illegally siphoning its data and undercutting its advertising model. If Meta were to take aggressive action, it could effectively shut AppLovin out of one of its largest revenue streams.

What does the industry think?

As always, brutally honest take here by Matej 🦄

Clear take by Adam & Gus here 🕺🏻

Don’t Trust, Verify!

Josh got an interesting one here!

No, it’s not revelatory.

The Risk: Maybe not fraud, yet.