Mobile Gaming is still growing

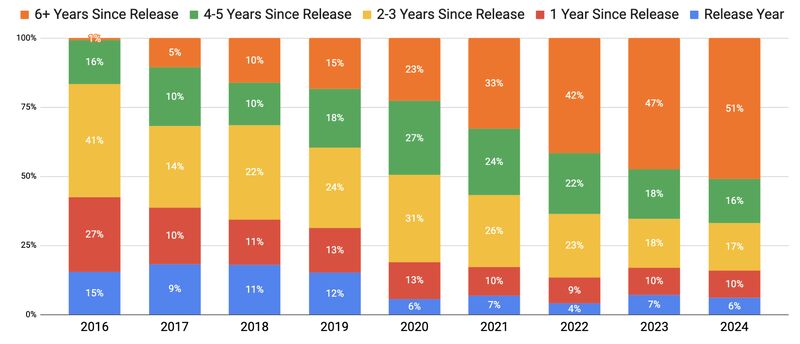

Mobile gaming is still growing, but a big chunk of the revenue comes from older games. The data shows this clearly (based on Sensor Tower): more than 50% of in-app and subscription revenue is from six or older games. That's why there was so much talk about new growth strategies at the recent GDC, like more creative user acquisition, using IPs in games, web gaming, new platforms, different business models, deeper hybrid monetisation, etc. The problem is, this makes it harder to get a clear picture of mobile gaming's real growth, especially in categories where revenue is coming in through less traditional ways. Current data systems might struggle to track this, at least for now. It'll be interesting to see how this evolves...