The Games Fund to Champion Women Gamers

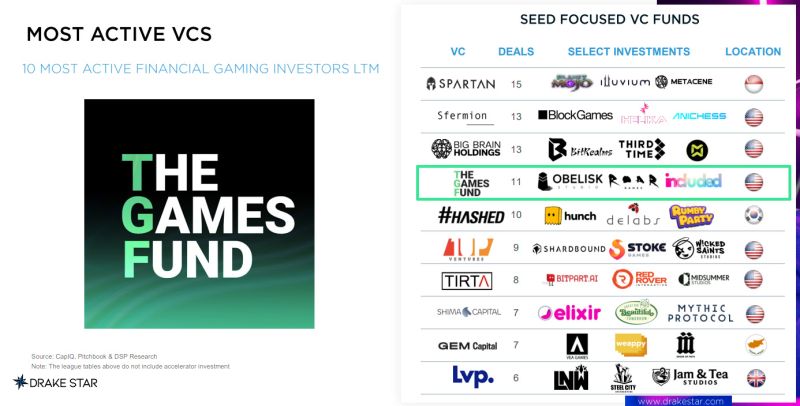

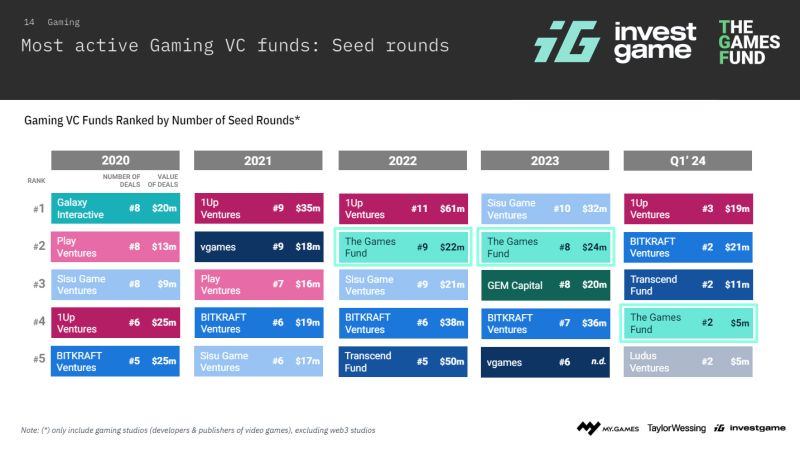

The Games Fund wants to create a more inclusive ecosystem for women gamers. Gaming, once considered merely a children's activity, has now grown into a dominant force in the global entertainment industry. This shift from a niche interest to a major player has changed perceptions and unlocked vast investment potential, particularly in emerging markets. On a global scale, the gaming market is forecasted to reach $282.3 billion this year and expand to $363.2 billion by 2027, with an audience of 1.472 million users. In the MENA region, the gaming industry is estimated to be worth $6.34 billion in 2024, projected to grow to $10.69 billion by 2029, representing an 11.02% increase. This growth is primarily fueled by greater access to technology, a youthful population, rising disposable incomes, and the availability of high-speed mobile internet and gaming hardware. As a result, […]