About the author

Aylin YAZICI

Publishing Manager @Joygame | Head of Content @Gamigion

AnalysisHighlightsJournal 913 Aylin YAZICI January 9

Here’s what’s covered in this deep analysis article on Royal Kingdom;

The mobile gaming landscape is more competitive than ever, with developers constantly testing new waters. Enter Royal Kingdom, a bold new entry in the match-3 puzzle space. But is it poised to take over the crown from the mighty Royal Match? You’ll find an intriguing combination of mechanics that separate it from the usual suspects like Candy Crush and Royal Match. This game is much more than just a pretty face with an addictive core loop. Let’s dive deep into the nuts and bolts of this game and its journey so far, looking at its performance, mechanics, and how it stacks up against the competition.

Royal Kingdom launched with a lot of fanfare, but initial performance stats tell a story of cautious optimism. At first glance, the game offered what seemed like a polished, high-quality experience. The high production value of the cinematics and detailed animations set the tone — Royal Kingdom isn’t cutting corners. But despite this glitzy entry, it faced a challenge: differentiating itself from the behemoth Royal Match, the reigning champion in the match-3 genre, pulling in millions of dollars per day.

When you look at Royal Kingdom’s performance after its launch, it’s clear that it’s still playing catch-up. The game has made steady progress, but can it achieve the explosive growth that Royal Match did? That remains the burning question. With Royal Kingdom generating less revenue and fewer daily active users in comparison, the task ahead is monumental.

The soft launch of Royal Kingdom was structured into three phases:

This timeline indicates a lack of sustained growth compared to Royal Match. By December 2023, the game was generating a modest $35,000 daily from in-app purchases, reflecting challenges in user acquisition. High acquisition costs and a low ARPDAU in the UK ($0.14) compared to industry standards ($0.25+) suggest struggles in scaling.

According to AppMagic, Royal Kingdom generated $5.49 million in net IAP revenue between November 21 and December 21. The US led in earnings with $3.13 million, followed by the UK ($1.01 million) and Australia ($432,000). In its first month, the game earned $1.73 million and had 995.9K downloads, outperforming its predecessor, Royal Match. Despite this success, Royal Match continued to generate $4.5 million daily. As of now, Royal Kingdom has earned $20.9 million and reached 10.1 million downloads.

Check out our latest report Mobile Game Leaders: 2024 Analysis

So, how does Royal Kingdom stand up against its predecessor, Royal Match? On paper, the two share some core gameplay features: they are both match-3 puzzle games with elements of home decoration and a clear progression system. However, Royal Kingdom has doubled down on its high-end, cinematic presentation, giving players a more immersive experience.

But here’s the thing: while the flashy animations and polished graphics are nice, they are not the magic formula for success. Royal Match has tapped into a user base that loves the simplicity of its gameplay combined with a satisfying progression loop. Royal Kingdom is still finding its groove here — its gameplay feels like it’s trying to be a little too much, possibly complicating the experience for some players who are just looking for that quick, fun match-3 fix.

The financial trajectory of Royal Kingdom is something that can’t be ignored. While it’s not pulling in the same revenue as Royal Match, it’s still making waves. The game’s creators have made it clear that they are in it for the long haul. In the highly competitive mobile gaming industry, the difference between success and failure often boils down to user acquisition (UA) and how much you’re willing to invest in pushing the game to the top of the charts.

One of the game’s key strategies seems to be about reinvesting profits into UA. As the marketing spend grows, the hope is that Royal Kingdom will eventually crack the code and hit the jackpot, just like Royal Match did. The company has a solid formula in place to scale; it’s just a matter of time before the game hits the right mix of players, mechanics, and monetization strategies.

What really sets Royal Kingdom apart is the use of dynamic level design and the way it introduces strategic depth into its puzzles. Unlike traditional match-3 games, Royal Kingdom brings a fresh twist on classic mechanics by incorporating explosions, special tiles, and even a competitive element through PvP-based events. The focus on multiple progression layers — from story unlocks to character upgrades — gives players a lot to chew on, ensuring they stay engaged over time.

That said, the game does face some friction in its mechanics. The initial learning curve is steep, and while the production quality is top-tier, the core gameplay loop can sometimes feel a little bogged down by too many complex systems. The complexity could be a barrier for casual players, who tend to prefer quick, gratifying experiences. But for hardcore puzzle lovers? This could be a goldmine.

If there’s one thing we know about Royal Kingdom, it’s that it’s positioning itself as more than just a “match-3 game.” It’s going after hardcore puzzle enthusiasts and competitive gamers, all while maintaining an inviting aesthetic for the casual crowd. The game isn’t trying to reinvent the genre but is instead looking to refine the experience, targeting both newcomers and long-term puzzle fans.

The real challenge, however, is balancing these diverse audience groups. Can the game keep casual players entertained without losing the hardcore puzzle enthusiasts? The answer lies in how effectively Royal Kingdom can continue to evolve its progression mechanics and introduce new, interesting twists to keep both types of players coming back for more.

Royal Kingdom began its journey in April 2023 with a unique blend of PvP mechanics and a social casino economy, mirroring the success of games like Coin Master. However, it soon became clear that this hybrid model was difficult to maintain, especially with the complexity of combining level-based puzzle gameplay with fast-paced casino-like rewards. In response, Dream shifted the game’s focus to PvE with a story-driven format featuring the Dark King. This pivot aligned Royal Kingdom more closely with the successful Royal Match formula, but it raised concerns about internal competition between the two games.

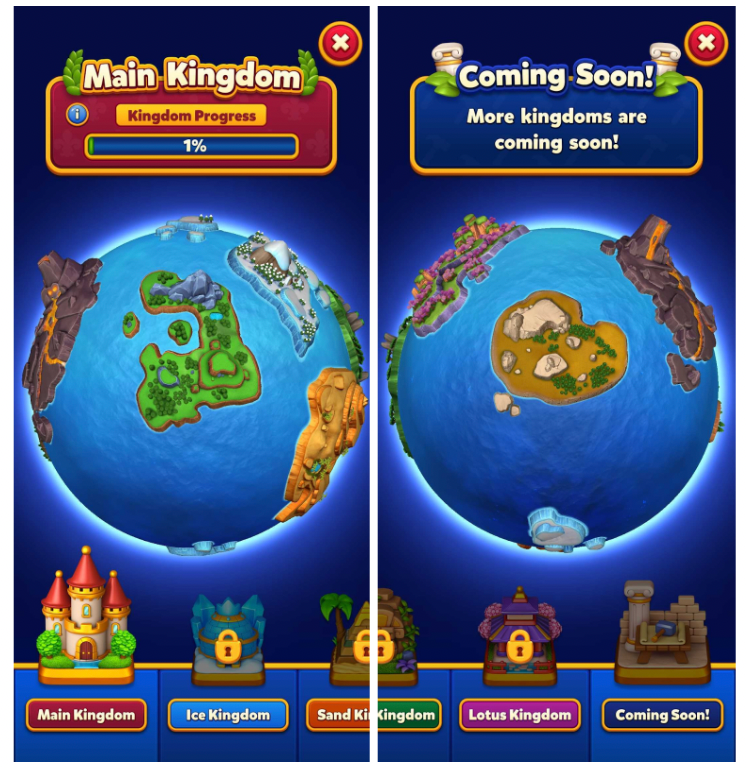

Royal Kingdom’s shift to an isometric map divided into districts marks a bold new direction compared to the singular space of its predecessor. The outdoor focus — at least in the current build — adds a touch of freshness, making it visually appealing and strategically engaging for players. In this new format, players use potions to build structures, earning coins and XP as they progress. This system not only rewards players but also offers long-term goals, making the experience more immersive.

While the map redesign doesn’t directly impact monetization, it provides a satisfying overview of progress, which is key for players who enjoy seeing their hard work pay off in meaningful ways. It may not add immediate revenue, but it enhances the overall experience and appeals to those who love the empire-building genre. The switch to districts and potential expansion into interior spaces later on gives the game a layer of sophistication, moving beyond a simple puzzle game and into the territory of more complex, casual gameplay.

Ultimately, this map shift supports the idea that Royal Kingdom is trying to capture a more strategic player who thrives on long-term goals and visual progress, while still maintaining the light-hearted, competitive spirit that made Royal Match so addictive.

To keep players coming back, Royal Kingdom must deliver on retention. And let’s face it, retention is the hardest part of any mobile game. It’s not just about catching the player’s attention with dazzling graphics; it’s about ensuring that they’re hooked and feel like they’re getting something valuable in return. The game’s level design, with escalating challenges and rewarding moments, works wonders in keeping players engaged. But the true test will be how the game evolves after the initial stages.

The battle to retain players isn’t just about offering cool rewards, though; it’s about offering something meaningful that fits within the game’s overall experience.

Win streaks aren’t just a typical feature in puzzle games — they’re a core mechanic that pushes players to keep going. Royal Kingdom takes the standard streak reward and kicks it up a notch, making the win streak more than just about boosters. The true prize? Doubling the end-game potions. This changes everything. Instead of relying on time-limited events for extra currency, the streak lets players permanently accelerate their progression. By doubling the potions, the game introduces a satisfying feedback loop, making the player’s journey feel more rewarding and giving them the sense of agency needed to push through even the toughest levels. With rewards scaling higher for harder levels and special attack modes, maintaining that streak feels like a win in itself, offering tangible benefits throughout the game. (x2 for hard and x5 for super hard) (enemy attack levels x10)

The level design in Royal Kingdom deserves a shout-out. Every puzzle is a carefully crafted challenge, with obstacles and power-ups that push players to think ahead. The key to any successful puzzle game is a well-balanced design that doesn’t feel frustrating. While Royal Kingdom has its moments of difficulty, it does a good job of offering enough variety and strategic options to keep things fresh.

The question is: Can it keep innovating? With every puzzle game, players eventually catch on to the formula. That’s where Royal Kingdom needs to keep shaking things up. New game modes, evolving mechanics, and continuous updates are what will keep players engaged for the long haul.

Royal Kingdom’s game design is a testament to the fine art of balancing difficulty and rewards. The newly added “Kingdom Levels” make the game more challenging than its predecessor, Royal Match, but with a twist: these levels are harder and deliver fewer rewards. The increase in difficulty pushes players to encounter the dreaded “out of moves” screen more frequently, which is crucial for the game’s monetization strategy. This mechanic fuels in-app purchases as players face the stark reality of running out of moves.

The game doesn’t just rely on tougher levels; it also incentivizes progression through a robust event system. Royal Kingdom awards players more event tokens per set of levels than Royal Match, shifting the focus towards events for both progression and rewards. The impact of this change is significant, as we see a 20% increase in ARPDAU (Average Revenue Per Daily Active User) when comparing the two games during their soft launch periods in the U.K. The change in the game’s design and monetization strategy is clear: while Royal Kingdom V1 had higher ARPDAU due to its social casino model, the V2 version appears to have more staying power. It’s all about creating a more engaging experience for a broader audience.

To understand the player conversion rates better, we can look at the stats from Royal Kingdom’s U.K. soft launch. In just six months, Royal Kingdom V1 was able to convert 6.6% of its downloads into daily active users (DAU) with an ARPDAU of $0.21. While that’s a decent figure, Royal Kingdom V2 outperforms it significantly, with 16% of downloads converting into DAU at $0.11 ARPDAU. This shows that while the initial conversion rate was higher in V1, the player engagement was not as broad, leading to less acceptance of the core systems. However, V2’s broader appeal and the refined approach to monetization are likely to make it a more sustainable product in the long run.

The moral of the story? It’s not just about squeezing out revenue from each player — it’s about building a deeper, more enjoyable experience. Dream seems to have realized that creating a system that appeals to a larger, more diverse audience, while maintaining a more traditional progression, could pay off in the long run. And, judging by the data, it looks like they’re on the right track.

A game like Royal Kingdom cannot succeed without an aggressive marketing campaign. It’s already spending big on user acquisition, and the company’s push into high-end advertising is evident. The creative materials — from eye-catching visuals to exciting in-game teasers — do a great job of enticing players to click.

But here’s the real kicker: The marketing has a personal touch. Think of the high-quality, cinematic trailers that make you feel like you’re watching a mini movie. Royal Kingdom is effectively blending gameplay with story-driven elements in its marketing, making it more than just a typical ad. The investment in creative assets is paying off, even though the game is still trying to find its footing in the ever-competitive mobile market.

The future of mobile game advertising is evolving rapidly. Royal Kingdom is at the forefront of this shift, using dynamic and engaging ads that appeal to players emotionally. It’s not just about showing the gameplay anymore — it’s about telling a story. Whether it’s the snake-eating puzzle or the epic challenge of saving the kingdom, the ads tap into a visceral feeling. This kind of emotional connection could be what sets Royal Kingdom apart in the future.

So, will Royal Kingdom usurp Royal Match’s throne? It’s possible, but it’s not a done deal. The game has all the ingredients for success, from stunning visuals to a deeply engaging puzzle experience. But whether it can continue to grow its audience, improve retention, and carve out a niche for itself in an ever-crowded market will be the true test. If it can keep evolving, Royal Kingdom might just become the next big thing in the match-3 genre.

Time will tell, but one thing’s for sure: Royal Kingdom is on a promising path, and it’s not going to give up without a fight.

Analysis by Aylin Yazıcı. Feel free to contact me.

About the author

Publishing Manager @Joygame | Head of Content @Gamigion

Please login or subscribe to continue.

No account? Register | Lost password

Are you sure you want to cancel your subscription? You will lose your Premium access and stored playlists.