Recap of 2023: Western Mobile Gaming Markets

Journal 9 Saikat Mondal January 1

In the ever-evolving landscape of mobile gaming, 2023 has been a year of remarkable trends and advancements in both Western and Eastern markets. For mobile gaming 2023 was the first year to register a positive growth post Covid with some reports indicating growth to as much as 4% just teasing the potential growth potential in this segment. In this newsletter, we’ll delve into the latest trends, explore the most popular titles, and examine what the future holds.

For this article, we would focus on the western (US, UK, Germany and France). In the next part of the same series we would keenly focus on the Eastern markets (Japan and South Korea) markets separately primarily because the genre preference on mobile vary vastly on mobile.

For western markets (US, UK, Germany and France):

-

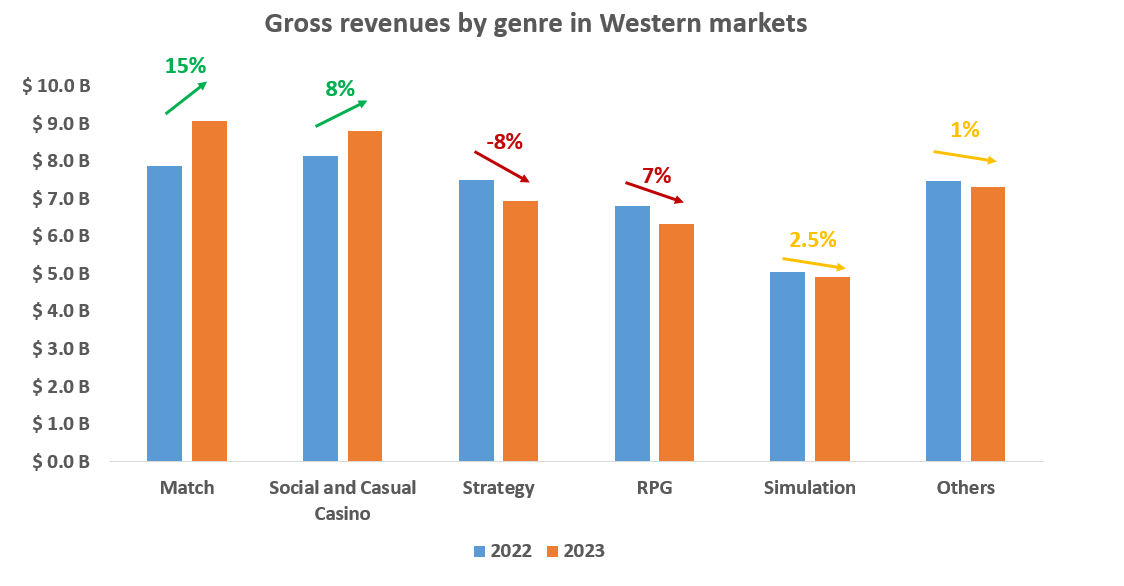

Match genre remained the top IAP grossing genre with 21% of all store revenues.

-

Social and Casual Casino contributed 19% owing to massive launch of Monopoly Go in this segment; Strategy and RPG each contributing 15% each and Simulation genre contributing 11% of overall IAP revenues

-

These top 5 genre contributed close to 80% of overall IAP revenues in 2023 for the western markets

(Please note the Ad revenues are not accounted in this analysis)

-

A total of 19 games in mobile hit a $1 Bn revenue mark globally in 2023 including Candy Crush Saga, Honor of Kings, Roblox, Royal Match, Coin Master, Genshin Impact, Gardenscapes, Pokemon Go, Game of Peace, Lineage M (top 10 mobile games by revenue)

-

Some of the notable trends on the top two genres are as follows:

-

Match genre

-

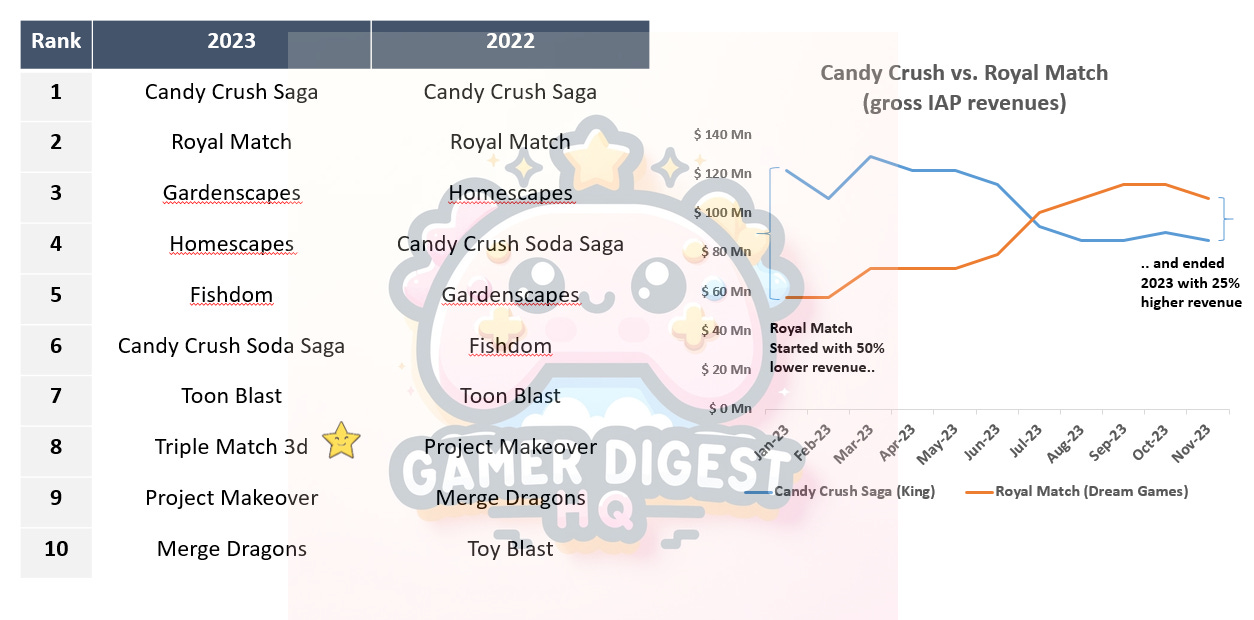

For the last 5 months Royal Match by Dream Games has been consistently outperforming Candy Crush Saga and taking its market leadership position slowly which shows the core strength of the title. However we still believe that Candy Crush Saga is still generating higher revenues (and definitely higher profits) due to cheap user acquisition (Candy Crush has large first party data to engage in reactivation campaigns), high user reach (increasing ad revenue potential, Royal Match doesn’t have ads), brand collaboration, alternate platform reach (not only restricted to app stores) and web-shops (which is a largely unknown factor and can favor either competitor on how effectively they drove traffic to this platform)

-

The top 10 games in 2023 just saw one new addition “Triple Match 3D” by Boombox Games launched in April 2022 indicating the stiff competition to enter the top league. Triple Match focuses on Physics based match mechanic distinct from the Tiles match mechanic both of which are interesting trends to watch out for in the match genre. (link to detailed deep dive into match genre evolution by DoF)

-

-

Strategy:

-

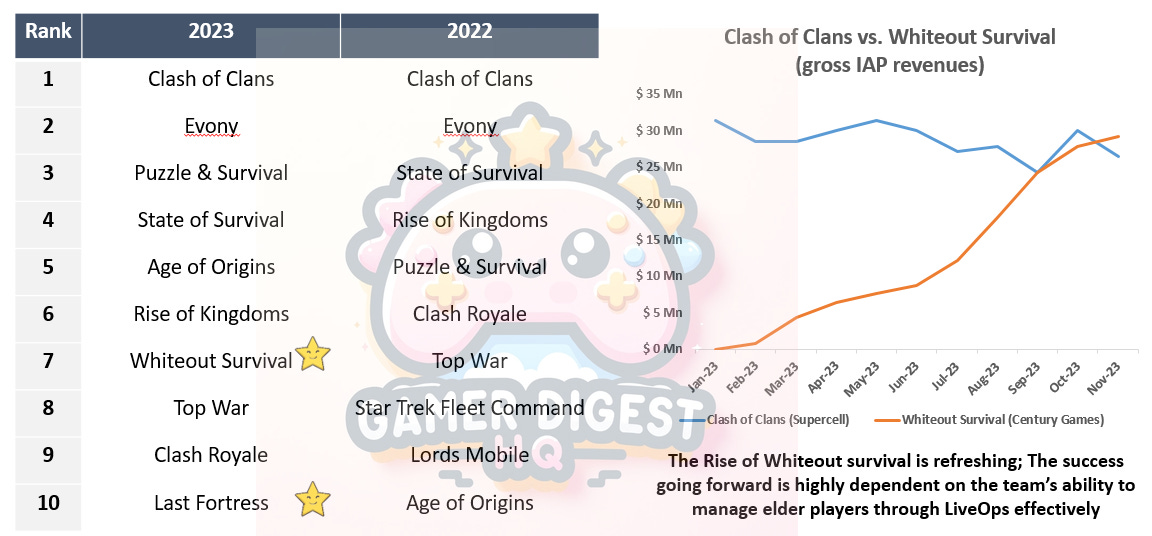

The rise of Century Game’s Whiteout Survival and Last Fortress (both relatively new titles) is refreshing to see the scope of developers to launch new games in top-10 league. Whiteout Survival first competed neck to neck with Evony and Clash of Clans before surpassing them for the first time in Nov’23.

-

-

Social and Casual Casino:

-

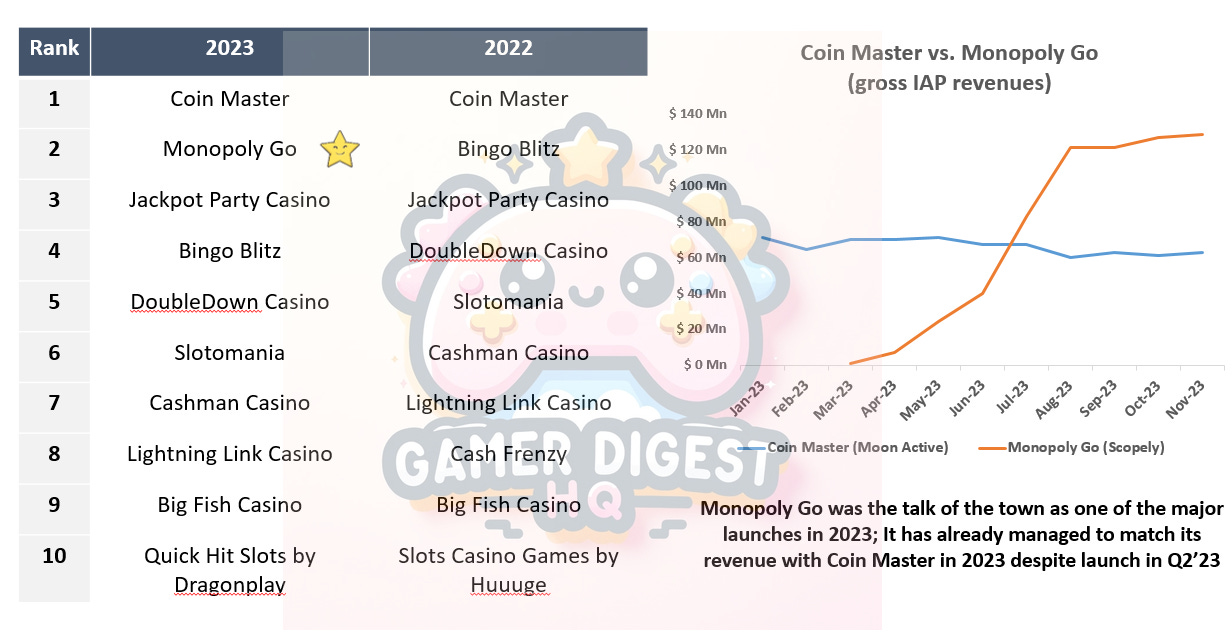

Monopoly Go was the biggest mobile release in 2023 for the Western markets. It has surpassed Coin Master and consistently so for the entire second half of 2023. Some of the discussion items related to Monopoly Go are found in the sources below:

-

Monopoly Go made more than a $ 1 Bn in revenues in the first year of launch with consistent spending on profitable UA channels (Source: Mobilegamer.biz, Product deconstructions: Pocketgamer.biz, Broad design philosophy: Pocketgamer.biz)

-

-

-