Out of 124 recent gaming investments, only 19 in Europe?

Journal 14 Ilia Eremeev June 3

InvestGame recently released a new report on business activity in the video game industry, and it’s quite positive! Make sure to check it out – link here.

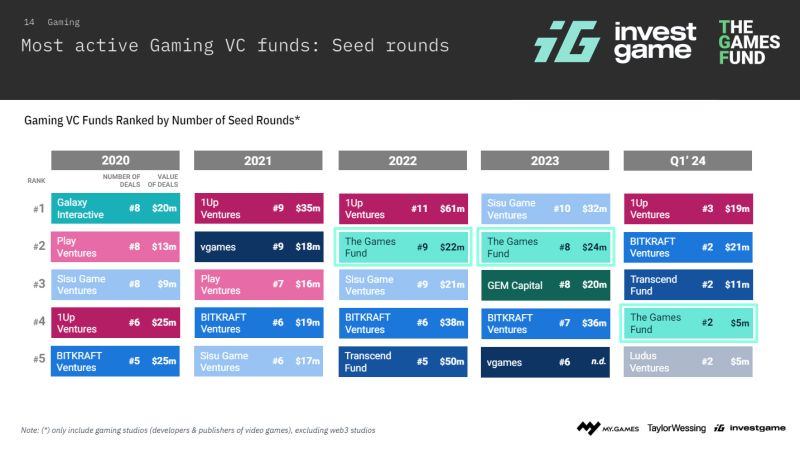

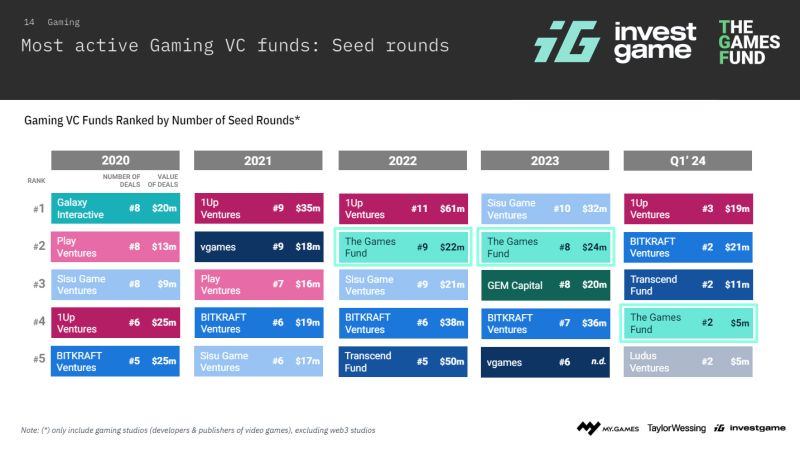

I am happy to see The Games Fund sits firmly among the most active early-stage gaming funds, leading investments in outstanding gaming startups. Despite all the challenges, we believe that great times, great games, and even more success stories are ahead of us all.

I also wanted to address an interesting question that Olle Pridiuksson recently raised.

He asked, “Why, out of 124 recent gaming investments, only 19 were in Europe? What is wrong with European gaming companies?”

My answer is: nothing is wrong!

1. The largest funds are based in the US, and US funds mostly invest in US companies.

2. The EU startup legal framework is extremely fragmented and quite complex. We’ve invested directly in Cyprus, Poland, France, Germany, Norway, Estonia, Finland, the UK, and the USA. Almost no US investors are willing to deal with this.

3. There are actually very few gaming VC funds focused on Europe or originally from Europe. Some are focused solely on specific regions, like Turkey, only the Nordics, or only Poland, partly because they are backed by LPs interested in developing these regions.

However, the European gaming scene is exceptional from all perspectives, boasting a fantastic talent pool and high-cost efficiency. It presents a significant opportunity for EU-focused funds like The Games Fund.

We invest directly in Europe and help companies become investable for international investors in the next stage. So far, we’ve helped raise over $50 million in follow-on rounds for our portfolio companies!