Mobile Gaming World: Finland

Journal 1011 Ömer Yakabagi October 18

What do we know about the Finnish Mobile Gaming Scene?

Here we go after our first shot “Mobile Gaming World: Türkiye”.

It wasn’t easy to gather all these data and insights together, BIG THANKS to Joakim, Antti, Joni, Jani, Jere, Gus, Veli-Pekka, Neogames, GameCity Kajaani, and IGDA Finland.

Appreciate the support!

Helsinki was the mobile game start-up capital a decade ago, home to Nokia, Rovio, and Supercell.

The scene attracted heavy investment, leading to successes like Fingersoft, Small Giant Games, and Seriously.

However, no new hit studios since the 2020s…

“We here in Finland, are at a disadvantage – and we’re blind to it,” Gus said.

Finnish Mobile Gaming Scene

We all know the giants. How about the data behind? 🦄

» Supercell

Clash of Clans, Clash Royale, Hay Day, Squad Busters, and Brawl Stars…

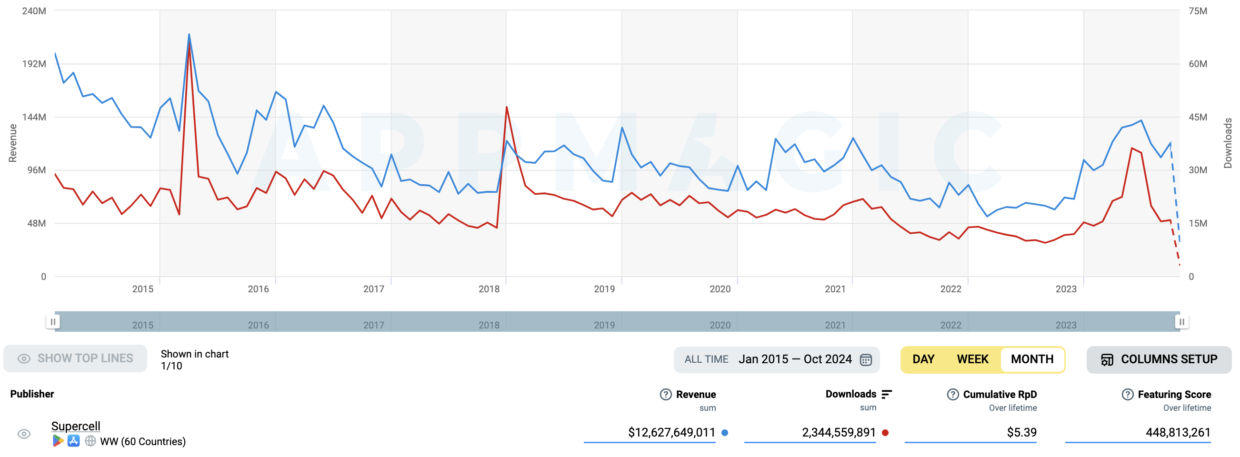

So far, Supercell has generated $12.7 billion in IAP revenue & 2.4 billion downloads.

Monthly figures? Approximately 15M downloads & $120M in IAP revenue per month.

Supercell hit its peak in 2015 & 2018 with Clash of Clans and Clash Royale, but post-2018 saw a slow decline, with Brawl Stars bringing brief recoveries around 2020–2022. While downloads have dropped, spikes in 2021–2022 hint at fresh interest from Squad Busters.

By late 2024, both downloads and revenue are dipping, signaling a need for fresh content or a new blockbuster game to revive momentum. Supercell’s focus now seems to be squeezing value from its loyal player base rather than chasing new growth.

» Rovio

Rovio’s lifetime performance shows $1.4 billion in revenue & 1.6 billion downloads, but a steady decline in both metrics after peaking in 2018.

Recent monthly figures indicate a slower pace, with around $3-4 million in revenue & 2-3 million downloads.

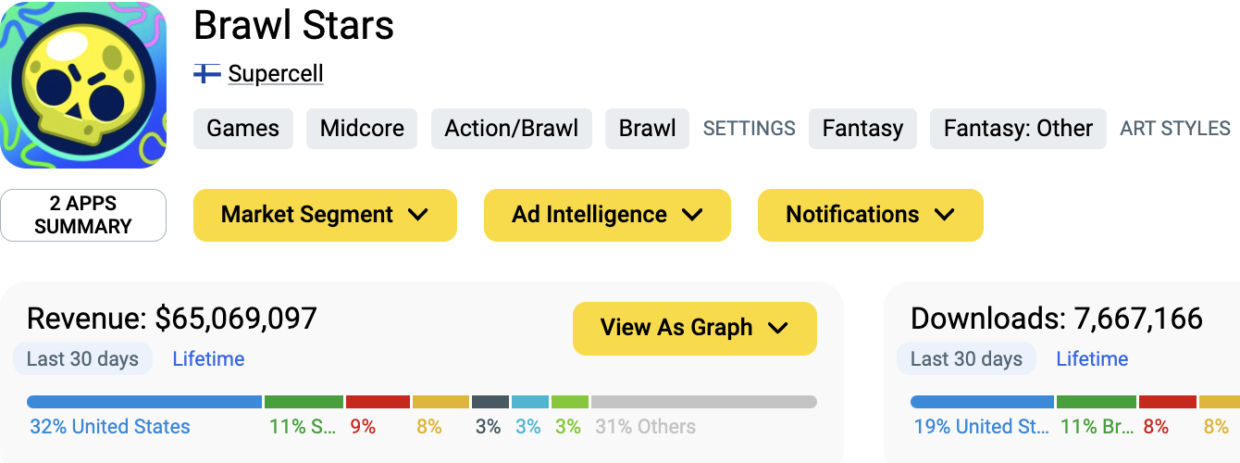

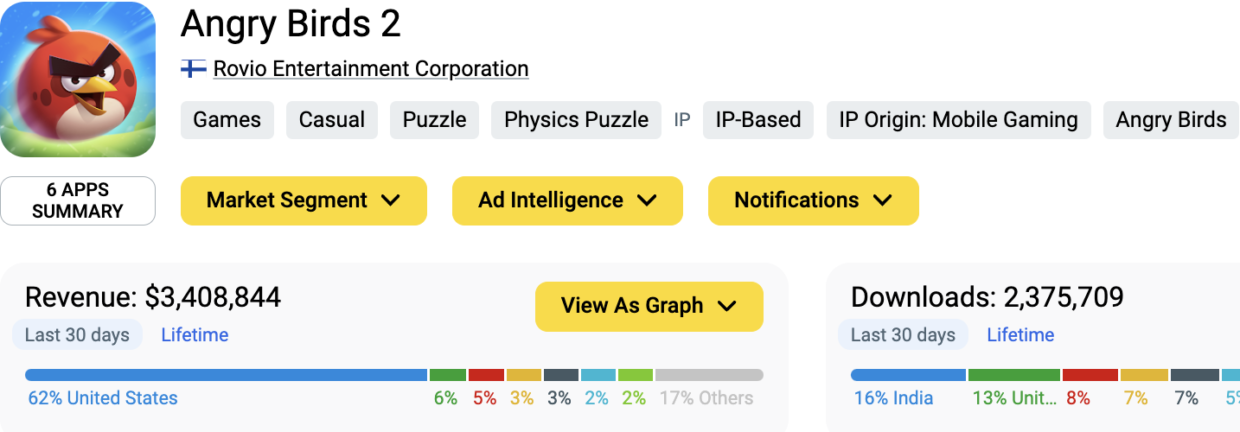

Angry Birds 2 has generated $3.4M in IAP Revenue & 2.4M Downloads over the last 30 days.

» Fingersoft

Fingersoft has generated $113.7M in IAP revenue and 1.2B downloads since launch.

They saw the peak in 2016, driven by the success of Hill Climb Racing 2, but have experienced steady declines in both downloads and revenue since then, with brief spikes through 2022.

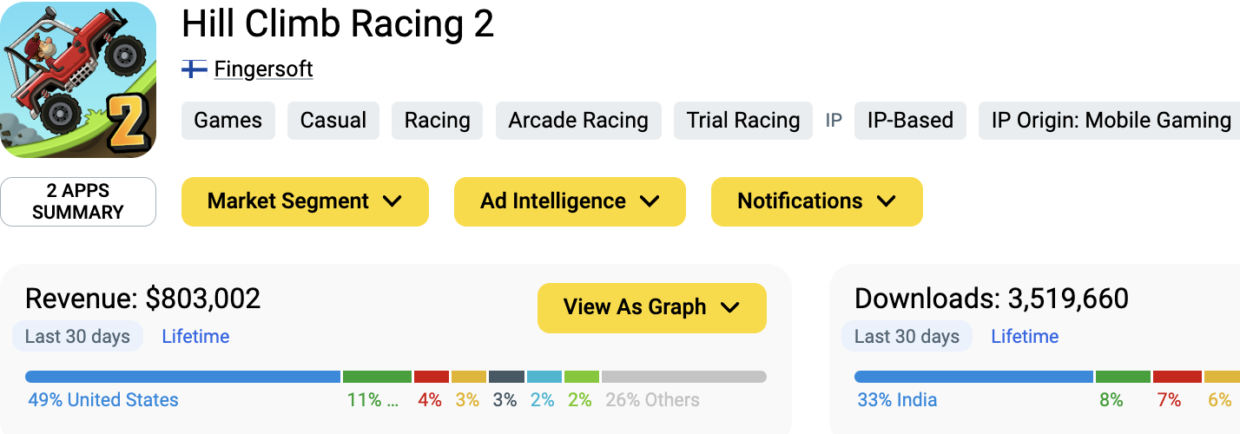

Recent monthly figures show Hill Climb Racing 2 generating $803K in IAP revenue and 3.5M downloads.

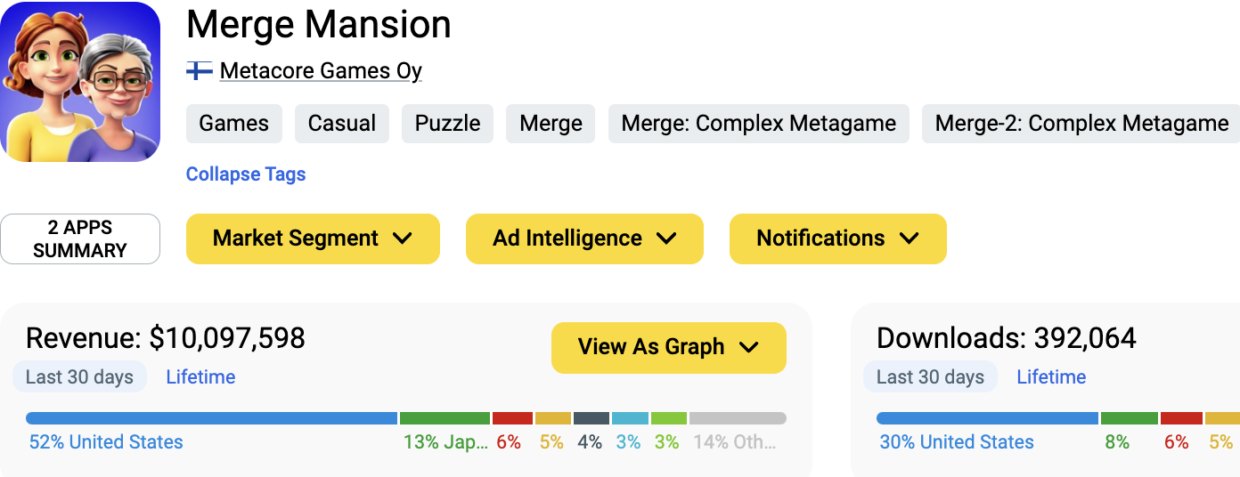

» Metacore

Metacore has generated $10M in IAP revenue and 400K downloads over the last 30 days.

Since its launch in 2020, the game has accumulated $362M in revenue and 46M downloads. After a strong growth period through 2021, both revenue and downloads have been on a gradual decline since mid-2022.

While Merge Mansion continues to perform well, recent figures suggest slower growth, and Metacore may need new updates or innovations to maintain player engagement and sustain its impressive revenue levels in the long term.

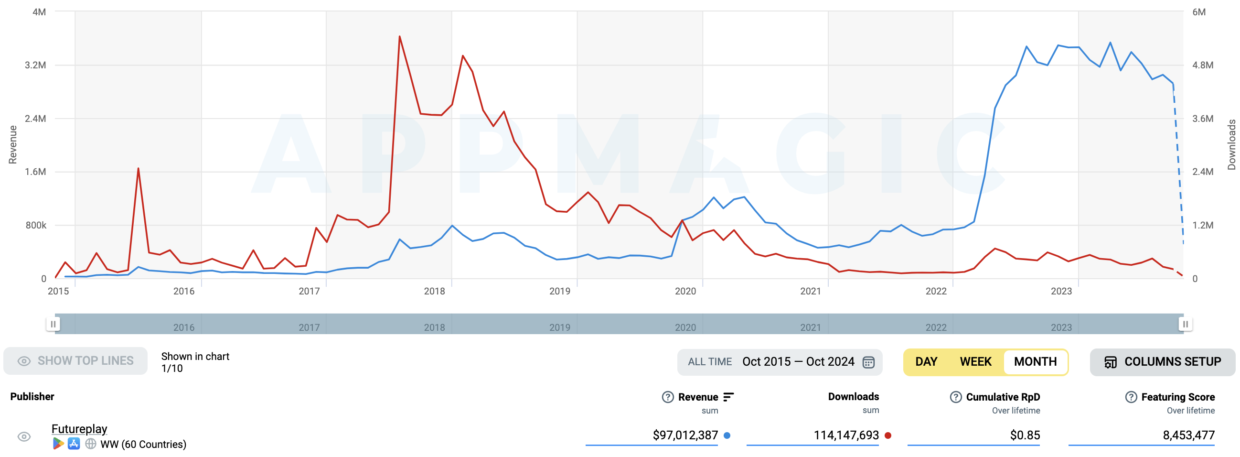

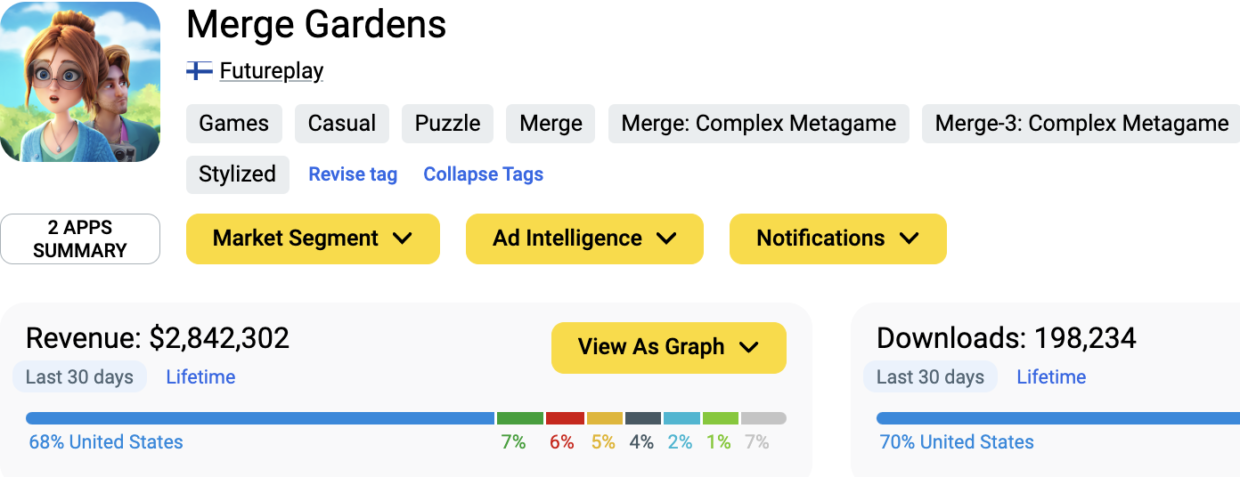

» Futureplay

Futureplay generated $2.8M in IAP revenue and 200K downloads in the last 30 days.

Since its launch, Futureplay has accumulated $97M in revenue and 114M downloads. They saw the peak in 2018, but both downloads and revenue have significantly declined since 2020, despite occasional spikes in 2021.

Merge Gardens continues to contribute to the company’s performance, though current trends show slowing growth.

Is it just 5?

Nope.

Many more Finnish mobile game studios are here such as Seriously Digital, Reworks, Lightheart, Sulake, Valas Media, Playsome, Critical Force, HypeHype, Treetop, MotionVolt, Hyperkani, Sumoing, Dodreams, Superplus, Touch Foo, Treetop Crew, Two Men and a Dog, and Cosmic Lounge.

Top Finnish Studios: September 2024

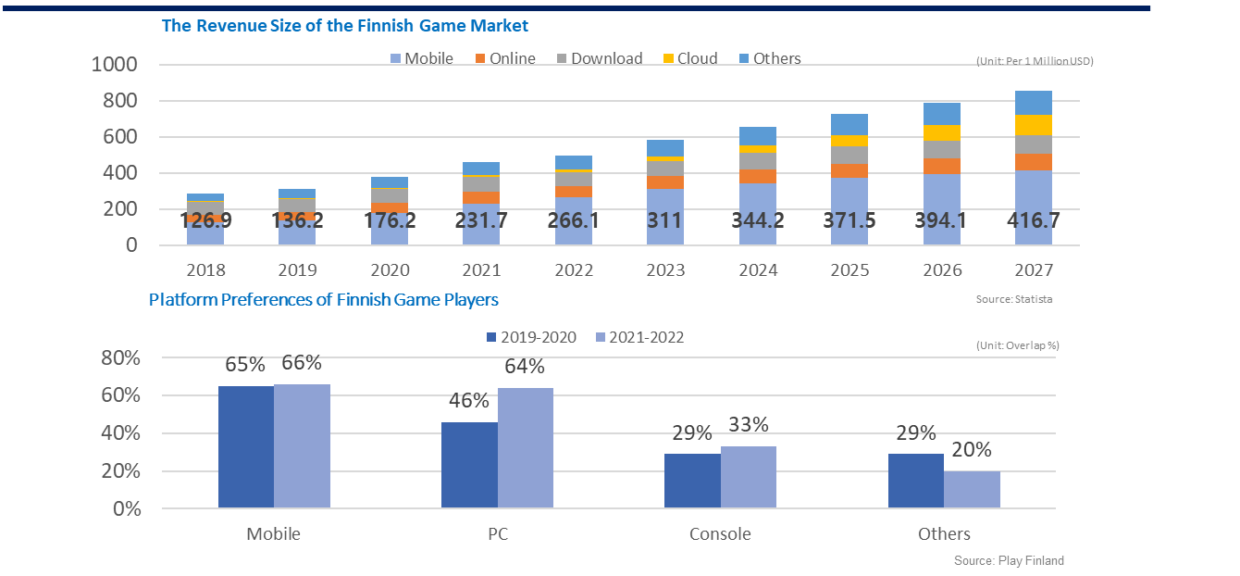

Data Corner: Mobile Gaming in Finland

- After Nokia, the mobile gaming industry received a great amount of attention.

- Government-funded support is the main driving force behind the growth.

- The size of the Finnish mobile game market in 2023 was $311M.

- In May 2023, Rovio was acquired for €706M by SEGA Europe.

- in 2022, the sector generated €3.2 billion.

Global Recognition

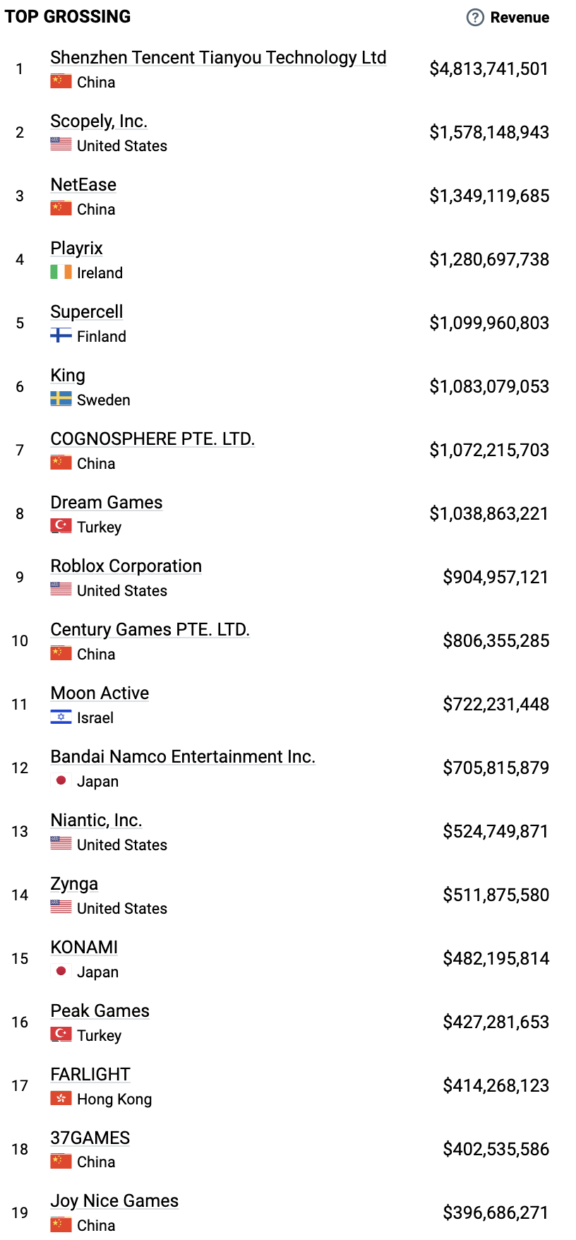

Supercell ranks 5th globally in 2024, generating $1.1 billion in revenue so far.

2024 Data by AppMagic

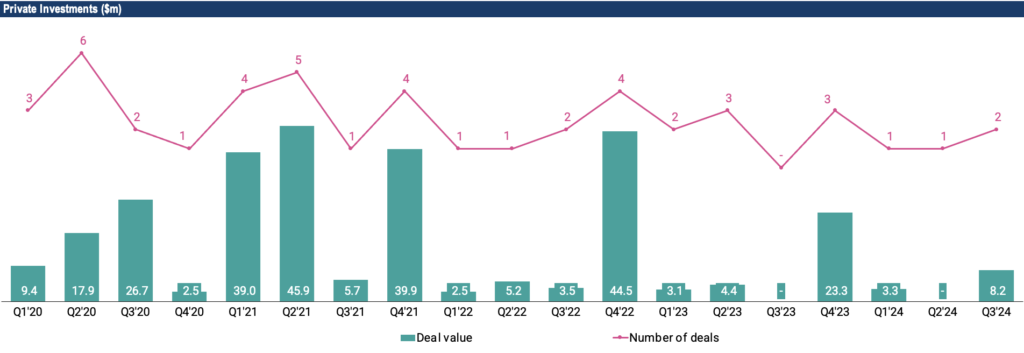

Investment Scene

Data: InvestGame – Q1’20 to Q3’24

| Year | Quarter | Company | Investor | Type | Category | Size, $m |

| 2023 2024 | Q3’23 Q3’24 | Rovio SuperPlay | Sega Playtika | Control Control | M&A M&A | 783 700 |

| 2021 | Q3’21 | Reworks | Playtika Holding Corp | Control | M&A | 600 |

| 2022 | Q2’22 | Next Games | Netflix | Control | M&A | 72 |

| 2021 | Q1’21 | Remedy Entertainment | – | PIPE, Other | Public offering | 50 |

| 2022 | Q4’22 | Yahaha | Andreessen Horowitz / Riot Games, Play Ventures, and Sisu Game Ventures | Series A | Early-stage VC | 40 |

| 2021 | Q2’21 | Yahaha | – | Series A | Early-stage VC | 31 |

| 2021 | Q4’21 | Mainframe Industries | Andreessen Horowitz / Riot Games , Play Ventures, and Sisu Game Ventures | Series B | Late-stage VC | 22 |

| 2023 | Q4’23 | Noice | F4 Fund, BITKRAFT Ventures, Team Builder Ventures, Sedona Holdings | Series A | Early-stage VC | 21 |

| 2021 | Q1’21 | Redhill Games | – | Series A | Early-stage VC | 18.6 |

| 2020 | Q3’20 | Metacore | Supercell | Corporate | Corporate | 17.7 |

| 2021 | Q4’21 | HypeHype | Supercell | Corporate | Corporate | 15.5 |

| 2021 | Q1’21 | Critical Force | – | Series A | Early-stage VC | 10 |

| 2020 | Q3’20 | Traplight Games | EQT Ventures / Play Ventures, Initial capital, and Hearcore Capital | Series B | Late-stage VC | 9 |

| 2020 | Q1’20 | Mainframe Industries | Andreessen Horowitz / Riot Games, Maki.vc, Play Ventures, Crowberry Capital, Sisu Game Ventures | Series A | Early-stage VC | 8.3 |

| 2023 | Q2’23 | Nitro Games | – | PIPE, other | Public offering | 7.2 |

| 2020 | Q2’20 | Dazzle Rocks | Galaxy Interactive EOS VC / Spintop Ventures, Ken Lamb, ByFounders, David Helgason, Modern Times Group, Sisu Game Ventures | Series A | Early-stage VC | 6.8 |

| 2021 | Q2’21 | Lightheart Entertainment | Makers Fund / Galaxy Interactive, Sisu Game Ventures | Series A | Early-stage VC | 6.8 |

| 2021 | Q1’21 | Return Entertainment | BITKRAFT Ventures / Sisu Game Ventures, vgames, 1UP Ventures, and Smok Ventures | Seed round | Early-stage VC | 6 |

| 2021 | Q3’21 | Loupedeck | zVentures / Play Ventures | Series A | Early-stage VC | 5.7 |

| 2022 | Q2’22 | Bit Odd | Index Ventures | Seed round | Early-stage VC | 5.2 |

| 2021 | Q1’21 | Next Games | – | PIPE, Other | Public offering | 5 |

| 2021 2023 | Q2’21 Q2’23 | Noice Cosmic Lounge | Angel investors Transcend Fund | Seed round Seed | Early-stage VC Early | 5 4 |

| 2020 | Q1’20 | Reflection.io | GameRefiner | Control | M&A | – |

| 2020 | Q3’20 | Iceflake Studios | Paradox Interactive | Control | M&A | – |

| 2020 | Q4’20 | EpocCam | Corsair Gaming | Control | M&A | – |

| 2021 | Q1’21 | Sulake | Azerion | Control | M&A | – |

| 2021 | Q1’21 | GameRefinery | Vungle | Control | M&A | – |

| 2021 | Q2’21 | Remedy Entertainment | Tencent | Minority | M&A | – |

| 2021 | Q2’21 | Housemarque | Sony | Control | M&A | – |

| 2021 | Q3’21 | Koukoi Games | SciPlay | Control | M&A | – |

| 2021 | Q3’21 | Futureplay | Plarium | Control | M&A | – |

| 2022 | Q3’22 | Savage Game Studios | Sony | Control | M&A | – |

| 2023 | Q3’23 | Speechly | Roblox Corporation | Control | M&A | – |

| 2023 | Q4’23 | Piñata | Metacore | Control | M&A | – |

| 2024 | Q2’24 | Remedy Entertainment | Tencent | Minority | M&A | – |

Kajaani Game Hub: Powering Finnish Gaming Success

It was so nice to know more about Kajaani Game Hub thanks to our chat with Veli-Pekka.

Kajaani Game Hub has become a powerhouse of innovation, nurturing some of Finland’s biggest gaming success stories. Studios like Critical Force & Kitka Games, creators of global hits Critical Ops & Stumble Guys, have emerged from Kajaani’s thriving ecosystem, setting new standards in mobile gaming and showcasing Finland’s talent on the world stage.

Central to this success is Kajaani University, home to a world-class game development curriculum that has launched numerous cutting-edge companies and provided exceptional talent to industry giants, from Supercell and Rovio to Remedy, Housemarque & Small Giant Games.

Meanwhile, the GameCity Kajaani initiative is supercharging the region’s growth, with €1.23 million dedicated to supporting new game studios in Kajaani.

Gaming Startups in Finland: From Boom to Bust?

Here’s our Q&A with Joakim Achren.

Finnish Entrepreneur, Investor & Founder of Elite Game Developers.

Joakim was previously the Co-founder of Next Games & Served as Director at Supercell. He now advises game studio founders on building successful companies.

Joakim, How Has The Finnish Games Industry Changed Over The Years?

Our industry has lost its earlier momentum. While the 2010s saw the rise of giants like Supercell, Rovio, and Small Giant Games, today there are fewer new startups with similar potential.

We kicked off this industry in Finland during the ’90s with a handful of PC game studios making notable strides. The launch of Max Payne marked a significant milestone. As we moved into the new millennium, we began focusing more on mobile content, thanks to Nokia’s substantial investment in developers creating for their devices. Nokia recognized early on that compelling content could attract users. By 1998, the Snake game on original Nokia phones had already shown that phones could be more than just for calls and texts.

The iPhone’s release in 2007 was a game-changer. Companies like Rovio, leveraging their extensive experience with Nokia, quickly seized the smartphone era’s opportunities. This period saw one of the most significant platform shifts in history. Giants like Supercell emerged, alongside Rovio, Small Giant Games, Seriously, Futureplay Games, and our own Next Games. Many companies thrived during mobile gaming’s heyday. However, recent times, especially post-pandemic, haven’t seen the same level of success.

What Made The 2010s So Successful For Finnish Game Studios?

3 Factors: The Market, Leadership, and Bootstrapping.

Back then, the App Store & Google Play were fresh and unsaturated, allowing small studios to thrive. Experienced leaders from traditional management backgrounds built scalable companies, and Nokia’s early influence allowed developers to experiment and grow without immediate funding pressures.

One major factor was the sudden influx of hundreds of millions of consumers acquiring smartphones in Western markets with high spending power. The App Store opened up a blue ocean of opportunities. Finland’s expertise in mobile gaming allowed us to capitalize on this swiftly.

I’ve often joked that I should have been a games investor in the 2010s and probably 70% of the companies I would have invested in would have had at least a hundred million dollar success. It was such a massive blue ocean opportunity that even a fool could have built a massive success.

Why Can’t New Startups Replicate That Success Today?

Large incumbents now dominate the market, making it tough for new entrants to compete. Leadership dynamics have changed, with flatter hierarchies creating fewer leaders equipped to build scalable ventures. Plus, early-stage founders face immediate pressure from VC funding, limiting their room to learn and innovate.

The market has become saturated, and the strategies that worked in the 2010s are no longer effective for several reasons. Earlier games were often derivatives of existing successful models—build-and-battle games or casual puzzles—that hadn’t yet been fully explored. Now, it seems every conceivable game type has been developed and launched, rendering old playbooks obsolete.

In contrast, markets like Israel and Turkey continue to see success because their founders have a stronger grasp of business and monetization strategies. They prioritize building monetization frameworks first and then developing games around them—a concept quite foreign to Finnish developers who focus on creating games they love to play.

There’s still hope for our industry as we navigate these challenging times. We must recognize that our current methods are unsustainable and adapt our approach to game development accordingly.

Building Finland’s Gaming Ecosystem by Mentoring Young Studios

Key Takeaways by Joni Lappalainen:

CEO of Dreamloop Games & Instrumental contributor to the Finnish Gaming & Startup scene.

VP of the Tampere Game Hub, Chairperson of Finnish Game Developers’ Association & Board at Platform6, Co-founder of Tampere Startup Hub, and IGDA Finland’s regional coordinator, handing it over last year after 9 years.

Resilience, Creativity & Collaboration: Finland Thrives Against the Odds

The free-to-play market began 15 years ago, with Angry Birds launching on 11.12.2009 as a key milestone. But now, mid-sized studios find themselves facing an uphill battle—caught between the giants and smaller indie teams. With investment money drying up, access to capital has slowed to a trickle. Yet Finland’s story is not just one of financial challenges; it’s about an ecosystem that has learned to thrive in adversity.

Geo-wise, Finland is neither Paris nor New York, lacking the warmth of Southern Europe.

Despite its cold winters and long, dark days, Finland has produced some of the world’s most iconic gaming companies. And while public funding isn’t as readily available here as in other parts of Europe, Finnish studios have adapted, becoming models of self-sufficiency and innovation.

While public game funding is scarce in Finland compared to other parts of Europe, Finnish studios have thrived through self-sufficiency and innovation. Lacking specific game funds and relying mostly on EU or tech-focused loans, Finnish devs have succeeded with creativity and resourcefulness.

What truly sets Finland apart is its deep sense of community.

Finland has one of the highest ratios of associations to citizens in the world, and this culture of collaboration extends into its gaming industry. Organizations like the Finnish Game Developers Association and regional hubs foster a spirit of knowledge-sharing and mutual support. This “rising tide lifts all ships” mentality has been crucial in keeping the industry not only afloat but thriving, with studios regularly sharing resources and expertise.

Despite these challenges, Finland remains a competitive player in the global gaming market.

Compared to studios in the US, Finnish companies have lower burn rates, making them more cost-effective. As remote work becomes the norm, Finland’s appeal as a gaming hub is growing. Although living costs are high, Finland offers unparalleled public infrastructure, a supportive business environment, and the title of the world’s happiest country. Sure, it gets cold, but with remote work, you can escape to a warmer climate for a few months while staying connected to Finland’s vibrant gaming scene.

An interesting story here:

10Tons, a mid-sized studio in Tampere that recently celebrated its 20th anniversary. Though their profits have been steady rather than staggering, they’ve consistently turned down M&A offers, choosing to remain independent. The CEO explained that while outside investment could boost their revenue, it’d likely come at the cost of their impressive 50% profit margin. It’s a lesson in balancing growth with sustainability, a philosophy many Finnish studios echo.

In recent years, a fascinating shift has occurred.

Finnish studios, particularly mid-sized ones, are moving away from mobile-only development and exploring the PC & Console. Even major players like Rovio are expanding their horizons. At the same time, Finnish companies are becoming more cautious about mergers and acquisitions. Interest from global giants like Tencent and Virtuos remains high, but many Finnish studios prefer to retain their independence, focusing instead on strategic partnerships and collaborations that align with their long-term vision.

Finland’s strength lies in its talent pool and its unique approach to fostering collaboration and innovation.

The culture of cooperation within associations and the broader ecosystem ensures that Finnish studios aren’t just surviving—they’re thriving. As long as this spirit of mutual support continues, Finland’s gaming industry will continue to punch well above its weight, attracting talent and investment from across the globe.

The Finnish games market is challenging from a VC perspective for several reasons.

Core Findings by Jere Partanen:

Principal at Sisu Game Ventures & CPO at Pandatron.

He’s investing in games & building an AI-driven coaching service.

Finnish studios often value design and innovation.

Aside from a focus on design, they’re often rather driven by engineering. Put together, this tends to lead to less of a commercial focus. In a mature market such as mobile games, there is less room to innovate in genres, new mechanics, and metagame frameworks. The winners tend to be those who execute against goals driven by commercial goals, with the opportunity space being exceedingly narrow.

More studios in countries like Israel and Turkey have recently succeeded partly since they are ruthlessly focused on developing commercially viable products while keeping costs relatively low.

They tend to have a more modern approach to LiveOps, especially when it comes to the personalization of offers, and focus on the daily engagement of users. As a result, they’re the ones seen as more venture-backable with a mature and saturated market in mind. Using its AI-driven approach and unusually heavy focus on early testing, Cosmic Lounge (one of Sisu’s portfolio studios) is one of the Finnish companies trying to bridge the gap between the traditional Finnish approach and the more commercially driven mindset we’ve seen in other markets.

While the Finnish ecosystem is stereotypically quite open, and companies are unusually willing to share their insights, we have seen relatively little investment from previously successful founders.

Some may offer advisory, but at least personally, I would have expected significantly more angel activity in the Finnish ecosystem. We surely do not lack pure capital from exits, so many founders have simply chosen not to invest in the next generation of Finnish developers. Their interests and financial goals have not been as aligned with investing in new game studios. This is fair, but I believe the scene has somewhat suffered because of this. Similarly, local generalist funds have almost entirely avoided games as an investment category. This and global slowdowns in venture funding have created an unfortunate situation for Finnish studios. Proven founders still receive funding, but the current situation may partly dissuade younger founders.

We are simply seeing fewer younger founders enter games looking for VC funding.

Frankly, a major issue here is that the younger folks in established studios (or startups, for that matter) do not have experience seeing a new game go from zero to scale. They may have worked on already scaled titles, but that’s hardly the same thing. So, they do not have the experience they could draw from when it comes to setting up a new studio. Another reason is that many Finnish youth are driven by values that are not the best fit for wanting to build scalable game studios. Maybe artistically focused indies, but not VC-backable mobile studios. Again, about Turkey, we see younger developers have a rather different mindset and priorities due to the country’s financial and political situation.

Finnish studios still need to continue adapting to the current market while ensuring they don’t lose the edge that has made them uniquely successful in the past. If they manage to adapt and keep that edge, there will still be a promising future for the Finnish mobile ecosystem. Still, many promising entrants are building venture-scale businesses. They might just not come from the usual angle one would associate with Finland.”

Here is our second chance for both established and emerging companies.

Top Points by Jani Torppa:

Co-founder of Geeklab & Jetiförlivet.

Finland has long been recognized for its world-class tech companies and globally successful games. However, the last 5 years have seen a shift in the landscape. While we haven’t witnessed the rise of a major new player in recent years, the industry is on the cusp of a resurgence, offering what feels like a second chance for both established and emerging companies.

Two key trends are unfolding.

First, established companies are making a strong comeback, investing significant resources into creating the next big hit. Second, newer or up-and-coming companies are securing funding and attracting top talent, positioning themselves to produce the next breakthrough game.

Exciting developments are underway.

It’s only a matter of time before we see the next major success story. In my view, three companies stand out as top contenders for the next big hit: Fingersoft, HypeHype, and Cosmic Lounge.

Finland’s gaming industry is on the brink of a new era, and it will be fascinating to see which of these innovative companies leads the charge.

Finnish Mobile Gaming Scene: Supercell Syndrome

Key Takeaways from Antti Kananen:

A seasoned entrepreneur, games executive, and product person with backgrounds from studios such as Huuuge Games, SciPlay, Koukoi Games, VRKiwi, and more.

Beyond working in the industry, he’s invested in roughly 20 companies in games, ad tech, and monetization services, while also serving in advisory and board roles for various companies both within and outside the gaming industry.

Finland’s strength has always been its infrastructure of talent pool and open environment of shared learning, insights, and knowledge through networking between studio personnel and their leadership. Moving forward this is something that we need to double down on, with updated lenses towards commercialization and how we run our businesses in the future.

The industry is more competitive, players are more demanding, and global competition is fierce.

To keep up with that, we need to explore things through the mentioned lenses instead of how we’ve done things in the past. We shouldn’t forget our creativity in connection with things, as that’s been a needle-mover for Finland to a large extent in the past – and will be in the future. Creative approach, though, alone isn’t enough nowadays as the commercial sentiment is beyond that leaning on e.g., user acquisition and distribution. On top of the mentioned things, we should also leverage our ‘sisu’ on explorations beyond the current commercial sentiment, towards creating the future of games and how they are played, e.g., consider something that is a needle-mover for the whole global industry.

There’s a bright future ahead on this front, as we play our cards right. However, I want to be an eye-opener for the industry here.

- Lack of commercial sentiment and leadership.

- Not knowing how to own companies, yet maintain them correctly after exiting.

- The funding landscape has shifted e.g., looking outside the borders more broadly.

- Political, educational, and economic issues and decisions.

Starting from a lack of commercial sentiment and leadership, after 2018 the industry has been moving slower, and left behind, vs. how foreign businesses evolved outside the borders:

- Finnish studios have been too creative-driven and relaxed.

- IP and brand syndromes have hit us, e.g., we haven’t seen or created many new hits since 1st ones or been able to create new IPs and brands.

- We missed completely good parts of the hypercasual wave and its learnings, and because of this, we came already late to hybrid casual.

- Many didn’t know how to distribute games as well as publish them, which was very visible during industry events before COVID-19, where many early-stage studios leaned on publishers to move the needle for them. After IDFA there’s been a gap also between how foreign studios distribute games vs. how our studios approach it.

- Finland had F2P as a ‘bad’ sentiment within its developers and indie scene, during the golden era of F2P, whilst abroad F2P was quickly welcomed and nurtured very far. We didn’t evolve on this front or follow shifts on best practices e.g., monetization, whilst foreign companies were excelling on it. Even our biggest player had to revamp its operations to raise the bar on this, which fortunately paid out well for them and will help us as an industry to go further.

- AAA, PC, and Console releases have seen misses lately, where also there has been issues such as budgets getting out of control, QA done poorly, and such.

- Everyone here tried to mimic Supercell, which caused Supercell Syndrome and resulted in not building unique moats for the businesses – which, in the end, led to some closures, etc. Success isn’t about imitation.

In terms of not knowing how to own companies as well as facing issues after exits:

- We have had founders who knew how to build companies as well as exit them – however, unfortunately, after exits the studios founded have faced shutdowns due to several issues with buyers.

- Buyers and foreign studios that are still operating here, who entered the market through M&A, have also let some operate their studios here with too much comfort over-commercialization, which has accumulated misses to commercial mindset developments.

- After exits, game millionaires haven’t started much new, which also has accumulated to reasons the industry here has been left behind.

We saw some acquisitions that went well in terms of building things the right way, so it’s not all bad.

Overall things go good and bad on a larger spectrum, and whilst some things have been holding us back as an industry here, we should always honor the good points and successes built. On this front, we’ll still be in the future benefitting from acquisitions and foreign entries that get attracted by the businesses we build. This enables not just cash movement but also know-how and insights movement into the industry, which will enable us to do things on the right business spectrum.

When we talk about the funding landscape, here are some examples:

- Games VCs have shifted to invest abroad, resulting in gates for cash inflow to the industry.

- Games millionaires have not participated much in circulating cash back to the industry. If they have taken stakes in game VC funds, the problem stays the same as long as game VCs look more and more outside the borders.

- Evergreen Finnish funds have shifted away from games. This includes successful funds who made it big in games but don’t believe they will see another Supercell.

- The government’s financing entities invested in wrong trends and shifts, on top of moving slowly around them.

Talking about political decisions, educational decisions, and economic issues:

- Highest taxation in the world, resulting also game millionaires moving out, etc. We got taxed more on just basic things like groceries here, by having our government raise VAT, whilst income taxation is probably the highest in the world.

- Educational programs have been shut down around games. Some don’t teach the commercial side the right way, whilst also some produce talent to wrong positions, resulting in unemployment, and so on.

- Work-based immigration regulations and their poor developments.

While I’m stating the above points, there are lots of good things that have happened also, and it’s important to honor them.

It’s also important to understand the facts we’re operating based on, starting from how hard it is to make a hit game, and so on. Some of the bets also take longer than others, e.g., AAA is more long-term play than mobile. On this scale comparing how Finland has built its success vs. some other industries, we’re still doing good. To maintain and grow that good, we need, though, to uplift our mindset more on the commercial front. This doesn’t mean throwing away our creative and strong points, overall it’s just about combining them better with business requirements the world is asking for.

While everyone loves working here, it is indeed time for the future, with an optimistic mindset, to take a reality check and start to improve everything – through leaning on what we do best: nurturing talent and an environment of sharing towards the commercial level the world is outside our borders. We need everyone for this cause, together.

Finland’s reputation and track record have made us attractive to partnerships, and this will continue in the future.

With established hits like Clash of Clans and Angry Birds, we put ourselves on the radar for international publishers looking to expand – and we made them enter the industry: Supercell ended up partnering with Tencent, and Rovio ended up partnering with SEGA. The same could be said about e.g., Small Giant Games finding its partnership with Zynga. These types of stories have boosted the industry with an inflow of new deals for small and larger studios, which has helped the industry to grow and mature. And as we build companies, and hopefully throughout those IPs, the right way with updated lenses on things, this will keep on increasing.

I’d like to see us building and owning things better as well in the future, and maintaining and growing that success.

Even better if we were able to build companies that go for acquiring and growing businesses abroad. We also definitely would need a publisher or two beyond our current setup, just to diversify things and enable our studios to offer global opportunities for foreign businesses. This, combined with a proper inflow of global opportunities, would set us up to the next level where some are already.

Seeing the good and bad on the acquisitions front, the good ones have taught us lots of things. Acquisitions are not just about cash flow and further funding, they bring resources, know-how, and global reach that local studios often might lack. When combined with our creativity and potential future uplifts with commercial takes, everything becomes about scaling, attracting talent, and tackling both ambitious and commercially fine-tuned projects.