About the author

Joakim Achren

General Partner @ F4 Fund, Co-Founder @ Next Games (acquired by Netflix), the most helpful investor on your cap table 🫡

Journal 13 Joakim Achren September 2

Before diving into this week’s piece, I wanted to ask if you know anyone considering starting a startup. If so, please encourage them to contact me on LinkedIn or submit a pitch through our website. We’re eager to connect with gaming and consumer startup founders. 🫶

Here’s this week’s piece.

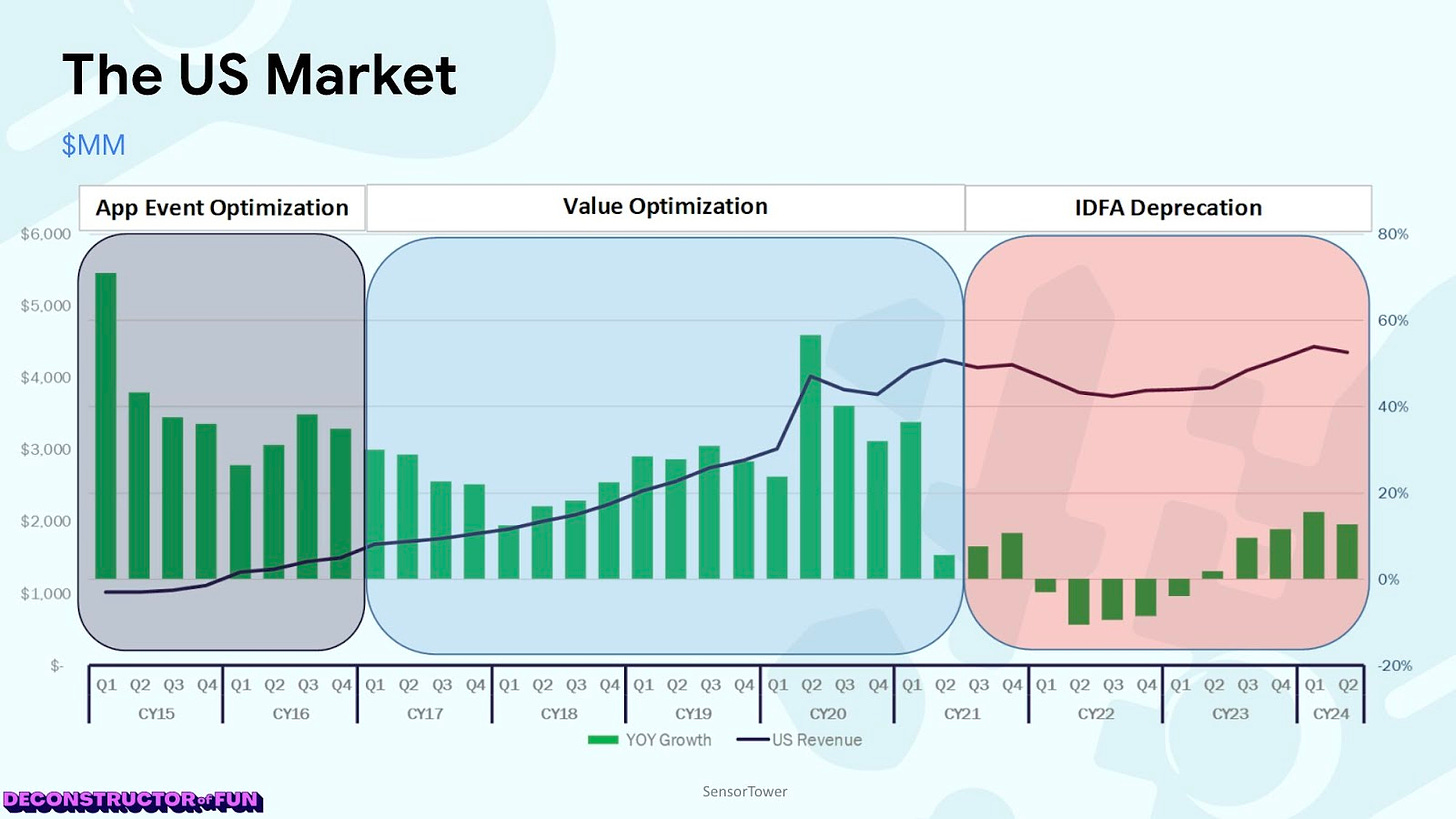

I recently saw a LinkedIn post from Miska Katkoff, in which he shared an insightful timeline chart by Eric Kress. The chart, copied and pasted below, details the mobile games industry’s YOY growth in the past ten years, highlighting revenue trends and the significant impact of Apple’s IDFA changes.

This, combined with a conversation I had with a US entrepreneur about VC investments in mobile gaming, inspired me to share my perspective on why mobile gaming has become a challenging space for investors.

Let’s discuss why mobile gaming studios have become so uninvestable over the past year. Note that I’m not referring to companies that have scaled a game, achieved phenomenal KPIs (Day-30 retention above 20%), and then raised money. I’m talking about startups that pitch an idea without consumer validation, expecting to raise funds.

In 2024, many mobile game studios operate in the realm of funds raised years ago (2021-2022) to build a game, soft-launching it later to assess the KPIs. Out of this batch of ZIRP-era mobile gaming pre-seed investments, numerous companies have decent KPIs but struggle to run effective user acquisition campaigns due to limited capital. They’re making some revenue but can’t scale their user base effectively with the budgets they have. Simultaneously, they need an adequate headcount to create enough content to keep players engaged long-term. Expanding content requires significant person-hours and capital, which most early-stage studios lack.

If these studios had more capital, they could scale their teams and overcome user acquisition challenges, potentially finding growth. But this only works if the ROAS (return on ad spend) doesn’t keep slipping further into the future—which I’ve observed is a common issue. Early, the cost to acquire a user is low, but as you scale, the cost goes up to a point where you pull back on UA spend, as the users you are acquiring just aren’t spending enough in the game to cover the costs to acquire them in the first place.

In the market, dozens, perhaps even a hundred VC-backed mobile game studios face similar struggles. Their KPIs are good but not super impressive, and they can’t scale or reach breakeven, where revenue covers headcount and marketing costs.

Despite these issues, I get new pitches coming in with the same risks. I challenge these founders: How can they believe this sector is fast-growing and worthy of VC investment? You’ll likely hit roadblocks because the mobile games industry isn’t what it used to be. Unlike the 2010s, when any developer with some skills could exit a mobile game studio for hundreds of millions, success isn’t widespread now—though there are exceptions.

I’ll give two.

For instance, if someone who built Gardenscapes at Playrix leaves after 12 years, VCs will eagerly invest in their new venture. This person has a decade’s experience on a billion-dollar franchise, boosting their odds of market success. Because there are so many gaming VCs out there, it’s tough for all of them to invest in each 10X game developer team when they are leaving the Playrixes of the world. In addition, the VCs who plainly look at the founder’s resume and invest, need to understand if the 10Xer is up to date with what can and will work in the current market.

Second, there’s geography. Certain parts of the world are intriguing—like Turkey and Israel. Game developers there work tirelessly, akin to Silicon Valley in gaming. This intense drive attracts venture capital to these regions. However, investors still conduct thorough groundwork and reference checks to ensure these founders are genuine and competent game developers committed to making it work—are they at least 5X game developers.

Recently, a founder asked me to highlight some positive signs for mobile game developers. Positivity arises when I see founders innovating drastically on product and distribution. It’s rare but exciting when it happens. Many pitches involve merging two game genres into a blue ocean strategy without proven user validation or an actual product. There should be better pitches than this.

Then, there’s the argument that you cannot prove anything without capital. Often, these founders remain tied to another company until they raise funds or assemble their team, making them uninvestable due to their lack of true seriousness about their venture. You could pull this off in the 2010s, but not today, my friend.

If you’re building something in mobile gaming, demonstrate your commitment by showcasing your developer knowledge and de-risking the company for investors through proven consumer demand for your game.

In March, I wrote about the future hopes for game studios. Gaming is growing like crazy every year; it’s just that we need innovation to capture the attention of the new audiences that are flocking to gaming. I hope new mobile gaming studios, tied with innovation, can flourish again.

To end this week’s piece, I want to give a quick shoutout to all people in the UA Creative space. Our portfolio company, Benjamin, is looking for a Lead Creative Producer to join its UA team.

About the role:

“We are seeking a dynamic and experienced Lead Creative Producer to join our User Acquisition team. This role is pivotal in driving our creative strategy, managing the production pipeline, and ensuring all creative assets meet our high standards for quality and effectiveness. The ideal candidate will have a strong background in mobile gaming or non-gaming apps, with a proven track record of managing complex creative projects across multiple media formats.”

More on the role can be found here. If you are interested or know anyone interested in this role, please ping co-founder Jaakko Hyttinen on LinkedIn.

About the author

General Partner @ F4 Fund, Co-Founder @ Next Games (acquired by Netflix), the most helpful investor on your cap table 🫡

Please login or subscribe to continue.

No account? Register | Lost password

✖✖

Are you sure you want to cancel your subscription? You will lose your Premium access and stored playlists.

✖