Mobile Games Leaderboard: Top Turkish Studios

Journal 320 Ömer Yakabagi August 21

Many are talking about the Turkish Mobile Gaming Scene.

How about the games?

The Turkish mobile gaming industry has become a powerhouse, producing many top-grossing games globally.

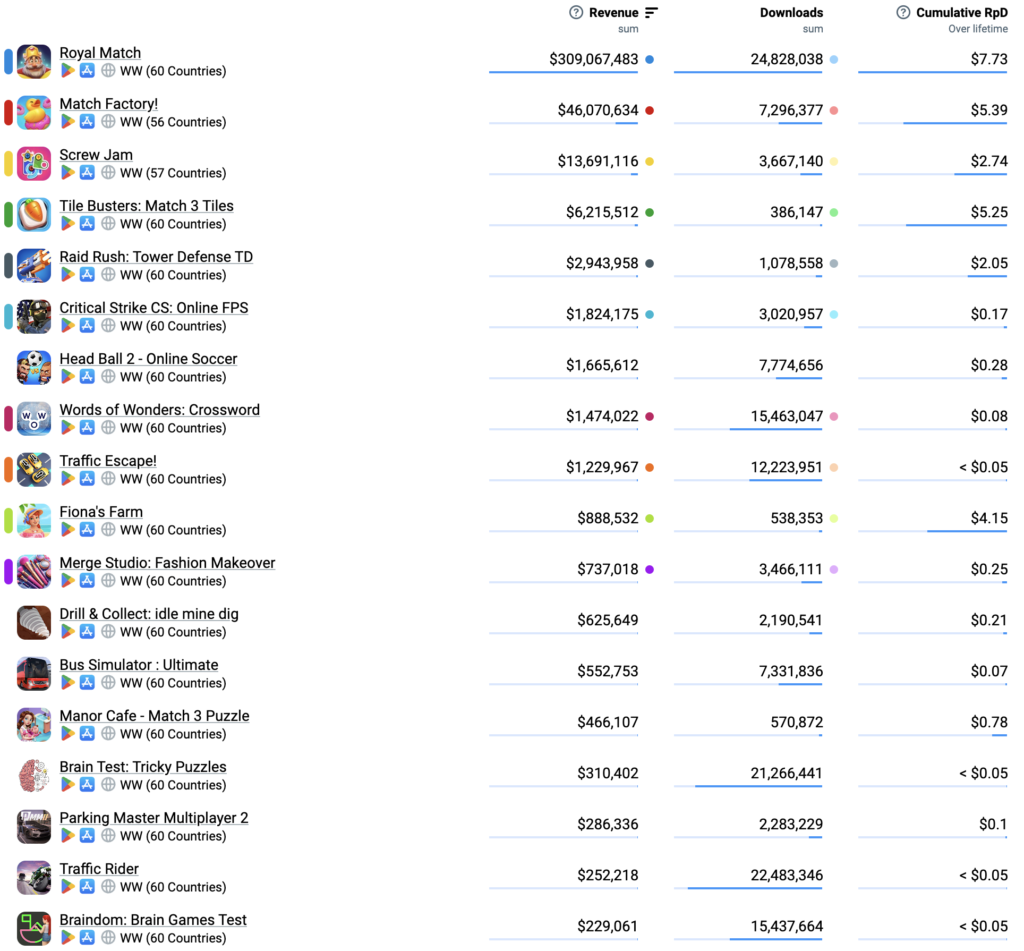

Our ‘Leaderboard’ highlights leading Turkish Studios’ hit games, showcasing their revenue and downloads over recent months. From Dream Games’ Royal Match to emerging titles like Traffic Escape by Fomo Games, the global competition is fierce, and these games are setting the stage for who will dominate in 2025.

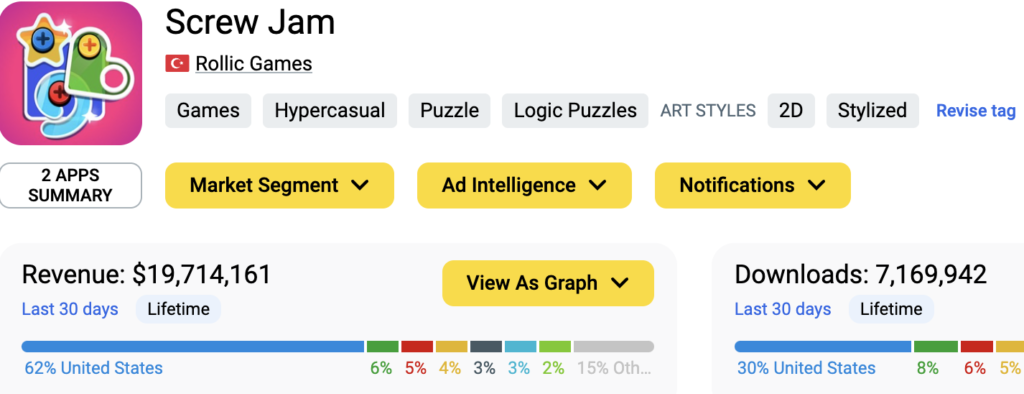

Top Grossing Games by Turkish Mobile Gaming Studios

Data: AppMagic (2024 May, June, July)

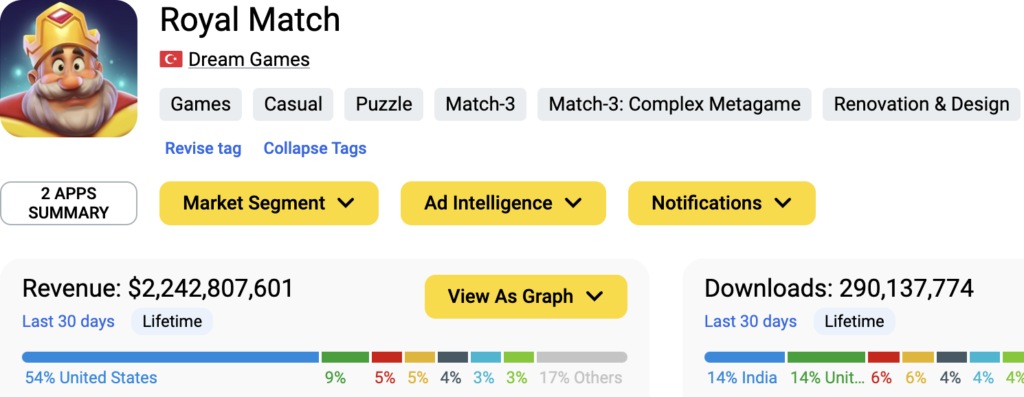

#1 Royal Match by Dream Games

Launched in February 2021, Royal Match surpassed $2 billion in Revenue and 290M Downloads.

Casual Puzzle Match-3: July 2024

Royal Match is #1 in Revenues with $105M and #2 in Installs with 7.6M in July.

Over the past 12 months, the Casual Match-3 genre generated almost $5 billion in Revenue and hit 1 billion Downloads.

Competition is fierce in 2024. Who will be the ‘King’ in 2025? 👑

Royal Match: Revenue & Downloads

Revenue grew steadily until mid-2023 and then stabilized, while downloads peaked and began declining sharply in mid-2024.

Despite fewer downloads, strong monetization keeps revenue high, suggesting a loyal and spending player base.

Winner Creatives: Royal Match

Top GEOs: U.S, UK, Japan, Germany, France

Top Ad Networks: AdMob, Unity, Fyber, AppLovin, Facebook

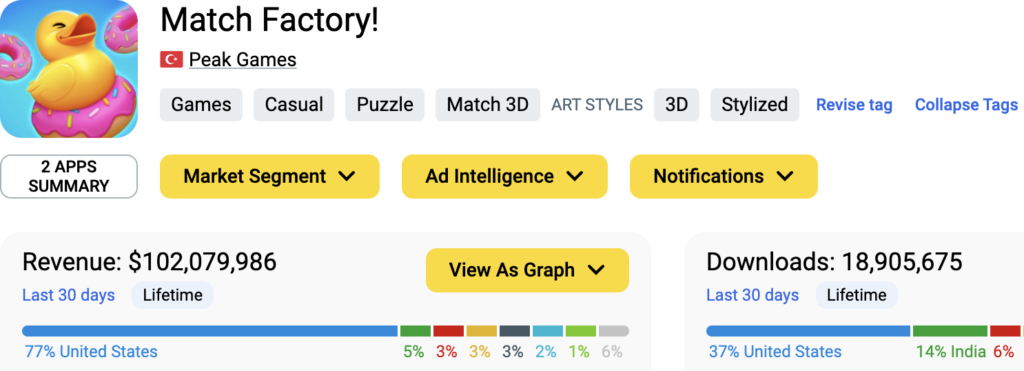

#2 Match Factory! by Peak Games

Released in November 2023, Match Factory! has surpassed $100M in Revenue with 19M Downloads.

Casual Puzzle Match-3D: July 2024

Match Factory! is #1 in Revenues with $16M and #2 in Installs with 2.1M in July.

In the past 12 months, the Casual Match-3D genre generated $371M in Revenue and 137M Downloads.

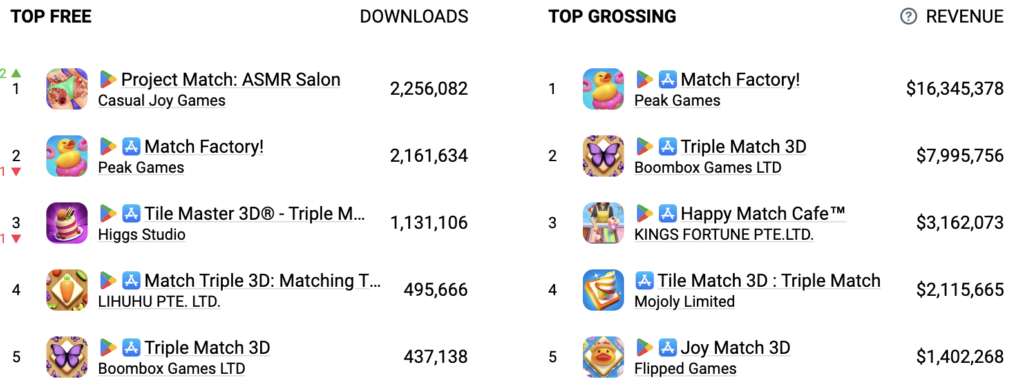

Match Factory: Revenue & Downloads

Both revenue and downloads have shown consistent growth, with notable spikes in both metrics around early 2024.

Winner Creatives: Match Factory!

Top GEOs: U.S, UK, Japan, Canada, Germany

Top Ad Networks: Facebook, AppLovin, Unity, Fyber, YouTube

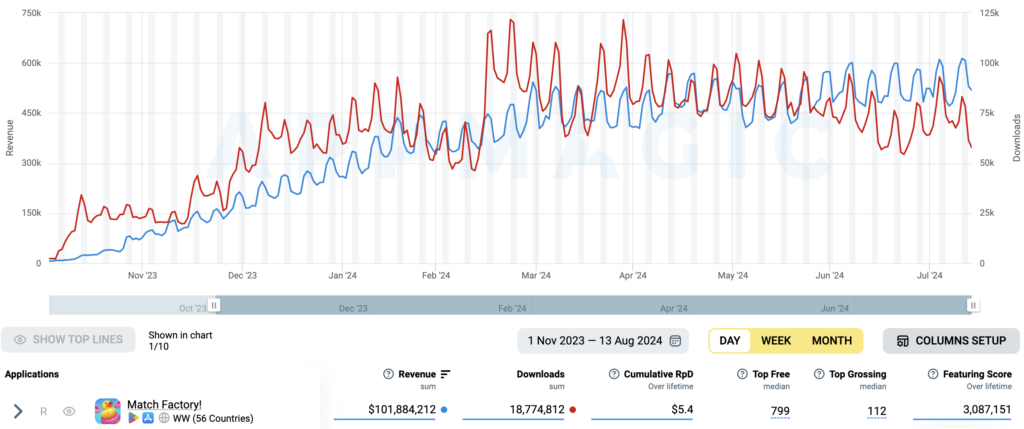

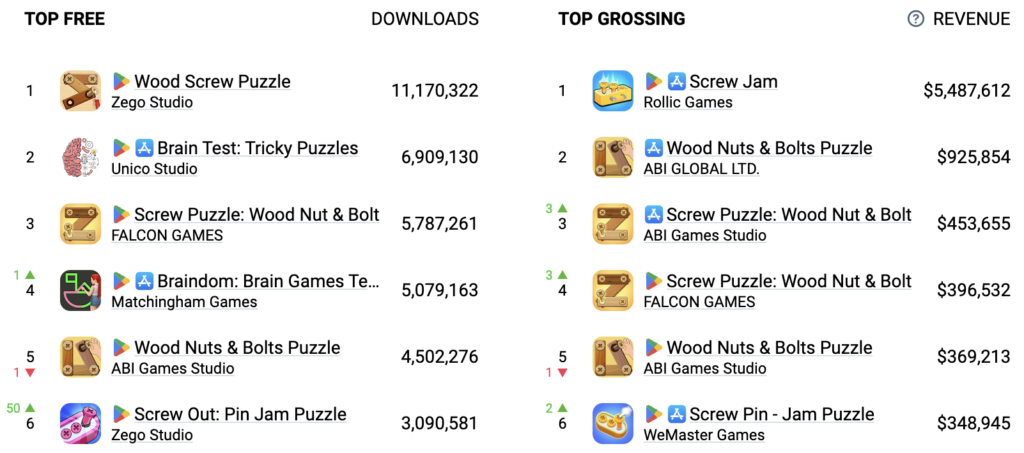

#3 Screw Jam by Rollic

Released in December 2023, Screw Jam has already $20M in Revenue and 7.2M Downloads.

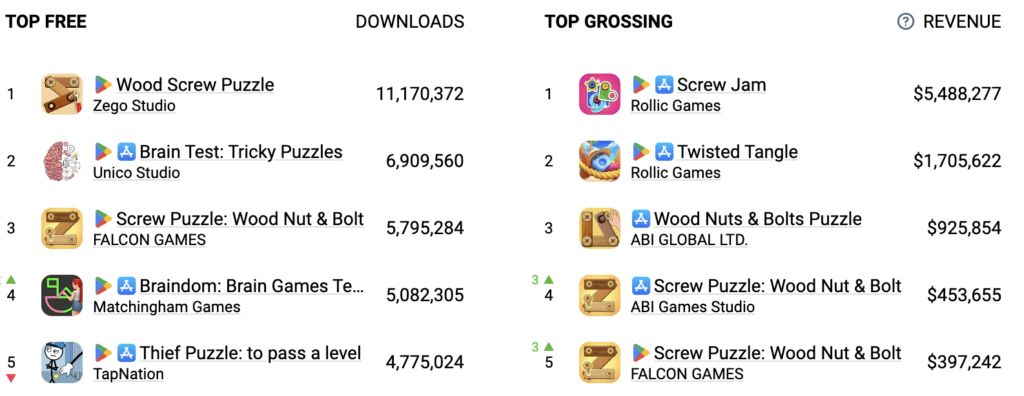

Hypercasual Puzzle 2D: July 2024

Screw Jam is #1 in Revenues with $5.5M and #38 in Installs with 1.4M in July.

In the past 12 months, the Hypercasual Puzzle 2D genre generated $71M in Revenue and 2.4 Billion Downloads.

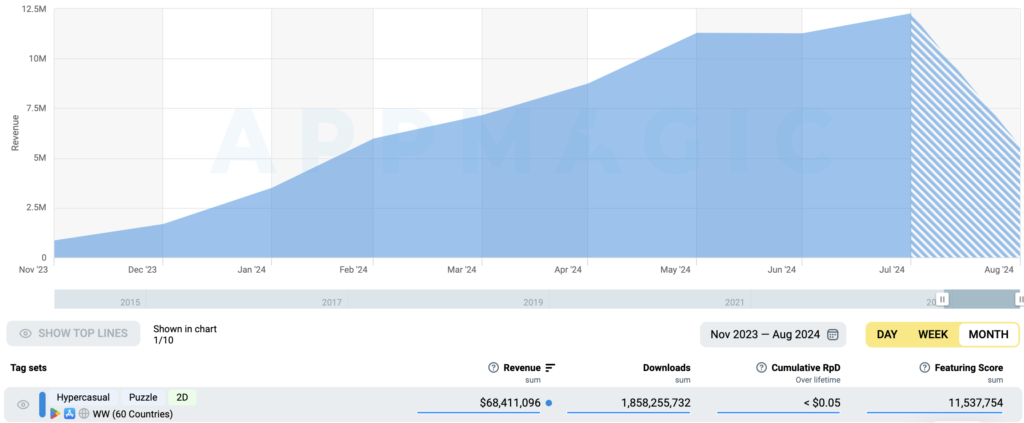

Screw Jam: Revenue & Downloads

The revenue and downloads both started modestly but increased significantly around March 2024. Although there are fluctuations, both metrics generally trend upward.

There are periods of volatility, especially in downloads, but here’s a steady growth trajectory overall. Sustaining this momentum will be crucial for continued success.

Winner Creatives: Screw Jam

Top GEOs: U.S, Japan, UK, Australia, France

Top Ad Networks: Unity, Fyber, Facebook, AppLovin, YouTube

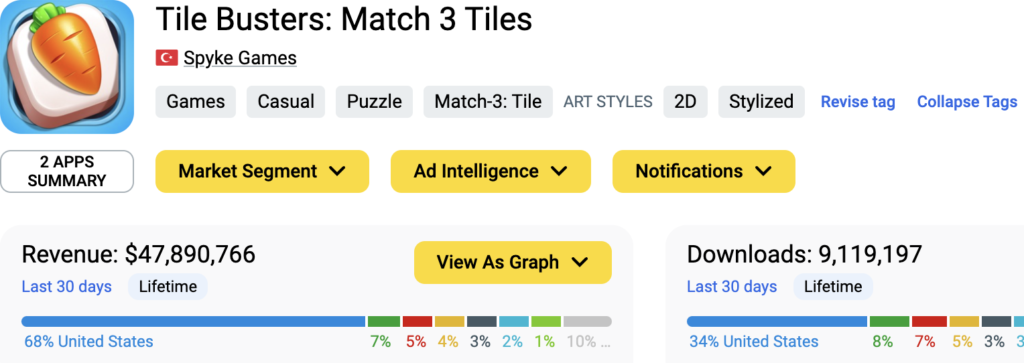

#4 Tile Busters by Spyke Games

Released in September 2022, Tile Busters has already surpassed $48M in Revenue and 9M Downloads.

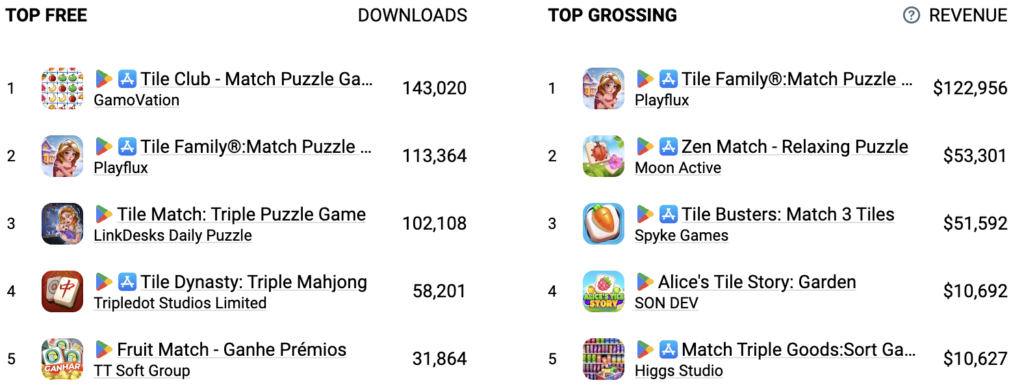

Casual Puzzle Match-3 Tile 2D: July 2024

Tile Busters is #2 in Revenues with $2M and #57 in Installs with almost 100K in July.

In the past 12 months, the Casual Puzzle Match-3 Tile 2D genre generated $116M in Revenue and 291M Downloads.

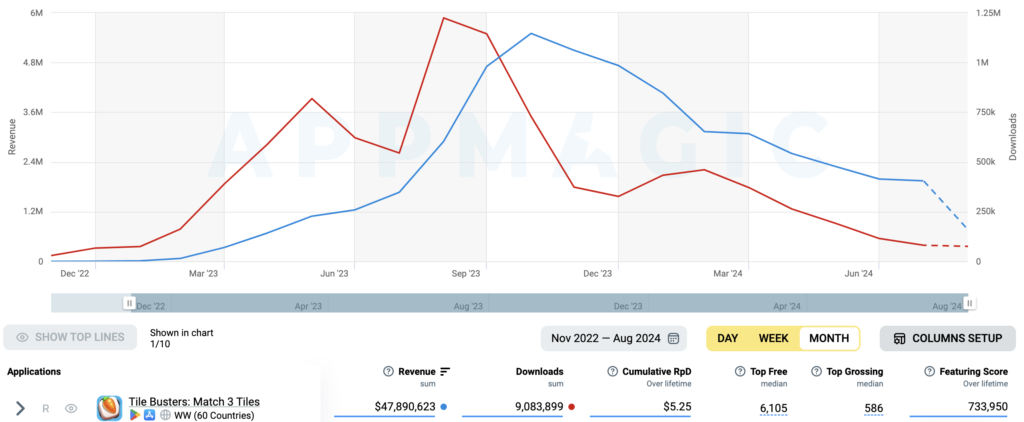

Tile Busters: Revenue & Downloads

Both revenue and downloads grew significantly until late 2023, reaching a peak. However, starting in early 2024, both metrics began to decline sharply.

The steep decline in revenue and downloads suggests the game may have peaked and could face challenges in User Acquisition and Retention.

Winner Creatives: Tile Busters

Top GEOs: U.S, UK, Australia, Japan, Canada

Top Ad Networks: TikTok, AppLovin, Unity, Chartboost, Fyber

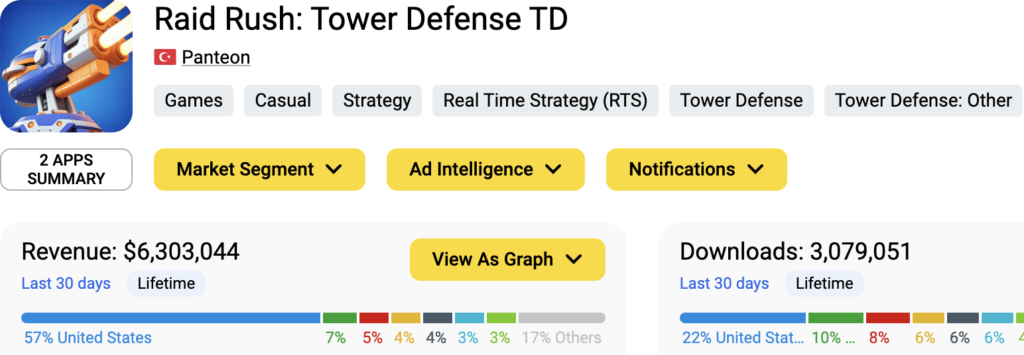

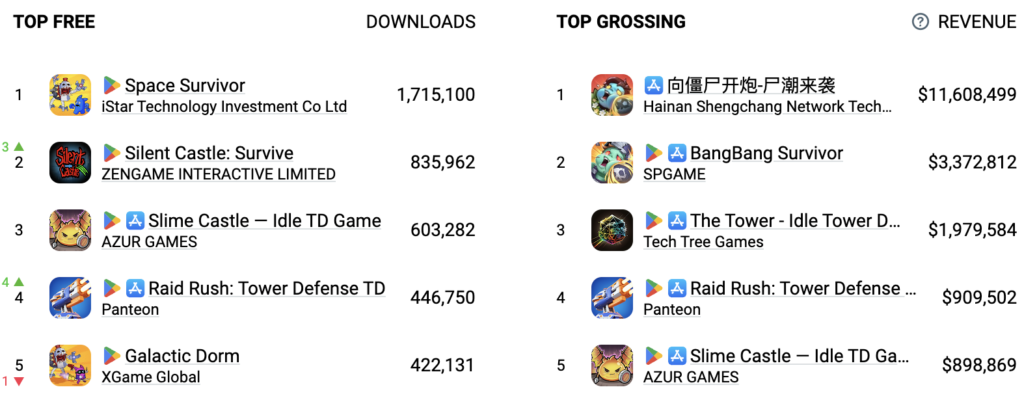

#5 Raid Rush by Panteon

Released in December 2022, Raid Rush surpassed $6.3M in Revenue and 3M Downloads.

Casual Strategy TD: July 2024

Raid Rush is #4 in Revenues with $900K and #4 in Installs with 450K in July.

In the past 12 months, the Casual Strategy 2D genre generated $116M in Revenue and 79M Downloads.

Raid Rush: Revenue & Downloads

Both revenue and downloads experienced strong growth leading up to a peak in Jan’24. Some recovery followed a sharp decline, but the trend remained volatile.

Winner Creatives: Raid Rush

Top GEOs: U.S, Japan, Canada, Germany, UK

Top Ad Networks: Facebook, AppLovin, TikTok, Unity, Fyber

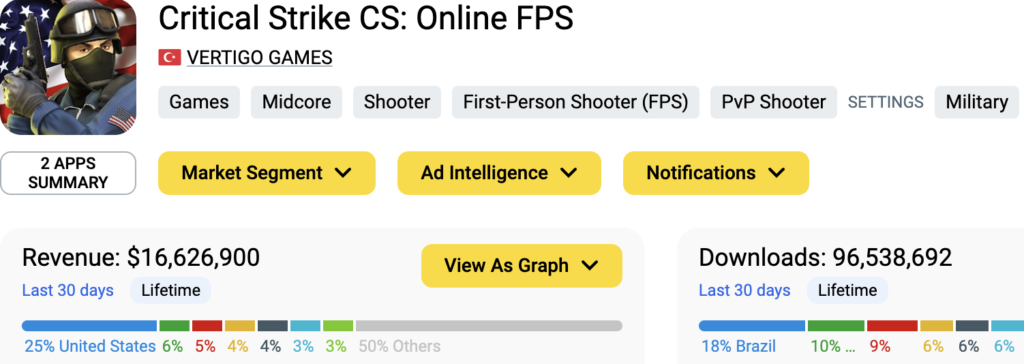

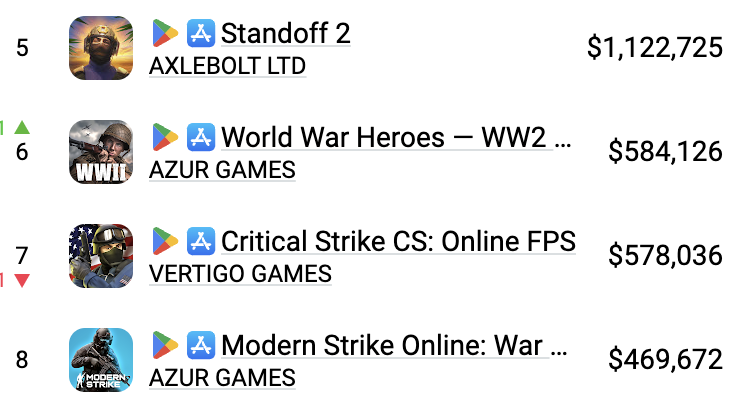

#6 Critical Strike CS

Released in April 2017, Critical Strike surpassed $16M in Revenue and 96M Downloads.

Midcore First-Person Shooter: July 2024

Critical Strike is #7 in Revenues with $578M and #23 in Installs with almost 1M in July.

In the past 12 months, the Midcore First-Person Shooter genre generated $733M in Revenue and 830M Downloads.

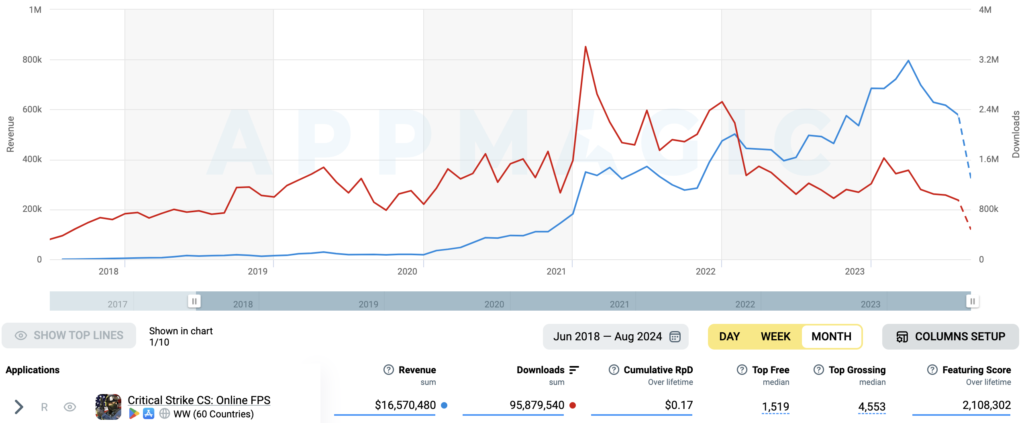

Critical Strike: Revenue & Downloads

Revenue and downloads experienced peaks and troughs, with significant spikes in early 2021 and mid-2023. However, both metrics have been declining since late 2023.

Despite the game’s large install base, the declining trend suggests challenges in retaining users and generating revenue.

Winner Creatives: Critical Strike

Top Ad Networks: Facebook, YouTube

Top GEOs: Brazil, Turkey, U.S, Poland, Israel

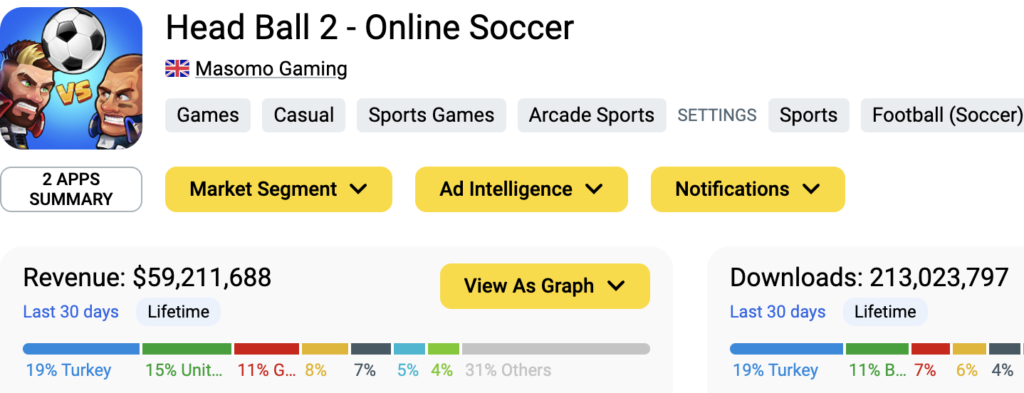

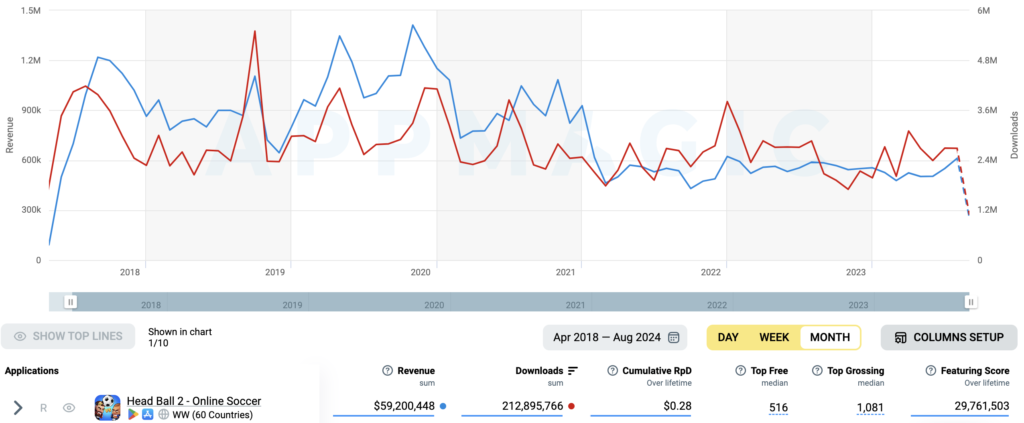

#7 Head Ball 2 by Masomo

Released in December 2023, Head Ball 2 has $59M in Revenue and 213M Downloads.

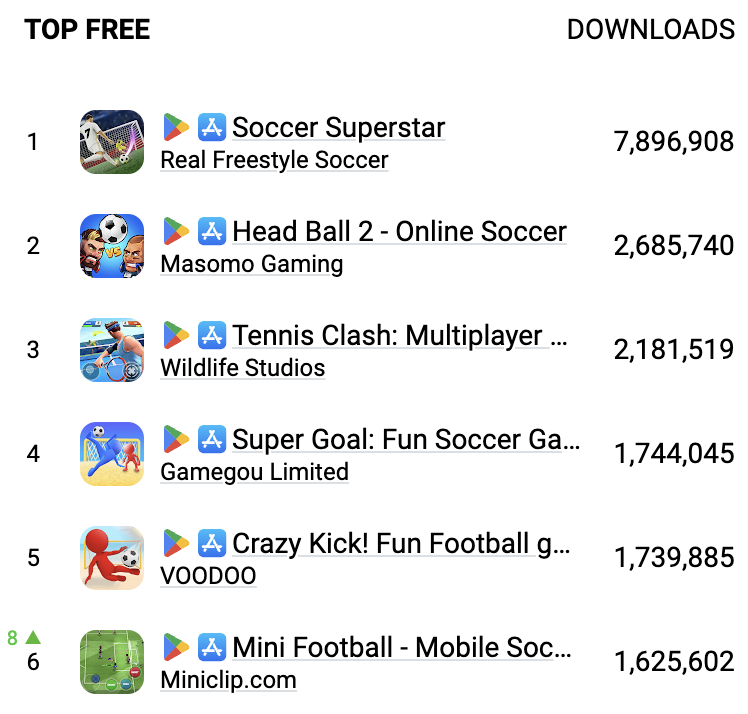

Arcade Sports: July 2024

Head Ball 2 is #11 in Revenues with $610K and #2 in Installs with 2.7M in July.

In the past 12 months, the Casual Arcade Sports genre generated $88M in Revenue and 476M Downloads.

Head Ball 2: Revenue & Downloads

Revenue & Downloads experienced early peaks around 2018, with subsequent fluctuations. The metrics have stabilized since 2021, though at lower levels, with periodic spikes.

The recent downward trend in both downloads and revenue suggests the game may be losing momentum, despite its large install base.

Winner Creatives: Head Ball 2

Top Ad Networks: YouTube, AdMob, Facebook

Top GEOs: Turkey, Italy, Brazil, France, Germany

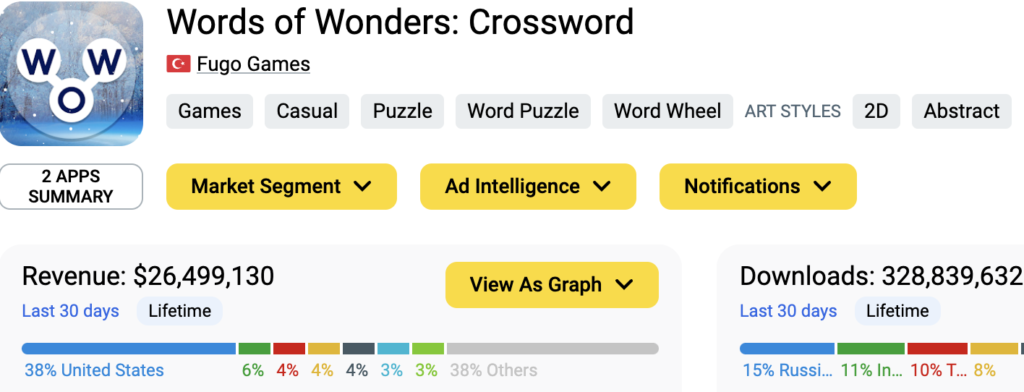

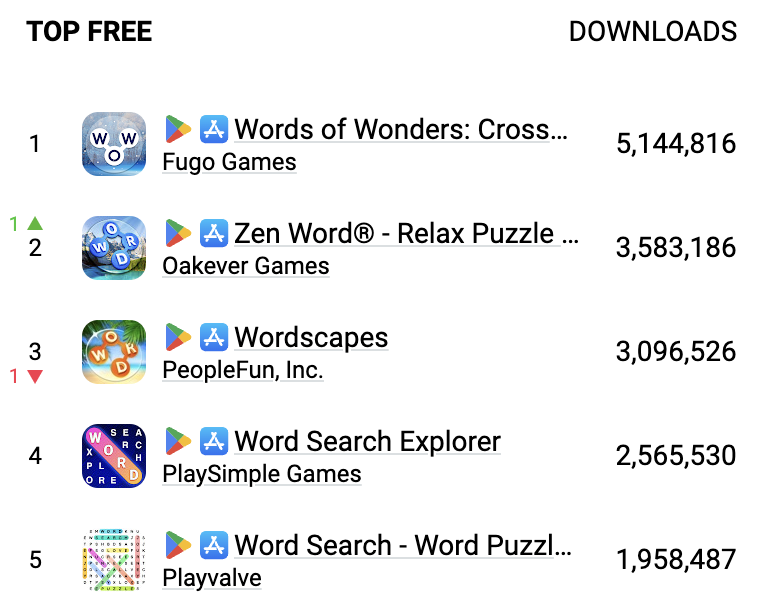

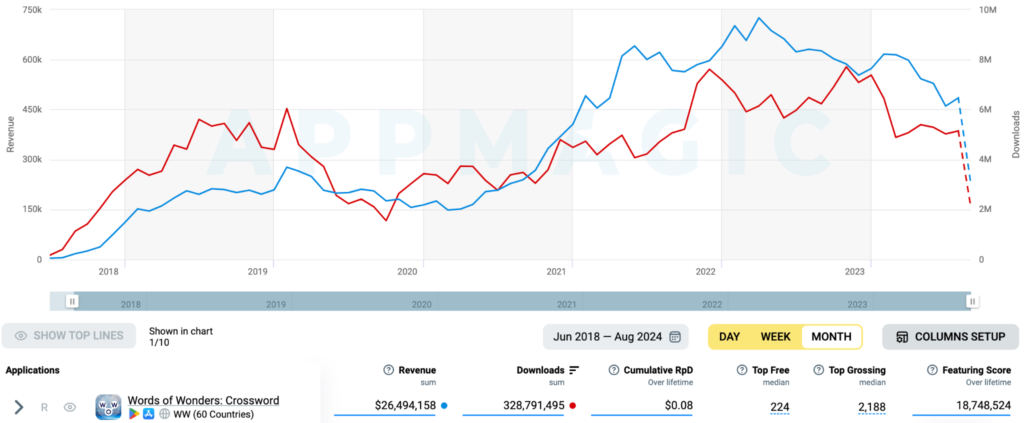

#8 Words of Wonders by Fugo Games

Released in April 2018, Words of Wonders has $26.5M in Revenue and 329M Downloads.

Casual Word Puzzle: July 2024

Words of Wonders is #12 in Revenues with $484K and #1 in Installs with 5.1M in July.

In the past 12 months, the Casual Word Puzzle genre generated $294M in Revenue and 746M Downloads.

Words of Wonders: Revenue & Downloads

Both revenue and downloads grew steadily until late 2019, after which both metrics experienced fluctuations and then began to decline around 2023.

Despite a large number of downloads, the declining trends in both metrics suggest the game may be struggling to maintain user engagement and profitability.

Winner Creatives: Words of Wonders

Top Ad Networks: AppLovin, Facebook, YouTube

Top GEOs: U.S, Chile, Turkey, Indonesia, Spain

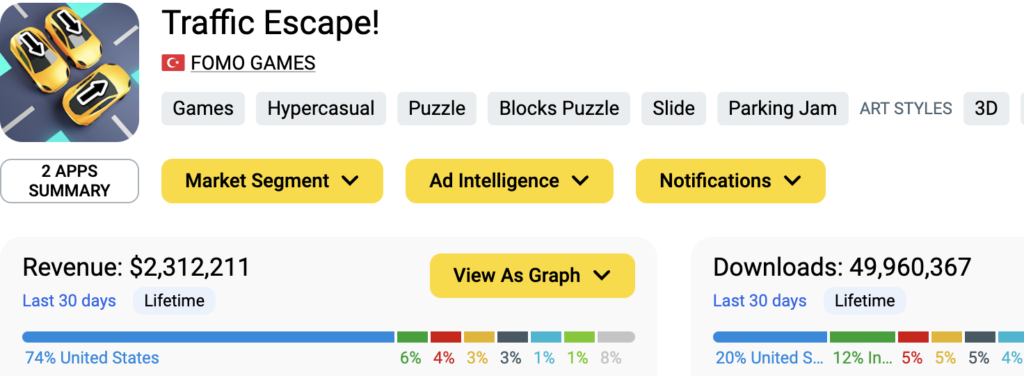

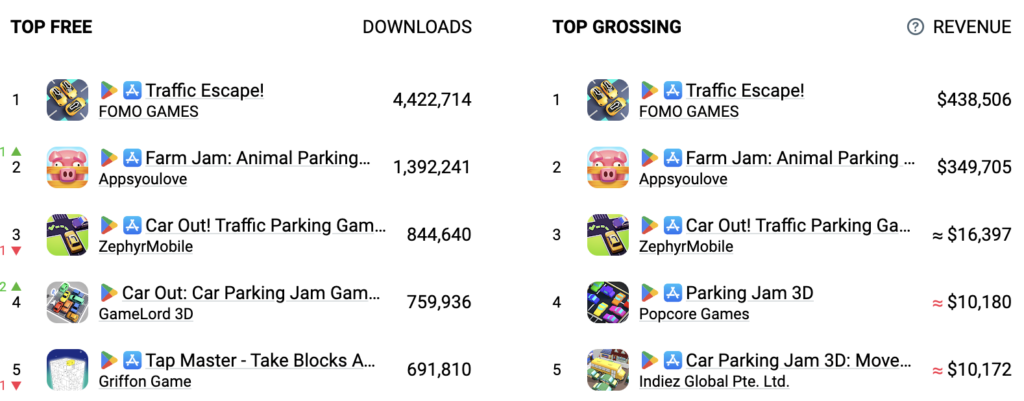

#9 Traffic Escape! by Fomo Games

Released in June 2023, Traffic Escape has $2.3M in Revenue and 50M Downloads.

Hypercasual Blocks Puzzle: July 2024

Traffic Escape is #1 in Revenues with $438K and #1 in Installs with 4.4M in July.

In the past 12 months, the Hypercasual Blocks Puzzle genre generated $9.4M in Revenue and 160M Downloads.

Traffic Escape: Revenue & Downloads

Revenue & downloads both peaked sharply towards the end of 2023, followed by a decline and then a slight recovery in mid-2024.

Winner Creatives: Traffic Escape

Top Ad Networks: AppLovin, Unity, Fyber

Top GEOs: U.S, UK, Australia, Germany, Brazil

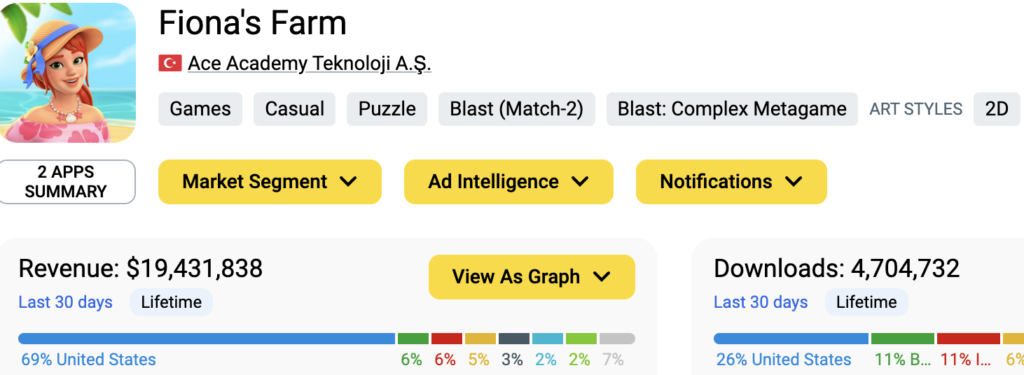

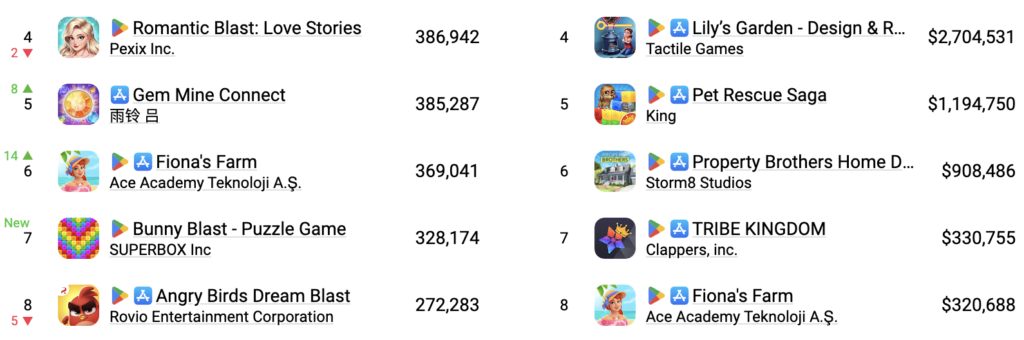

#10 Fiona’s Farm by Ace Games

Released in September 2022, Fiona’s Farm has $19.4M in Revenue and 4.7M Downloads.

Casual Strategy TD: July 2024

Fiona’s Farm is #6 in Revenues with $320K and #6 in Installs with 370K in July.

In the past 12 months, the Casual Strategy 2D genre generated $116M in Revenue and 79M Downloads.

Fiona’s Farm: Revenue & Downloads

The download trend has been highly volatile, with several peaks and troughs throughout the period. Despite fluctuations, the game has seen periods of significant user acquisition, particularly in late 2023 and mid-2024.

The recent spike in downloads suggests renewed interest, but the volatility indicates the need for sustained user engagement strategies to maintain growth.

Winner Creatives: Fiona’s Farm

Top Ad Networks: AppLovin

Top GEOs: Germany, Brazil, Chile, Canada, Indonesia

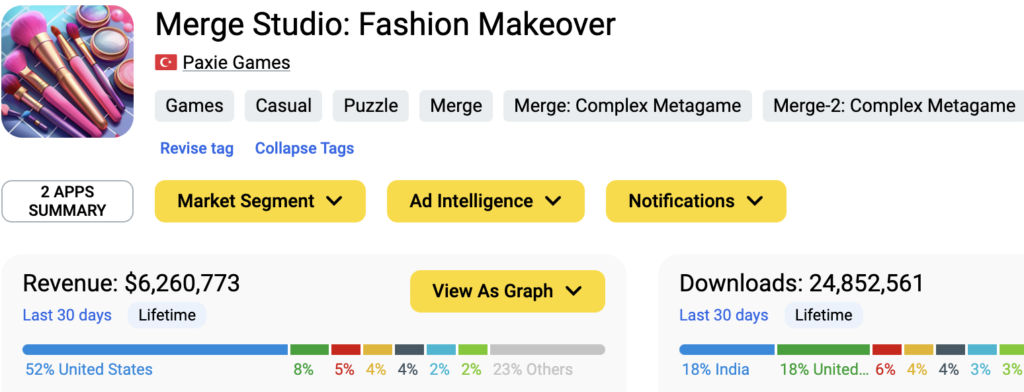

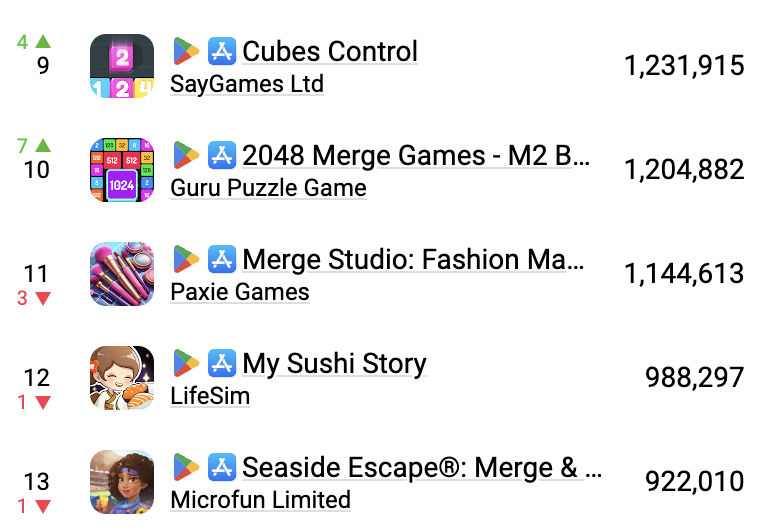

#11 Merge Studio by Paxie Games

Released in December 2023, Merge Studio has $6.3M in Revenue and 25M Downloads.

Casual Puzzle Merge-2: July 2024

Merge Studio is #26 in Revenues with $300K and #11 in Installs with 1.1M in July.

In the past 12 months, the Casual Puzzle Merge genre generated $1 Billion in Revenue and 616M Downloads.

Merge Studio: Revenue & Downloads

Both revenue and downloads grew significantly in the first year, peaking around mid-2023. However, both metrics have shown a decline since then, with recent upticks in mid-2024.

The game has experienced fluctuations, suggesting challenges in sustaining growth. To maintain momentum, it may require strategies to boost user retention and optimize monetization.

Winner Creatives: Merge Studio

Top Ad Networks: AppLovin, Facebook

Top GEOs: India, Pakistan, U.S, Australia, Brazil

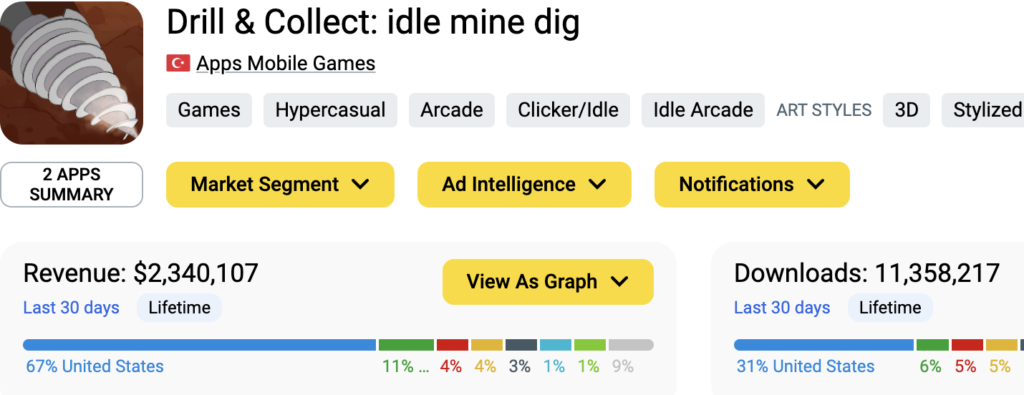

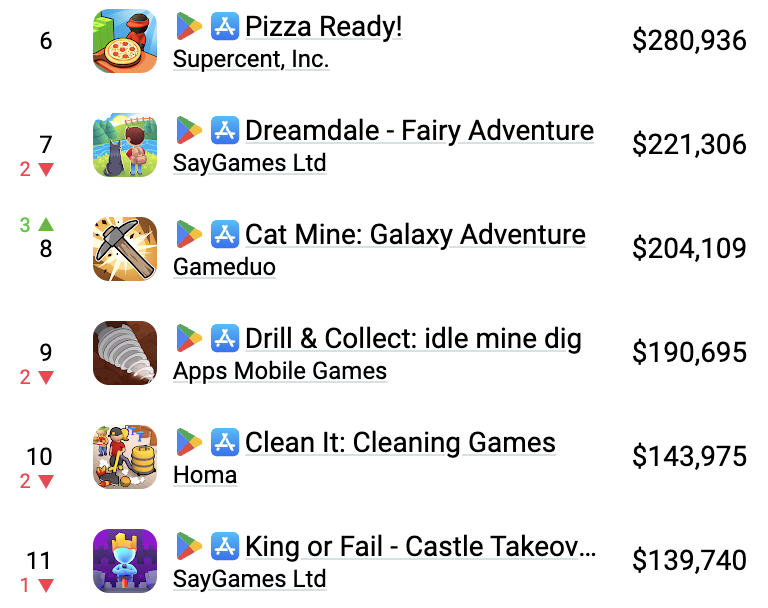

#12 Drill & Collect by APPS Mobile Games

Released in April 2023, Drill & Collect has $2.4M in Revenue and 11.4M Downloads.

Hypercasual Idle Arcade: July 2024

Drill & Collect is #9 in Revenues with $190K and #29 in Installs with 570K in July.

In the past 12 months, the Hypercasual Idle Arcade genre generated $68M in Revenue and 1.1 Billion Downloads.

Drill & Collect: Revenue & Downloads

Both revenue and downloads experienced a rapid increase shortly after launch, peaking around mid-2023. However, both metrics declined significantly afterward, with some recovery in early 2024 before another downward trend.

The sharp fluctuations suggest challenges in maintaining a steady user base and consistent revenue. Sustaining growth will likely require improved user retention strategies and optimizing monetization efforts.

Winner Creatives: Drill & Collect

Top Ad Networks: AppLovin, Facebook

Top GEOs: U.S, Germany, Canada, UK, India

#13 Bus Simulator by Zuuks Games

Released in June 2019, Bus Simulator has $15M in Revenue and 200M Downloads.

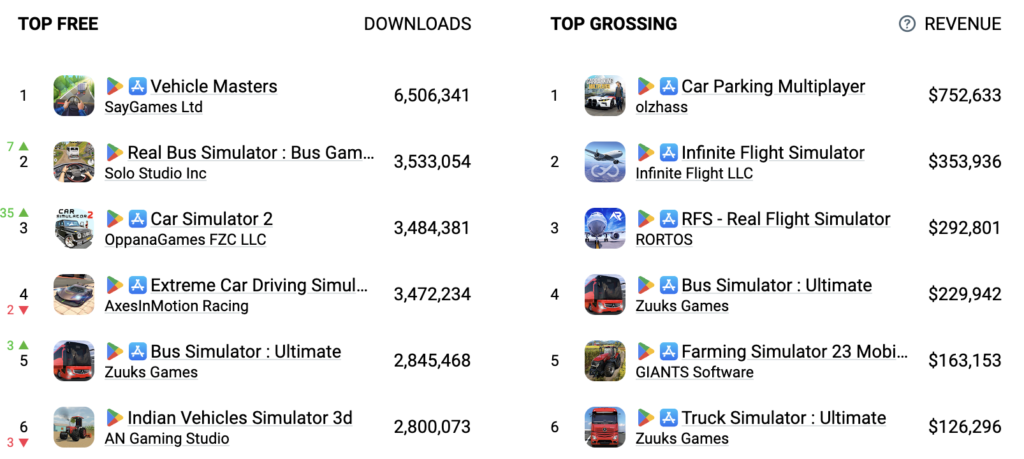

Vehicle Simulator: July 2024

Bus Simulator is #6 in Revenues with $320K and #6 in Installs with 370K in July.

In the past 12 months, the Vehicle Simulator genre generated $47M in Revenue and 2.3 Billion Downloads.

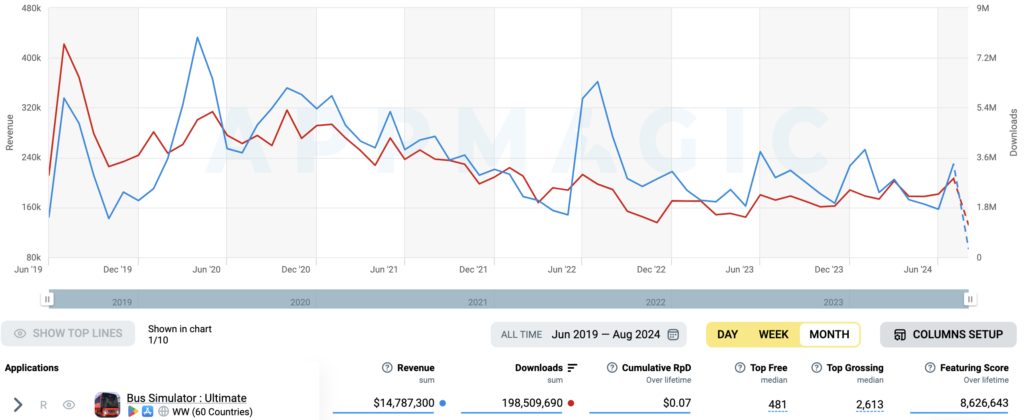

Bus Simulator: Revenue & Downloads

Bus Simulator has experienced multiple peaks and troughs in both revenue and downloads, with significant spikes in early 2020 and mid-2022.

However, both metrics have shown a gradual decline since those peaks, with occasional minor recoveries.

Despite the game’s large install base, the declining trends suggest challenges in maintaining user engagement and revenue growth.

Winner Creatives: Bus Simulator

Top Ad Networks: YouTube, Facebook

Top GEOs: Turkey, Italy, Chile, Spain, Switzerland

#14 Manor Cafe by GAMEGOS

Released in July 2018, Manor Cafe has $2.3M in Revenue and 50M Downloads.

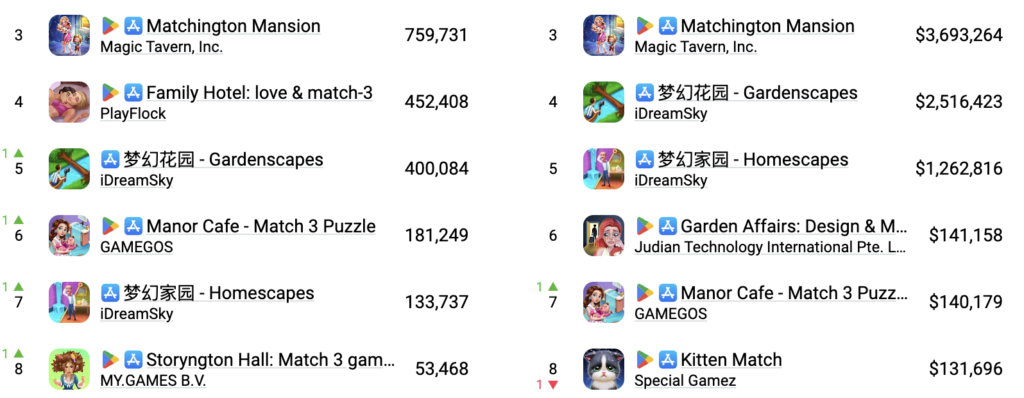

Gardenscapes-like Puzzle: July 2024

Manor Cafe is #7 in Revenues with $140K and #6 in Installs with 180K in July.

In the past 12 months, the Gardenscapes-like Puzzle genre generated $1.1 Billion in Revenue and 120 Million downloads.

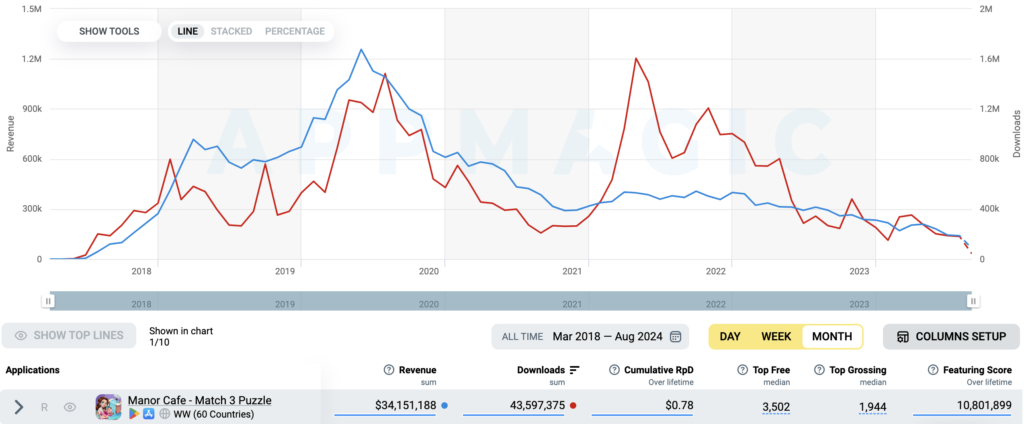

Manor Cafe: Revenue & Downloads

The game experienced strong growth in both revenue and downloads during its early years, peaking around 2019 and 2020.

However, since then, both metrics have steadily declined, with only brief periods of recovery. The consistent downward trend suggests challenges in sustaining user engagement and maintaining revenue. Revitalization efforts may be necessary to halt the decline and re-engage the player base.

Winner Creatives: Manor Cafe

Top Ad Networks: AdMob, AppLovin, Facebook

Top GEOs: India, U.S, Indonesia, Pakistan, Germany

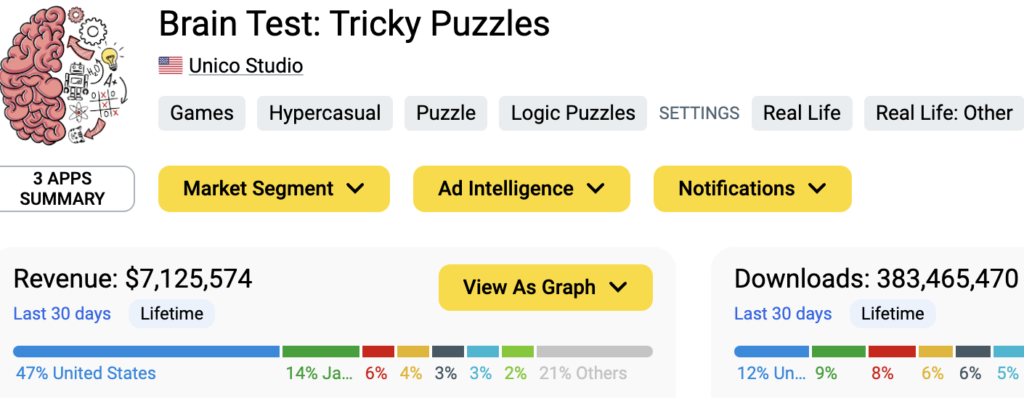

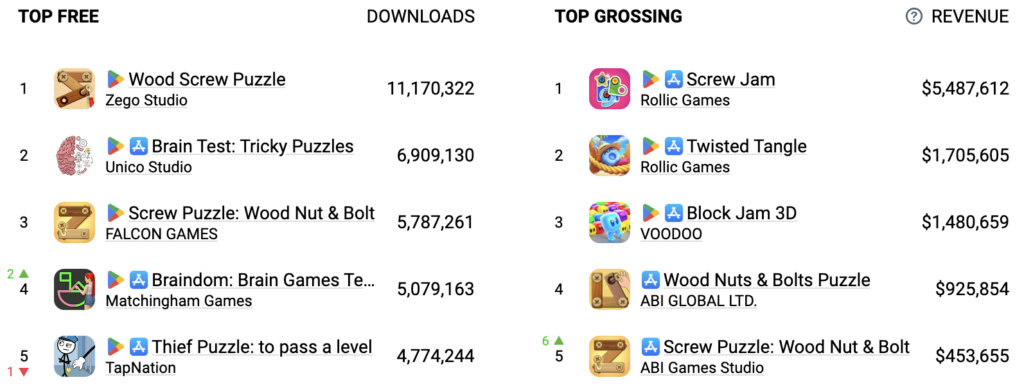

#15 Brain Test: Tricky Puzzles by Unico Studio

Released in November 2019, Brain Test: Tricky Puzzles has $7.1M in Revenue and 383M Downloads.

Hypercasual Puzzle: July 2024

Brain Test is #19 in Revenues with $100K and #2 in Installs with almost 7M in July.

In the past 12 months, the Hypercasual Puzzle genre generated $113M in Revenue and 3.2 Billion Downloads.

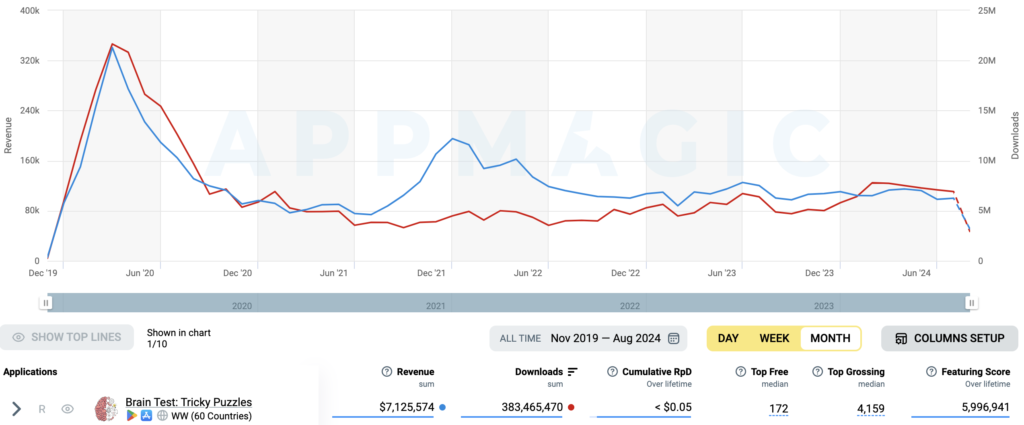

Brain Test: Revenue & Downloads

Brain Test saw rapid growth shortly after launch, peaking around mid-2020. However, revenue and downloads have steadily declined, with only minor fluctuations.

The consistent decline in both metrics suggests that the game may be struggling to retain users and generate revenue. Focusing on improving monetization strategies and enhancing user engagement will be essential to reverse this trend.

Winner Creatives: Brain Test

Top GEOs: Brazil, Japan, India, U.S, Canada

Top Ad Networks: Facebook, Unity, AppLovin, Fyber

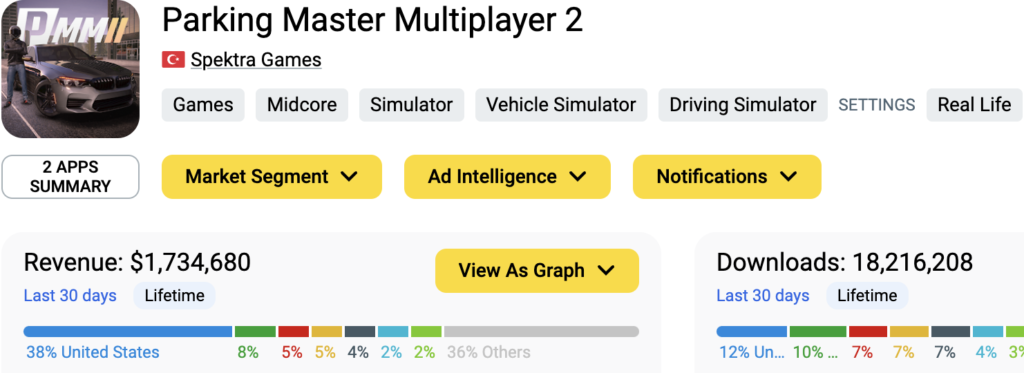

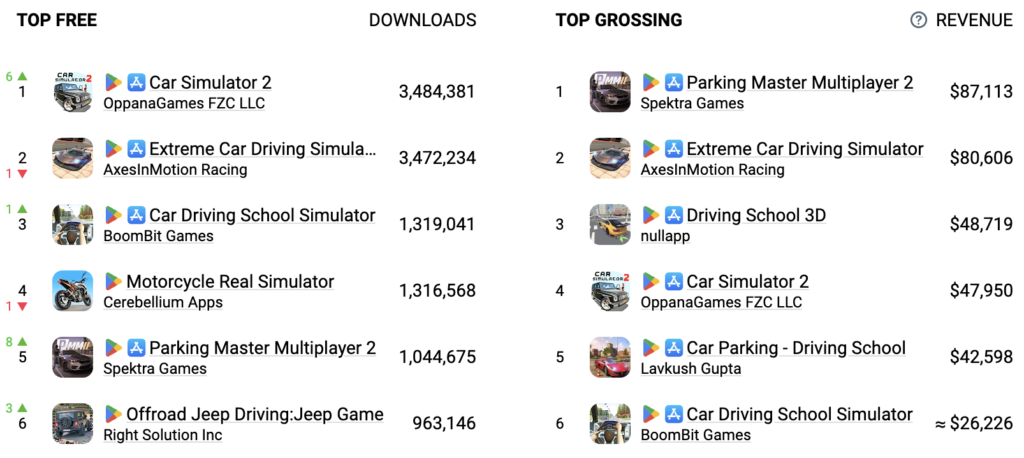

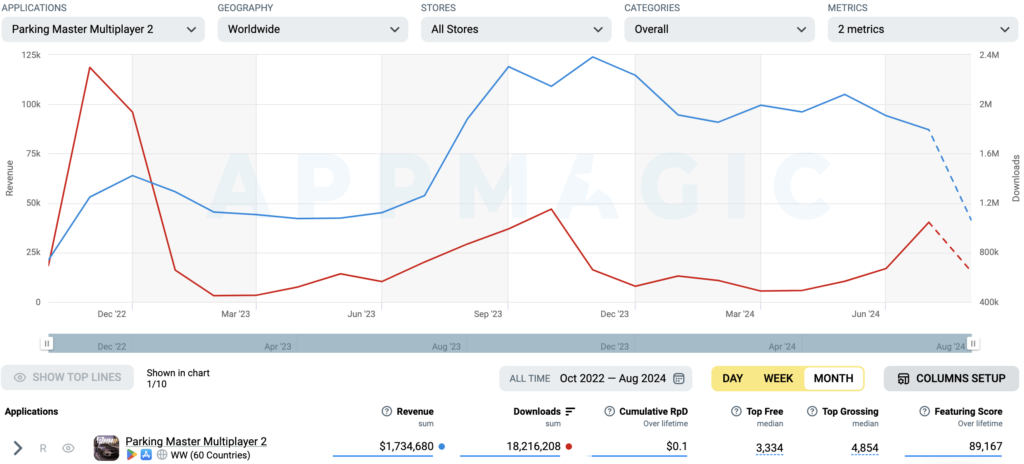

#16 Parking Master Multiplayer 2 by Spektra Games

Released in September 2022, PMM2 has $1.7M in Revenue and 18.2M Downloads.

Driving Simulator: July 2024

Parking Master Multiplayer 2 is #1 in Revenues with $87K and #5 in Installs with 1M in July.

In the past 12 months, the Driving Simulator genre generated $6.5M in Revenue and 520M Downloads.

Parking Master Multiplayer 2: Revenue & Downloads

The game initially experienced a sharp rise in both revenue and downloads, peaking in late 2022. However, both metrics saw a significant decline afterward, followed by a gradual recovery in mid-2023, with another downward trend emerging in 2024.

The fluctuating trends suggest challenges in maintaining consistent user engagement and revenue growth. Strategies to stabilize and enhance user retention and monetization may be necessary to sustain long-term success.

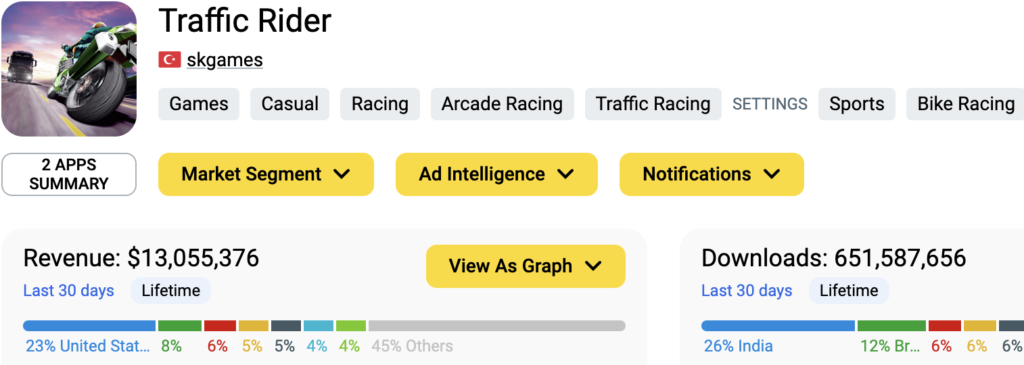

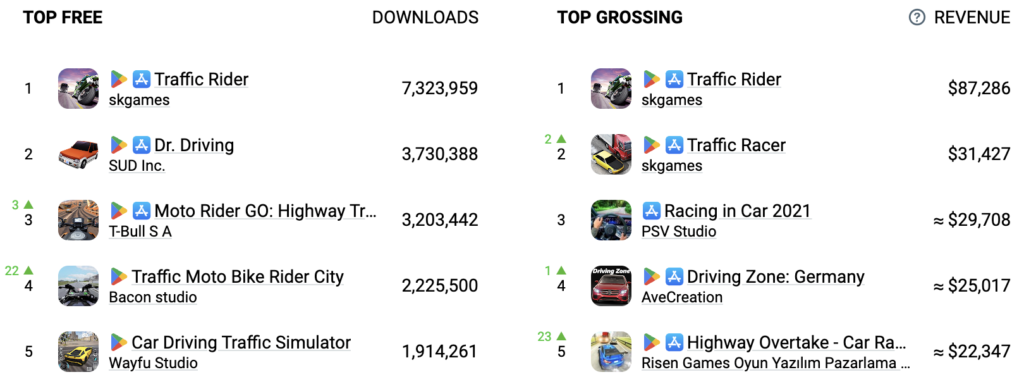

#17 Traffic Rider by SKGames

Released in Jan 2016, Traffic Rider has $13M in Revenue and 652M Downloads.

Traffic Racing: July 2024

Traffic Rider is #1 in Revenues with $87K and #1 in Installs with 7.3M in July.

In the past 12 months, the Traffic Racing genre generated $4.5M in Revenue and 560 Million Downloads.

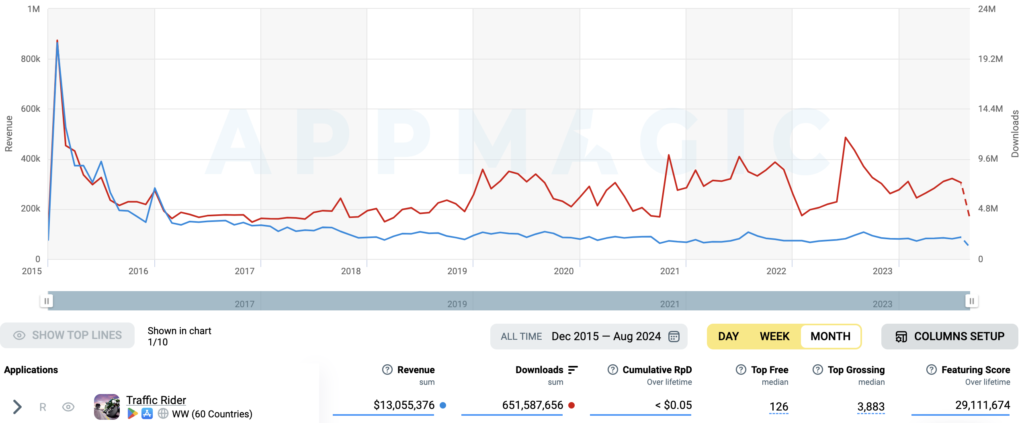

Traffic Rider: Revenue & Downloads

Traffic Rider experienced an initial surge in both revenue and downloads shortly after its launch, peaking in Jan 2016. Since then, both metrics have gradually declined and stabilized at lower levels, with occasional minor spikes, particularly around 2019 and 2021.

The long-term downward trend suggests challenges in retaining user engagement and generating revenue. To revitalize the game, efforts could focus on improving monetization strategies and re-engaging the existing player base.

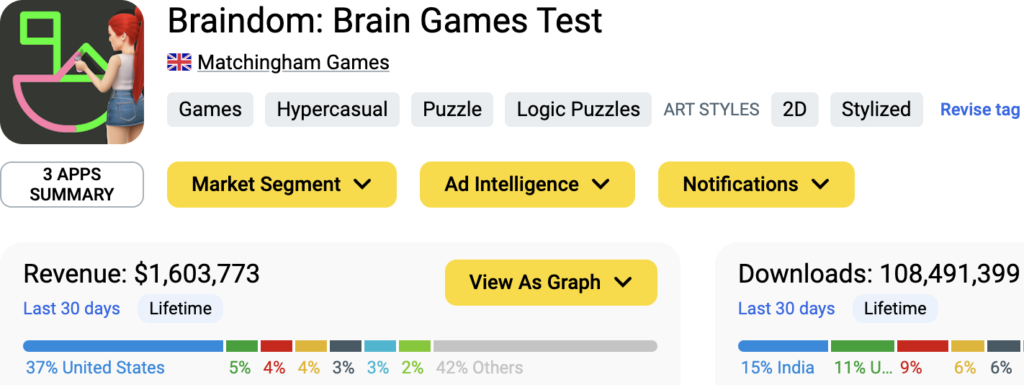

#18 Braindom by Matchingham Games

Released in June 2020, Braindom has $1.6M in Revenue and 108M Downloads.

Logic Puzzle: July 2024

Braindom is #15 in Revenues with $79K and #4 in Installs with 5.1M in July.

In the past 12 months, the Logic Puzzle genre generated $49 Million in Revenue and 1.3 Billion downloads.

Braindom: Revenue & Downloads

Braindom experienced a rapid rise in both revenue and downloads shortly after its launch, peaking in late 2020. After the peak, both metrics declined sharply and stabilized at lower levels through 2021 and 2022.

A notable recovery in downloads occurred in 2023, with a corresponding but smaller increase in revenue. The recent rise in downloads presents an opportunity to focus on improving monetization strategies to capitalize on renewed user interest.

Winner Creatives: Brain Test

Top Ad Networks: Facebook

Top GEOs: Brazil, U.S, Turkey, Pakistan, India

Conclusion

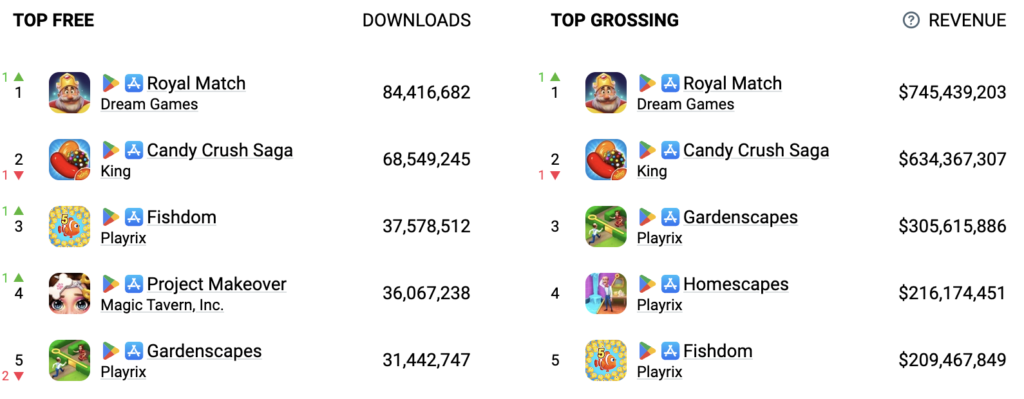

Turkish mobile game studios continue to make significant strides, with titles like Royal Match and Match Factory leading the charge in revenue and downloads.

While some games face challenges in sustaining growth, the overall momentum of the Turkish mobile gaming scene remains strong. As the industry evolves, these studios will need to innovate to maintain their leadership and capture the crown in 2025.