Mobile Game Leaders: August 2024

JournalReports 105 Ömer Yakabagi September 3

The mobile gaming market in August 2024 is a mix of stability and change!

Top games are holding their ground in Downloads & Revenues, but there are some interesting shifts with new titles entering the scene.

While overall downloads have dipped a bit, smart monetization strategies are keeping revenues strong or even growing. Emerging games are making waves, showing the market’s ability to adapt and grow.

Let’s dive into the top Pubs & Games to see the trends in mobile gaming.

Trending Games – Top Free

So, what?

The ranking changes among these games reveal interesting trends in the mobile gaming market. Games that offer quick, engaging, and often social experiences seem to be climbing the ranks more significantly. Titles that introduce novel gameplay mechanics or capitalize on popular genres (like puzzles, racing, and action) also show strong performance. Moreover, games with significant ranking jump likely benefited from recent updates, marketing pushes, or seasonal events that boosted their visibility and appeal to the audience.

Top Movers:

- Bus Mania – Car Jam Puzzle (ZPLAY):

- Ranking Change: Jumped to Rank 75 from zero!

- This significant increase can be attributed to the game’s appeal as a casual puzzle game, which is often quick to pick up and play. The game’s mechanics of solving puzzles in a car-themed setting may cater to a wide audience looking for fun yet challenging content.

- TDS – Tower Destiny Survive (SayGames):

- Ranking Change: From 8700 to Rank 233.

- This considerable jump could indicate a surge in popularity possibly due to recent updates or events within the game. Tower defense and survival genres are known for their addictive gameplay, and new content might have revitalized user interest or attracted new players.

- Traffic Racer Pro: Car Games (TOJGAMES):

- Ranking Change: 7500 to 264.

- The ranking increase might be due to the game’s appeal in the simulation and racing genres, which are quite popular on mobile platforms. It could also be benefiting from recent marketing efforts, updates, or positive user reviews highlighting new features or improvements.

- Scream Go Hero (Ketchapp):

- Ranking Change: 2168 to 84.

- Ketchapp games often feature simple, yet engaging mechanics. The arcade genre’s appeal, especially in providing quick and entertaining gameplay sessions, likely contributes to its rising popularity.

Trending Games – Top Grossing

And?

The top-grossing games of August 2024 exhibit diverse genres, including RPGs, action, rhythm, and narrative-driven experiences. Games that showed significant rank improvements are those leveraging strong IPs, engaging mechanics, or consistent updates that keep the player base active and spending. Seasonal events, new content releases, and strategic monetization efforts seem to be the primary drivers of these ranking changes. The trend indicates that mobile gamers are not only seeking new experiences but are also willing to invest in games that offer continuous and engaging content updates.

Top Gainers in Grossing Rankings:

- AFK Journey:

- Ranking Change: 456 to 32

- Revenue: $45M

- The massive leap in ranking suggests a recent surge in IAP, potentially driven by in-game events, new content releases, or marketing campaigns. The game’s RPG elements and AFK mechanics could appeal to a wide audience looking for engaging, yet low-maintenance gameplay.

- Pokémon Masters EX:

- Ranking Change: 732 to 86

- Revenue: $4.2M

- Pokémon games have a dedicated fanbase, and ranking improvements could be driven by events, new character releases, or collaborations that increase spending. The nostalgic value and ongoing content updates help retain and attract players.

Top Ad Creatives in August

Based on AppMagic Data out of 57,800 Creatives:

Top Ad Networks:

- AppLovin: 44%

- Unity: 21%

- Facebook: 16%

- YouTube: 9%

- Fyber: 7%

Top GEOs:

- U.S: 14%

- Brazil: 9%

- France: 6%

- India: 6%

- Japan: 6%

- Turkey: 5%

- U.K: 5%

Winner Creatives?

- Bus Mania by ZPLAY

- Frontline Heroes by Homa

- Going Balls by Supersonic

- Wood Turning 3D by Eliten

- Wood Nuts & Bolts Puzzle by ABI

- Merge Dinosaurs Battle Fight by TVC

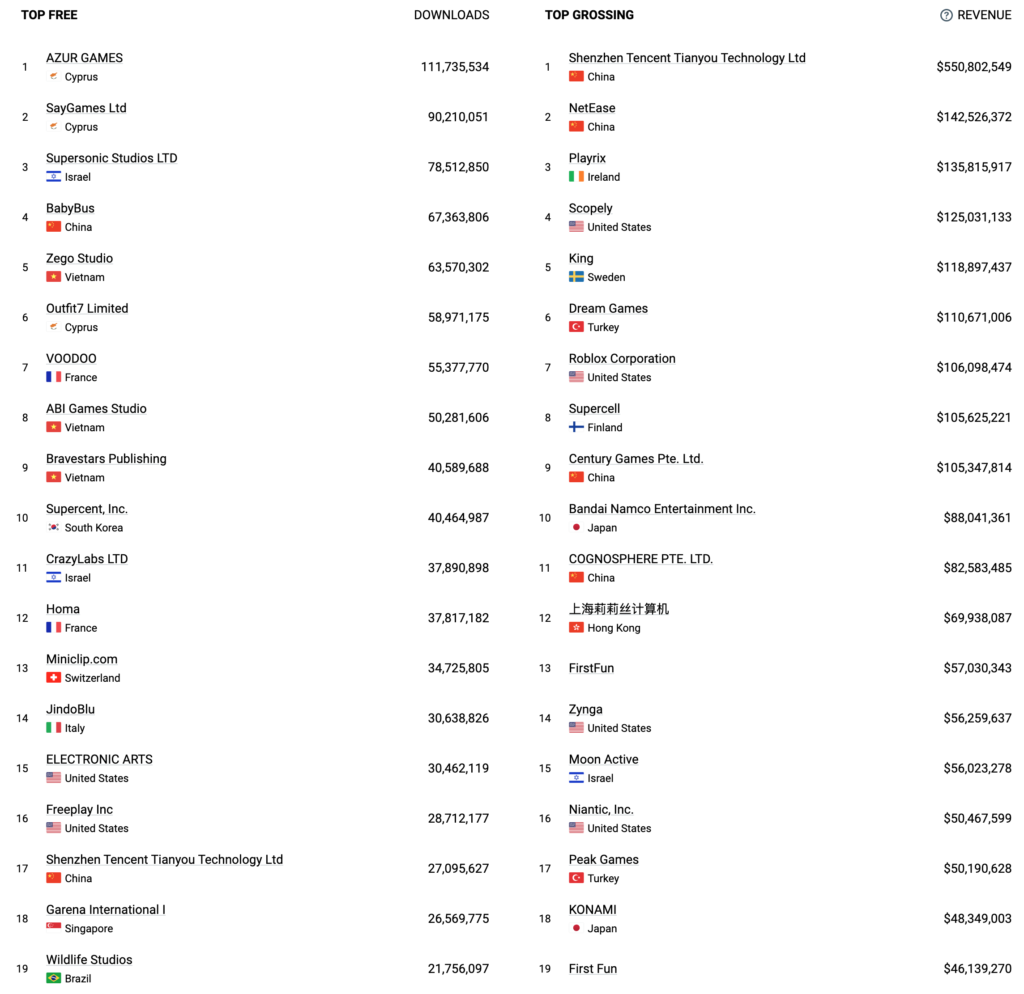

Top Publishers – Downloads & Grossing

The market shows strong but slightly declining download figures, while revenues generally increased or remained stable, reflecting strong monetization strategies by top companies.

- Stable Market Leaders: Top companies maintain positions with slight shifts in figures.

- Minor Download Declines: Most companies saw reduced downloads, possibly due to saturation or seasonality.

- Effective Monetization: Despite download drops, top companies increased or maintained revenues.

- Global Presence: Companies from various regions show strong market positions.

Top Free Downloads:

- Consistent Leaders from Cyprus:

- Azur Games and SayGames remain top in both months. Minor decreases in downloads from July to August (Azur: 120M to 111M; SayGames: 107M to 90M).

- Shifts in Rankings:

- Supersonic and BabyBus maintain top positions but with fewer downloads in August (Supersonic: 83M to 78.5M; BabyBus: 78M to 67.4M).

- New Entrants and Declines:

- Several top publishers saw reduced downloads, indicating market saturation.

Top Grossing Revenue:

- Revenue Leaders:

- Tencent remains top, increasing from $518M in July to $550M in August.

- NetEase and Playrix are also stable in top positions with slight revenue changes.

- Growth Among Competitors:

- Dream Games saw growth from $105M to $111M, indicating strong engagement.

- Stable Revenue Figures:

- Scopely remains consistent in IAP.

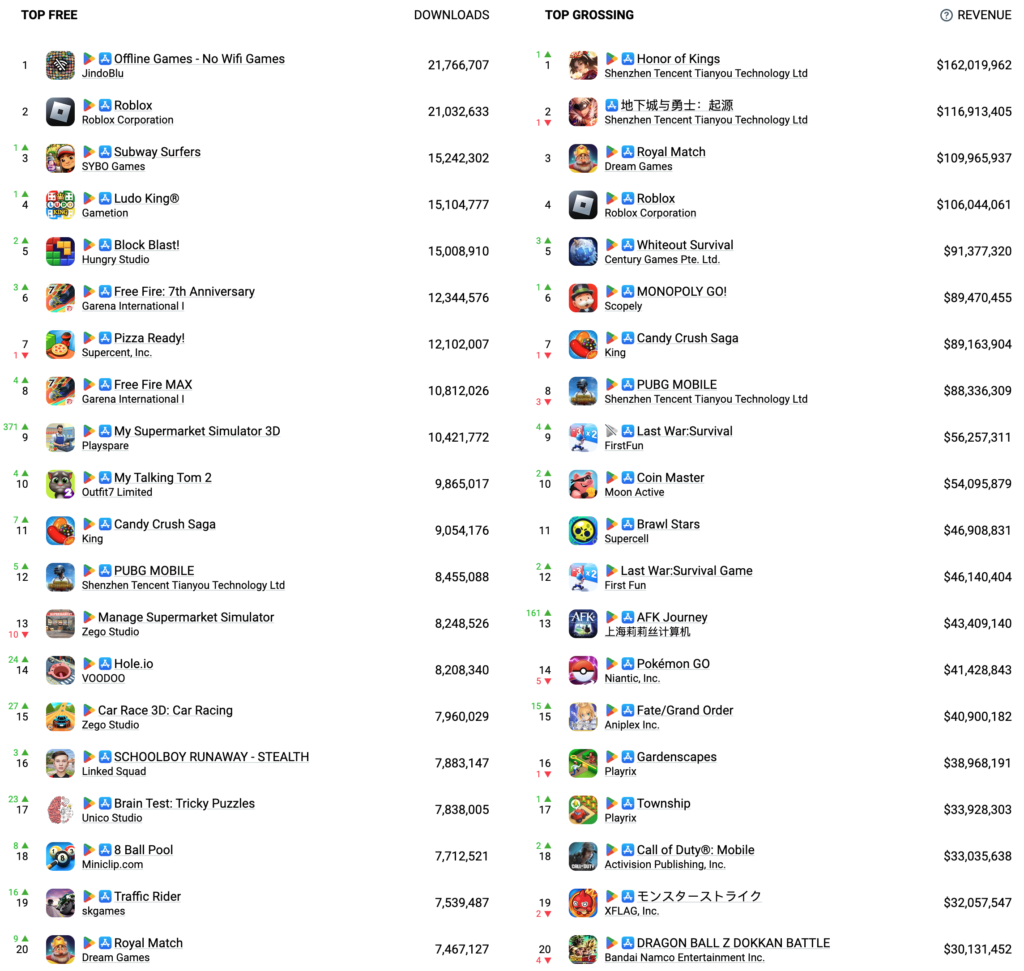

Top Games: Downloads & Grossing

What’s there?

- Market Stability with Slight Fluctuations:

- Top games show consistent performance in both downloads and revenue, with slight fluctuations likely due to seasonality or new content releases.

- Emerging Titles and Market Dynamics:

- New entries in both free downloads and top-grossing lists indicate a dynamic market where new games can rapidly gain traction.

- Monetization Success:

- The top-grossing games reflect effective monetization strategies, with several games showing revenue growth despite stable or declining downloads.

Top Free Downloads:

- Consistent Leader:

- JindoBlu’s Offline Games remained the top downloaded game in both months, though downloads decreased from 34.8M in July to 21.8M in August.

- Notable Movers:

- Subway Surfers climbed from 4th to 3rd place, with downloads remaining fairly stable (15.8M in July to 15.2M in August).

- Block Blast! moved up to the 5th position from 7th.

- New Entries and Exits:

- My Supermarket Simulator 3D made a significant jump from 18th to 9th place, indicating a surge in popularity with 10.4M downloads in August.

- My Talking Hank: Islands and Wood Screw Puzzle dropped out of the top 10 from July to August, showing a decline in user interest.

Top Grossing Revenue:

- Top Performers and Revenue Growth:

- Honor of Kings took the top spot in August with a significant revenue increase to $162M, up from $115M in July.

- Tencent’s other game, Honor of Kings variant, moved to second place with $117M.

- Stable Revenue Generators:

- Royal Match and Roblox remained in the top 4 across both months, with stable revenues of around $110M and $106M, respectively.

- Significant Changes:

- Whiteout Survival jumped from 8th to 5th place in revenue, reflecting an increase in user spending ($91.4M in August).

- AFK Journey made a notable entry into the top 15, rising to 13th place with $43.4M in revenue in August.

- Revenue Declines:

- Zenless Zone Zero dropped out of the top 10 revenue list in August, indicating a decline in user spending.

More?

Mobile Games Leaderboard: Top Turkish Studios

Rewarded UA: Incentivised Ad Platforms 2024