About the author

Mariusz Gąsiewski

CEE Mobile Gaming and Apps Lead @ Google | "Insight guy" | Investor Get connected with me via LinkedIn

Journal 4 Mariusz Gąsiewski November 8

Mobile gaming is a very competitive industry. It is high risk-high win business (not easy to achieve success, although once you achieve it, it can be extremely high success).

There are many challenging topics in the whole industry, ie strong concentration that is visible below:

At the same time there are still a lot of factors that will drive growth of mobile gaming in the next months and years. I decided to put them together (at least some of them). Some of them are trivial, some of them could not be really neglected or underestimated at the first sight. As quite data-driven person I was trying to look at them by perspective of data (as in another way it would create easily the “wishful thinking”).

In the chapter Short term topics I included those topics that I believe will have strong influence on growth of the mobile gaming and perception about value of that market in the short term ( time perspective 6-12 months).

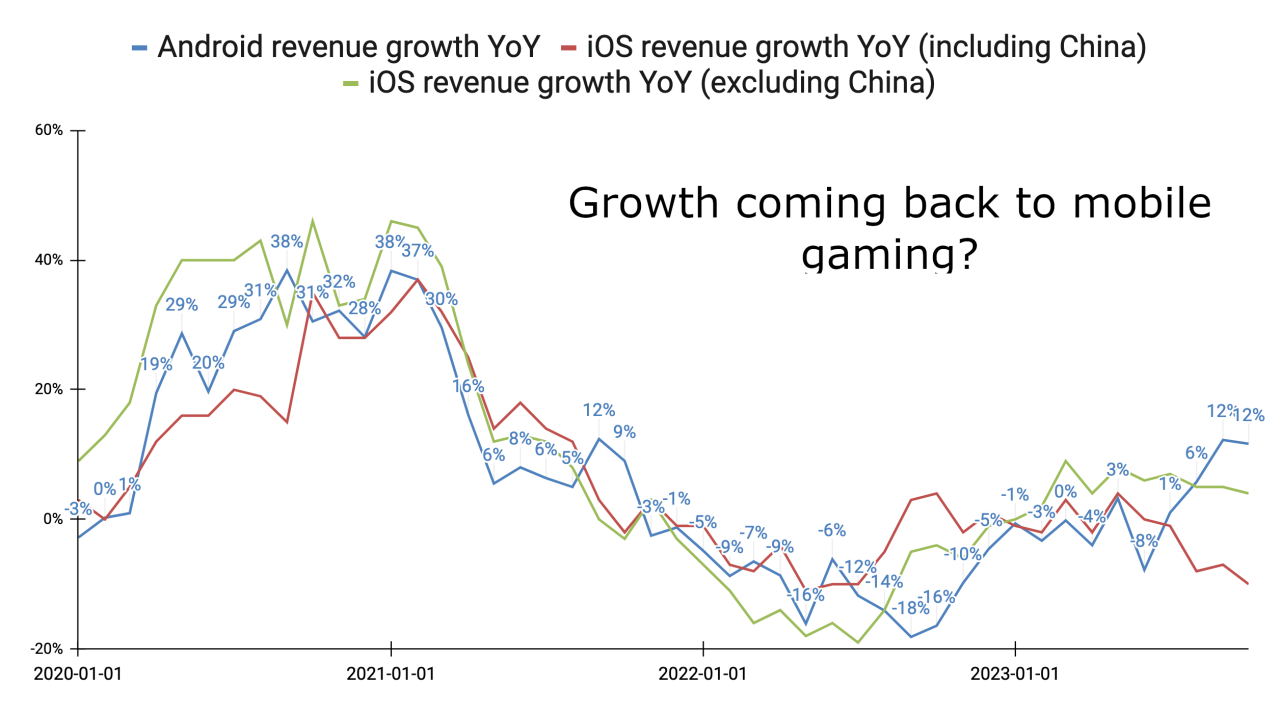

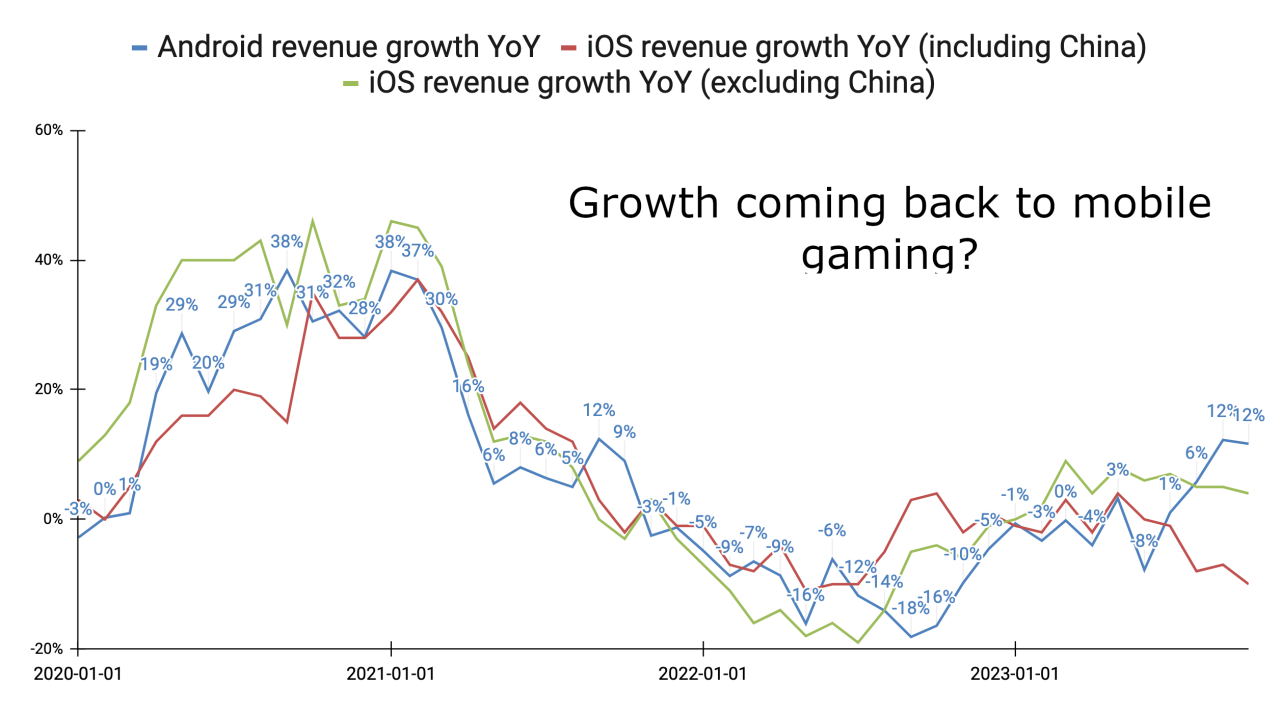

Is the worst in mobile gaming behind us? I pondered this question a few months ago while examining external and internal data. I dedicate a considerable amount of time to analyzing external and Google data to gain insights into the mobile gaming and apps market.

Upon reviewing recent data and trends, it appears that we are trending in a positive direction. Growth rates have been improving since March, across both Android and iOS platforms (data sourced from Data.ai).

In October 2023 revenue on Android grew 12%YoY (versus October 2022). It is 2nd month in a row with double digit growth rate (in September 2023 vs September 2022 it was 12% YoY growth rate too)!

Data for iOS is improving as well. If you look at last months at global iOS data, it does not seem positive. In October 2023 the iOS has growth rate -10% YoY (versus October 2022) and in September 2023 it was -7% YoY (versus September 2022). Although once you look deeper and exclude China from that calculation (as it is not really addressable market for vast majority of mobile gaming players) then the growth rate for October 2023 is 4%YoY (versus October 2022) and 5% YoY in September 2023 (versus September 2022).

With that result whole Android revenue in 2023 has positive growth rate vs 2022 (January-October 2023 vs January-October 2022 would ~2% YoY). Whole iOS revenue (with exclusion of China) in 2023 has positive growth rate vs 2022 as well (January-October 2023 vs January-October 2022 would ~5% YoY).

Again is seems the worst is behind us :).

It is quite widely known that in the last quarters investment in mobile gaming strongly decreased. Anyone looking for investment in mobile gaming has hard time to find it. You can see it based on Dealroom data.

At the same time what is interesting once you compare industry growth rates in the industry with investment in mobile gaming, you can see some correlation. In general higher growth rates bring higher investments in ~ 3 quarters later (see comparison of investment data from Dealroom compared with YoY data for mobile gaming growth (data including China and data without iOS in China)

As industry data in general is improving in mobile gaming (see previous chapter), then we can expect that next year will be better in investments in mobile gaming than this one.

Upon examining the market data, it becomes evident that financial markets have a greater level of confidence in PC/Console companies compared to mobile gaming companies. This disparity is reflected in the EV/EBITDA metric, a commonly used measure for comparing companies. In general, EV/EBITDA tends to be lower for mobile companies than for PC/Console companies. Moreover, this metric for mobile companies has experienced a significantly steeper decline compared to its peak in 2021.

Mobile example: Playtika

Mobile example: Krafton

PC/Console example: Electronic Arts

PC/Console example: Paradox Interactive

This decline occurred due to several factors, including:

It appears to me that these metrics, particularly EV/EBITDA, have the potential to grow in the coming months as more analysts recognise the fundamental shift in the mobile gaming industry’s growth strategy:

Unlike the growth patterns observed in 2021 and 2022, the current approach places a stronger emphasis on continuous performance improvement, achieved through various means such as enhanced creative content, improved product monetisation (ie. adding +10% in Buyer rate, + 5% in ATV, + 8% in click-to-install ratio etc.), improved product localization and a broader market focus beyond just the US. Such growth is less spectacular, although it allows to keep profitability metrics in line with growing scale.

There are many approaches towards that optimisation. Simplifying it is about growing top metrics that finally improve revenue:

This strategic shift prioritizes pushing monetisation together with scaling operations rather than simply acquiring as much traffic as possible. So finally scaling happens only once ROAS metrics remain favorable. Again it matters in my opinion as it will influence heavily the overall financial/investment sentiment for mobile gaming.

In the chapter Middle term topics I included those topics that I believe will have strong influence on growth of the mobile gaming and perception about value of that market in the middle term ( time perspective 1-2 years).

The topic of ad monetization and hybrid monetization has become a ubiquitous element in mobile gaming-related presentations. Statements and examples often highlight the increasing adoption of various ad types to diversify revenue streams.

However, it’s quite rare for people to explicitly mention this as a segment of the market. While the importance of ads in mobile gaming monetization is acknowledged, estimations of the mobile gaming market often solely focus on in-app purchases.

Data that is very often used to estimate gaming market is provided by Newzoo (here is the update from August 2023).

It is amazing source of data, although we read there “Our revenue numbers exclude taxes, consumer-to-consumer second-hand trade, advertising revenues earned in and around games, (peripheral) hardware, business-to-business services, and the traditionally regulated online gambling and betting industry.

This underestimation is significant, as mobile gaming comprises the majority of ad monetization use cases. Fortunately, initial attempts to estimate this market have emerged. Standard market tools like Data.ai are actively working to provide meaningful insights, bringing much-needed knowledge to this topic in the coming months. As a result, the official and high-level valuation of the mobile gaming market is poised to increase substantially from its current level.

Determining the exact size of the ad monetization market remains challenging. However, a recent attempt by Statista in October 2023 provides an indication.

They define in-game advertising as “various forms, including static or dynamic ads displayed in the game environment, product placements where real-world brands are integrated into the game content, or sponsored content created specifically for the game.” This definition encompasses a wide range of use cases, with mobile gaming likely constituting a significant portion.

Statista estimates the in-game advertising market at $94.53 billion, compared to $89.25 billion for mobile games.

Hybrid monetisation in mobile gaming – details

Based o the data and use cases we can see that Hybrid monetisation is getting important in specific genres (especially casual gaming). Below you can see share of IAP and ads monetisation in different mobile gaming genres based on Unity Gaming Report 2023.

What is more this type of monetisation has good perspectives as it seems has pretty strong popularity and preference among mobile gaming audiences (data based on Unity Gaming Report 2023).

Hybrid monetisation in countries

Topic of in-game advertising is important in specific markets where users are more likely to pay with their time and using ads to get access to specific content.

Again there is not much data around value of in-game advertising market in specific markets. As I mentioned just recently (October 2023) Statista made an attempt to estimate that market in different countries. See that estimates below – it is shown versus estimation of mobile gaming market.

I believe in the next months and years as the market will grow, there will be more and more data points around in-game advertising. Especially in many markets in-game-advertising is expected to grow significantly (see its estimation for 2027 based on Statista estimates.

Ads in specific markets

We can see a specific correlation between a country’s wealth and the willingness of its users to pay with their time and engagement for specific content when that content is provided for free.

A very interesting research study was recently published by Statista (online survey, August 2023) that examined attitudes towards online advertising in different countries. Below is a comparison of how many people from specific countries agreed with the statement ‘I am often annoyed by advertising on the internet’ versus the statement ‘I don’t mind advertising if I get free content in return’.”

Here are results for developed/close to developed countries:

Here are results for Emerging markets

Valuation of the market

Even if we exclude China (estimated at $40.20 billion out of the $94.53 billion) and acknowledge the difficulty in precisely determining the mobile gaming portion, it’s evident that we’re dealing with a substantial market that will significantly impact the valuation of the mobile gaming market. This is particularly relevant for financial markets, financial analysts, and investors who often overlook this topic. Additionally, in-game advertising is expected to grow at a compound annual growth rate (CAGR) of 14% to 8% over the next three years, as per Statista data.

If we add some additional points – i.e growth of mobile ad spending in regions like Latin America (data below based on eMarketer, March 2023)

or India (data below based on eMarketer, March 2023)

so in places where those gaming parts are of course very strong, then we can expect that topic will be growing in importance.

Market concentration

This topic is important for one more reason. Since in-app revenue data is far more readily available, we can assess market concentration (i.e., the ease of shaping or entering the market) based on in-app revenue.

This, of course, leads to the strong (and accurate) conclusion that market concentration in mobile gaming is high.

See here Google Play revenue divided by “buckets” (based on Data.ai top Google Play games by revenue divided by buckets, “top 10 games by revenue”, “top 11-50 games by revenue”, etc.)

There is not much data around revenue concentration in ad side of mobile gaming business. Although once we look at downloads concentration (as the proxy for some views around ad monetisation in mobile gaming) we can expect that revenue concentration is much lower there.

See here Google Play downloads divided by “buckets” (based on Data.ai top Google Play games by downloads divided by buckets, “top 10 games by downloads”, “top 11-50 games by downloads”, etc.)

In conclusion, the ad monetization market, particularly within mobile gaming, represents a significant and growing segment of the overall gaming industry. As more data becomes available and the market matures, its impact on the valuation of the mobile gaming market will become increasingly evident.

Emerging markets are closely intertwined with the previous topic, and for several reasons. It is widely acknowledged that a significant portion of gaming growth will be driven by emerging markets, such as Brazil, India, and Indonesia. These markets are predominantly mobile-gaming-first.

Once we look at top countries by downloads on Android (January-October 2023) we see that majority of top countries would be Emerging markets. Below you can see data for January-October 2023 in millions of downloads (based on Data.ai).

Revenue estimates for Emerging markets

Very often revenue data for top Emerging markets has pretty low base, although quite nice growth rates. Below you can see data for revenue growth YoY, so January-October 2023 vs January-October 2022 for top countries by downloads (based on Data.ai).

Estimating the size of these markets presents an additional challenge. For instance, in-app revenue data from Data.ai estimates the Indian market at around $170 million, while AppMagic estimates it at around $270 million. Simultaneously, Niko Partners from Asia estimates that the gaming market in India will generate approximately $900 million in 2023, with 97% of players on smartphones.

In very recent study published by Lumikai in cooperation with Google, gaming in much broader definition (including Real Money Gaming, eSport) was valued for around 1.1 Bn USD (Midcore, core being estimated for around 400M USD and Casual, hypercasual for around 700M USD). Below estimates for 2023 (in millions of USD).

In the data IAP is estimated for around 500M USD in 2023 and Ads for around 600M USD in 2023).

Why those estimates matter?

While revenue estimation challenges exist across all platforms, mobile gaming is particularly affected due to its stronger presence in non-Western markets (estimation of mobile and non-mobile revenue for 2023 based on Newzoo).

As data for these countries improves in the coming months, it will further boost the mobile gaming sector.

Changes in the Emerging Markets

In many cases we underestimate changes, revolution happening in some big Emerging Market and its impact on potential mobile gaming business.

See below growth of non-cash payments in Brazil in the last years (based on Worldpay data from March 2023). A few years ago most of mobile gaming companies did not care about Brazil, now most of them do.

And compare that data with of non-cash payments in Indonesia in the last years (based on Worldpay data from March 2023).

…and similar data for India (based on Worldpay data from March 2023).

.. and even Nigeria (based on Worldpay data from March 2023).

It is an intriguing topic, as it is widely acknowledged that women have become an increasingly significant part of the mobile gaming market. However, there is a dearth of comprehensive data on this subject, data that could move the discussion beyond the mere statement that ‘women have become an important part of the mobile gaming audience.’

Particularly in Emerging markets, the proportion of women with access to smartphones is expanding rapidly, which is also translating into increased gaming activities among this demographic.

Here are some of the factors that are driving the growth of female mobile gaming:

In the chapter Long term topics I included those topics that I believe will have strong influence on growth of the mobile gaming and perception about value of that market in the middle term ( time perspective 3-5 years and later).

Increased Free Time for Entertainment

In the long term, technological advancements like AI are expected to reduce working hours, leading to more free time. A significant portion of this free time is likely to be dedicated to entertainment, particularly gaming. Some effects of that trend we should see in much earlier time perspective.

In this case number of gamers playing on mobile devices is expected further to grow even in Western markets (data for US).

Additional topic that will be very important in case of mobile gaming (surprisingly not often discussed) is 5G. 5G connections are expected grow significancly in the next years (below data for mobile connections based on GSMA Intelligence from March 2023).

Why this topic is so important? It will give totally different opportunities in downloading the content

Think about it in other way. You download a game that’s 300MB in size, using 5G, 4G, 4G LTE, and 3G networks. Here’s how long it might take to download the movie on those different kinds of mobile networks (using realistic speeds in good quality of those networks):

See based on below example from OpenSignal how 5G is changing download experience already (based on OpenSignal tests in Latin America).

To see greater impact of 5G changes it is good to look at current comparison between 4G and 5G experience.

Currently new 5G network technology continues to offer users extremely high real-world average download speeds that are many times faster than average 4G download speeds.

In six markets, average 5G download speeds are over 10 times as fast as 4G speeds: India (19.2x), Malaysia (14.4x), Sri Lanka (13.8x), Brazil (13.5x), Kuwait (10.8x) and Guatemala (10.4x). However, users in most markets see 5G speeds that are three to six times as fast as 4G (based on OpenSignal data).

There are significant improvements in the on-demand video streaming experience and multiplayer gaming experience with 5G in almost all markets. Video Experience is especially improving in those places that have pretty low quality network today – there was improvement between 37.6% (Sri Lanka) and 4.7% (Netherlands) better with 5G. Similarly, for Games Experience the uplift with 5G ranges from 31.3% (Guatemala) to 2.7% (Japan).

A number of emerging markets see some of the greatest improvement in experience with 5G for both gaming and video streaming. Users across India see an uplift of 23.4% for Video Experience and a similar 29.2% for Games Experience ranking second globally for improvement on that measure.

Growth of 5G smartphones

Growth of 5G connections will be supported by growth of 5G smartphones. The volume of 5G smartphone shipments worldwide is forecast to grow heavily between 2020 and 2027. In 2023, around 646.5 million 5G smartphones were estimated to be shipped, with this number growing to over one billion by 2027 (estimates based on Statista data)

Mounting evidence suggests that cross-platform gaming will emerge as a leading trend in the gaming industry.

Consider the findings of a recent study conducted by VGM for Google in February 2023 (question “Which of the Following gaming trends do you currently use or interact with, if any?”)

Even though awareness of other trends is relatively high, cross-device gaming stands out as a particularly appealing concept (question “Which of the following gaming trends have you heard of, if any?”)

Cross-platform is especially visible among younger demographics (data from recent Newzoo report “How and why different generations engage with video games in 2023” showing how youngest generations are more likely to play on all 3 platforms (mobile, PC, console).

What is true console and PC gaming are significantly popular among younger generations.

Naturally, the question arises: “Who is more likely to benefit from this trend?” Will traditional (PC/Console) developers be better positioned to adapt their gaming experiences to mobile, or will mobile developers have the advantage in transitioning their experiences to PC/Console platforms?

Predicting the outcome is challenging due to the numerous variables involved. There seems to be a prevailing belief in the industry that this trend will favor traditional developers with strong, iconic IPs as we will see continuing migration of AAA PC and console games to mobile.

Personally, I’m not entirely convinced of this notion. Why?

In my opinion, gaming is fundamentally about understanding the audience and crafting the best possible experience for that audience.

From this perspective, we can categorize gaming into two distinct segments:

One additional indicator about that topic is the fact it is more common than F2P model (dominant in mobile gaming part) is more and more often moved to PC/Console gaming than Premium model (dominant in PC/Console market) moving to mobile space.

Of course, the growing consolidation within the market could significantly alter all these dynamics, making for an interesting period ahead.

I have already included Emerging Markets in the medium-term section, although I believe it should be mentioned here as well.

The reason for this is that Emerging Markets is a broad term encompassing numerous countries. Consequently, some of these countries will have a significant impact on medium-term mobile gaming growth, while others will primarily influence mobile gaming in the long term, and still others will influence mobile gaming in both the medium and long terms.

Here are some key factors to consider when evaluating how these Emerging Markets will impact long-term mobile gaming growth:

India will be good example here. In very recent study published by Lumikai in cooperation with Google, gaming in broader definition (including Real Money Gaming, eSport) was valued for around 2.6 Bn USD in 2023 with gaming genres being estimated for around 1.1 Bn USD (Casual and Hypercasual ~ 700M USD and Midcore and core ~400M USD). By 2028 the gaming industry is estimated to have value 7.5 Bn (growing around 20% YoY). Casual and core gaming is estimated to have value ~ 5 Bn USD (below data in Bn of USD).

What is interesting strong part of that market is delivered by IAP in gaming genres. IAP is estimated for around 500M USD in 2023 with projections to reach 3.3 Bn USD by FY28 (growing more than 40% YoY). Ads are expected to grow significantly to reach 1.7 Bn USD by FY28.

It is enough to see differences between age groups in Western markets and Emerging Markets

Smartphone video game players in the United States as of June 2023 based on Consumer Insights Global survey 2023

Share of mobile gamers in Southeast Asia in 2021, by country and age based on Statista Digital Market Insights from April 2022

Any comments, thoughts? Agree, disagree? Feel free to share! 🙂

About the author

CEE Mobile Gaming and Apps Lead @ Google | "Insight guy" | Investor Get connected with me via LinkedIn

Please login or subscribe to continue.

No account? Register | Lost password

✖✖

Are you sure you want to cancel your subscription? You will lose your Premium access and stored playlists.

✖