- arrow_back Home

- keyboard_arrow_right Highlights

Gaming M&A to $6.6B in Q1 2025: Scopely’s $3.5B Power Move

HighlightsJournalReports 24 Gamigion April 10

Aream & Co. Quarterly Gaming Report here.

M&A activity surged to $6.6 billion in Q1 2025 — the highest in two years — more than doubling the $3.2B from Q1 2024.

Leading the charge?

Scopely’s massive $3.5 billion takeover of Niantic’s licensed games business — think Pokémon Go, Monster Hunter Now, Pikmin Bloom. That one deal alone carried the quarter, propelling M&A past even pre-pandemic highs.

Without it, numbers would’ve slightly dipped year-over-year.

Mobile gaming dominated, as usual, driving most of the quarter’s value. Private consolidators stayed aggressive despite financing hurdles, reshuffling portfolios, and hunting for opportunity. Miniclip followed close behind with a $1.2B acquisition of puzzle giant Easybrain

The momentum didn’t stop at M&A:

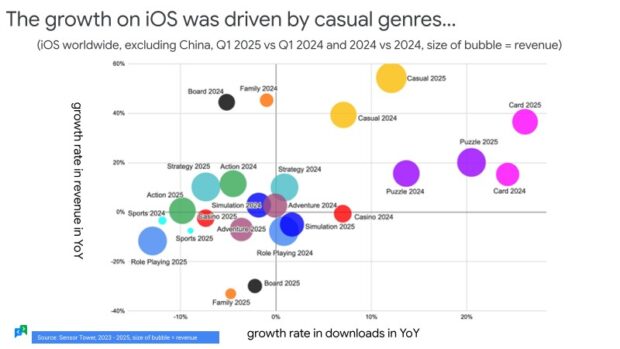

- Mobile saw modest growth, with Asian studios like Habby, Dream Games, and Florere leading the U.S. market surge.

- On PC, Steam hit a record concurrent users.

- Console stayed steady, with big moves looming — the Nintendo Switch 2 reveal and GTA 6 on the horizon could make 2025 a landmark year.

Aream & Co.’s inaugural Video Game Market Update sets the tone for a bold new era in gaming. The full report dives deep into platform trends, valuation shifts, and why legacy mobile hits still rake in the lion’s share — 64% of 2024’s mobile revenue came from games four years or older.

Source: PocketGamer