Game Subscription Truthers Remain the Industries Flat Earthers

Journal 1 Phillip Black February 6

The Wall Street Journal reports Netflix is considering IAP and ads to monetize the $1B a year it’s spending on gaming.

So far, they’ve bought old F2P mobile titles and removed IAP to the tune of fewer than 1% of subscribers their playing games daily. Like Apple Arcade, Netflix gaming is quickly becoming the hospice of F2P; a pivot to IAP and ads is a come-to-Jesus moment that Microsoft, Apple, and Roblox could learn from. Despite a morgue brimming with OnLive, EA Play, UPlay+, Gamefly, Stadia, and GameTap, along with the countless litany of failed individual game subscriptions, gaming executives are keen to ignore the economics of what makes gaming different from all other media.

In 2021, Netflix’s Chief Product Officer claimed: “We feel our subscription model yields some opportunities to focus on a set of game experiences that are currently underserved by the sort of dominant monetization models and games. We don’t have to think about IAP or other monetization. We don’t have to think about per-title purchases. Really, we can do what we’ve been doing on the movie and series side, which is just hyper laser-focused on delivering the most entertaining game experiences we can.”

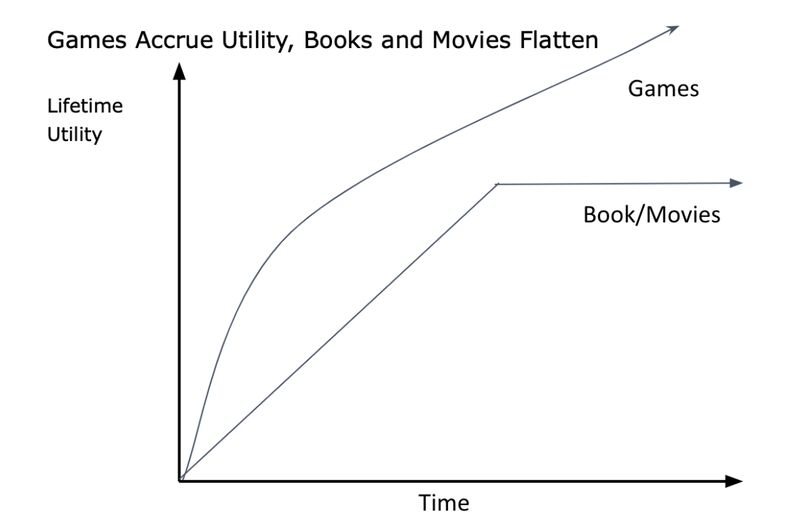

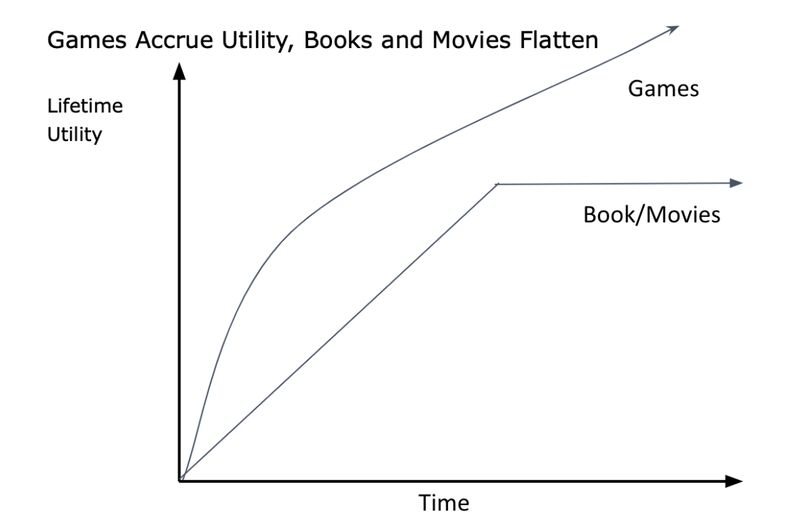

But this claim betrays how players consume games. Movies and TV provide fixed hours of engagement, usually the length of the movie or TV series, with consumers rarely re-watching the same content. Meanwhile, a single game offers thousands of hours of entertainment while the very nature of the content consumed differs.

The content consumed in a game like Overwatch or Clash Royale is the pursuit of strategy equilibrium and mastery of mechanics. A new unit in Clash Royale changes how players organize their decks, even if they don’t use the unit directly (they must counter it). The new units provide hundreds of new hours of content to consume relative to one month or so of labor to produce the unit. The marginal content output of a given member of the 16 people (!) Clash Royale team is astronomical. Compare this to the thousands of crew members and weeks necessary to produce even a single one-hour episode of Game of Thrones – supply can’t keep pace with demand in TV and movies.

Aligning monetization with the explosion of engagement tails from games has defined the last two decades of the industry. Subscriptions cap revenue per paying user, diminishing the correlation between engagement and revenue, while IAP and MTX maintain the correlation and even strengthen it as engagement increases.

Ironically enough, for game subscription-based services to survive, they should focus on single-player titles. Live-service economics washes away in a world of linear-based gameplay and limited content updates. Instead, games like Control or God of War look like Peaky Blinders: driving y number of viewer hours for x cost. In this framework, games are nothing more than another type of growth content to feed the subscription loop.