The numbers for Q1 2025 here.

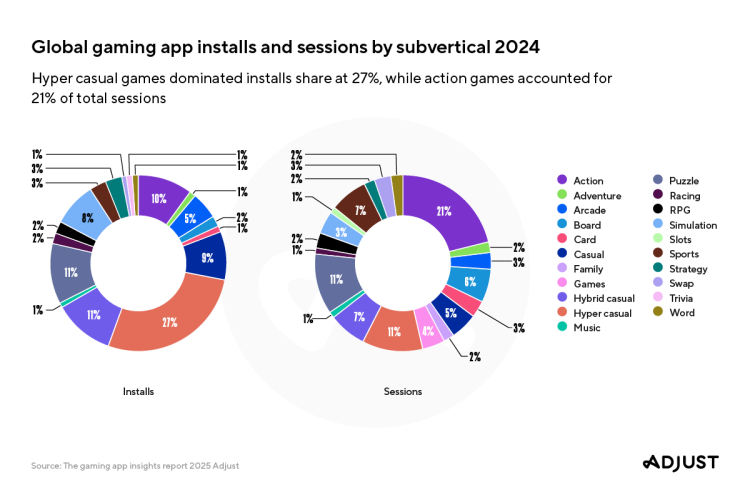

The numbers for Q1 2025 are in 👇 Every quarter, we take some time to analyse where the market is shifting, and not always in the ways we’d expect.📉 Android saw a drop in both downloads (-8.5%) and revenue (-4.8%) YoY.📈 iOS? Downloads dipped slightly, but revenue grew by 2.4% YoY. Players are spending more, even as installs slow down.But that’s not all:🧩 Puzzle and Casual games still dominate in downloads.⚔️ RPGs and Strategy games continue to lead in revenue.🇺🇸 The US drives monetization in Casual and Casino.🇯🇵 Japan loves RPGs and Simulation.🇨🇳 China is ramping up in Action and Strategy on iOS.