How Turkey became a Mobile Games Powerhouse

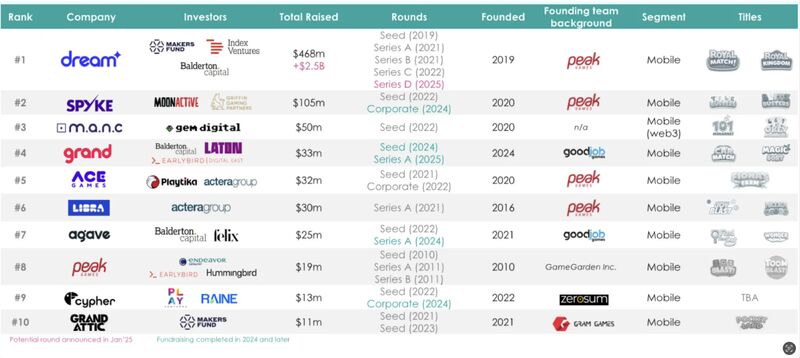

How did 𝗧𝘂𝗿𝗸𝗲𝘆 became a mobile games powerhouse b/t 2020-2025? 💪 Here's an eye-opening retrospective from Investgame."Following Peak’s landmark acquisition, a wave of entrepreneurship emerged, with over 80 new startups founded by or employing former Peak employees. Approximately half of these startups remained in the gaming sector, fostering knowledge transfer and driving the ecosystem’s rapid growth." - InvestgamePersonally, I hadn't realized the impact of the Peak acquisition on the local industry.This also, (coupled with the agile / 'fail fast' culture) explains the dominance of Casual in Turkish development.