Mobile Gaming after 2024 & Q1 2025?

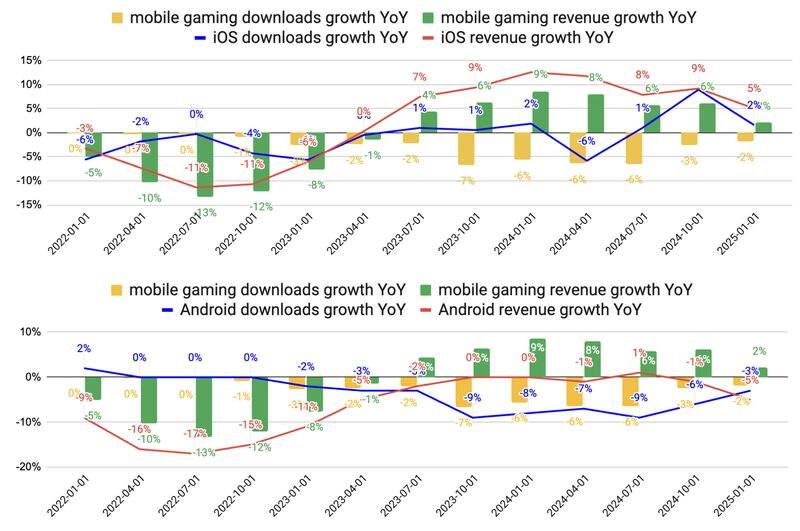

What is happening in mobile gaming after 2024 and Q1 2025? We can look at Sensor Tower to see what is happening there (each category is presented with 2024 data illustrating the growth from 2023 to 2024, and with 2025 data illustrating the growth from Q1 2024 to Q1 2025; size of the bubble presents the in-app/subscriptions revenue). Based on the data, we can see that 🔹 iOS is heavily driven by casual genres (Casual, Puzzle, Card games have very strong data) 🔹 evan casual genres have strong revenue concentration in top titles 🔹 core genres on iOS are starting the year with worse results than in 2024