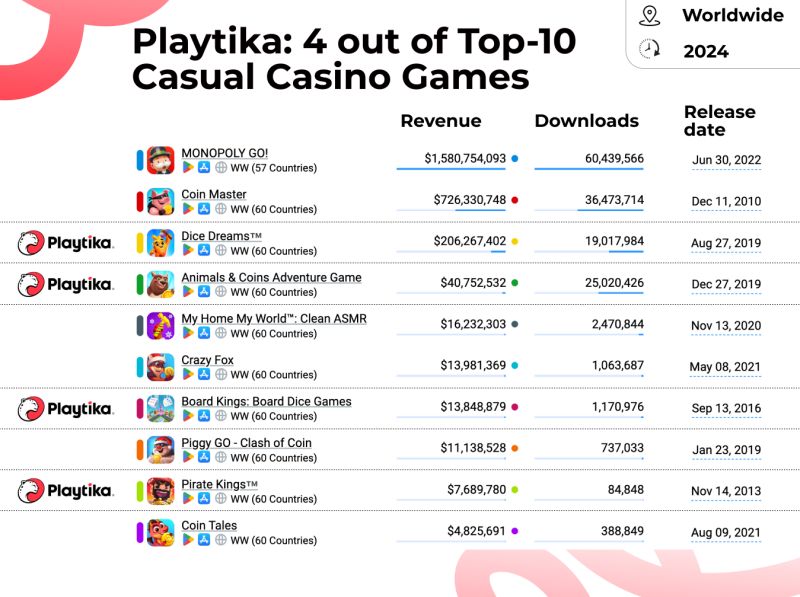

Top 10 Gaming Publishers in IAP Revenue in 2024

Top 10 Gaming Publishers by Worldwide IAP Revenue in 2024 💫 The much-anticipated top is finally here, led by Tencent with $6.3B in revenue for 2024, driven by Honor of Kings, PUBG Mobile, and the release of Dungeons & Dragons 🔥Scopely climbed from 6th to 2nd place, reaching $2B in revenue, thanks to the outstanding success of Monopoly Go! 💥Supercell and Century Games are the two newcomers to the top, driven by the phenomenal growth of Brawl Stars and the great success of the innovative 4X strategy Whiteout Survival, respectively 💣