- arrow_back Home

- keyboard_arrow_right Highlights

AppLovin Empire: Monopoly in Mobile Gaming?

Highlights 785 Ömer Yakabagi November 25

Everyone is talking about Applovin.

They have been reshaping Mobile Gaming, building an ecosystem that covers everything.

It’s become a one-stop shop spanning Ad Tech, UA, CTV, Monetization, Creatives, and even its own Games!

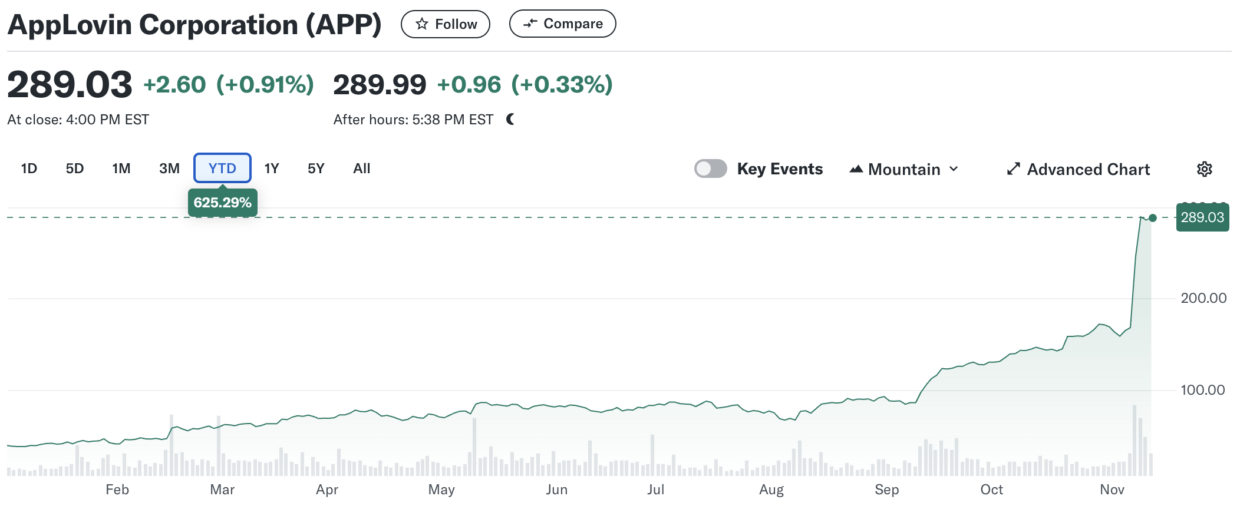

Alright – Let’s start with the fun part – NASDAQ!

+625% since Jan. YES, your 100K would have been 625K in a year.

How?

Special thanks to Brian Truman for putting his 2 cents out here:

Since ATT, on iOS Meta has had trouble with attribution. Yes, APP has a great team and killer ML chops. Their prediction algorithms are remarkable. But what makes APP truly the best is winning the attribution game. They have benefited tremendously from Apple’s shift toward privacy and SKAN.

When serving an ad that they created via their own SDK they are collecting strong data points that are passed to the MMP and that probabilistic match is far more likely to be credited to APP than another ad source. This means, if there is more than one possible last-touch ad source that falls within the attribution window, AppLovin is most likely to win.

Q3’24 Highlights:

- Revenue: $1.2B, up 39% YoY

- Adjusted EBITDA: $722M, marking a 72% YoY growth

- Free Cash Flow: $545M, a remarkable 182% rise YoY

- Software Platform Revenue: $835M, up 66% YoY

What’s Behind?

AppLovin’s Ad Tech growth, driven by advanced AI in the AXON platform, is catching eyes. They’re now expanding from Gaming into e-commerce, where early results promise almost 100% incremental growth.

Looking Ahead:

Q4 guidance remains strong, forecasting $1.25B, and AppLovin is doubling down on share buybacks, adding $2B to its authorization.

AppLovin’s #1 Competitor – Unity?

-53% since Jan. Why?

Controversial Pricing Model: In 2023, Unity introduced a “Runtime Fee” tied to game installations, sparking backlash. Runtime fee was revoked in 2024.

Leadership Changes: CEO John Riccitiello resigned in October 2023 amidst the pricing controversy. New CEO Matthew Bromberg took over in May 2024 to restore trust.

Layoffs: Unity cut 25% of its workforce in January 2024 as part of a reset, focusing on core areas.

Financial Challenges: Revenue has been under pressure, with a 16% drop in Q2 2024, prompting a reduced annual outlook.

ironSource Integration: Acquired to boost monetization, ironSource’s integration has added restructuring challenges.

“Alleged bullying and mismanagement within Unity’s Ad Tech arm have led to a toxic atmosphere, unhappy staff, and dozens of resignations, we’re told.”

Story Behind?

Back in August’20, Unity turned down a huge $20B merger offer from AppLovin. Instead, they teamed up with ironSource to level up their Monetization tools.

AppLovin wasn’t ready to give up just yet. They wanted to make a big splash in the market but dropped their offer by September’22 after Unity’s choice, realizing that Unity & ironSource together could be a fierce competitor.

Then, in October’23, AppLovin’s interest in Unity fired up again.

Unity’s new Runtime Fee sparked developer frustration, and CEO John Riccitiello stepped down, opening the door for AppLovin to make a move. They rolled out some new AI tools to win over Devs, hinting they might either team up with Unity or go head-to-head to shake things up.

Monopoly?

By centralizing every aspect of Growth & Monetization, AppLovin has become an indispensable partner in Mobile Gaming, from UA & Analytics to Monetization & Creative Development.

AppLovin is shaking things up big time. They’re not just playing in the mobile ad space, they’re pushing e-commerce to new heights with killer tech, like Shopify integration through their AXON Platform, which finds the best users for brands. Results? Doubling traffic. It’s not just Ads anymore; it’s a whole new way for e-commerce to win on mobile.

What if AppLovin goes after Unity now? With MoPub already in the back pocket, AppLovin could be bold enough to take on Unity, especially now that Unity’s future seems a bit wobbly. Sure, it might raise a few eyebrows, but AppLovin has the resources to pull it off – and the timing couldn’t be better.

With the Unity deal, AppLovin would be setting up the ultimate package for Devs: A True One-stop Shop for building, scaling, and monetizing games with data at its core. Imagine the perks for Game Devs – better tools, lower costs, and serious insights.

AppLovin would be rolling out the red carpet for them in every way possible, creating a game-changer for mobile that everyone’s going to want a piece of.

If the Ironsource & Unity deal had turned out well, maybe this Monopoly Empire would not have been for AppLovin!

How about AppLovin’s path? 🚀

Key Acquisitions & Tools

MoPub: Ad Monetization Powerhouse

In Jan’22, AppLovin completed its acquisition of MoPub, expanding its control over Mobile Ad Monetization by integrating into MAX Mediation.

- Unified Mediation: By combining MoPub’s features with MAX, AppLovin has created one of the most efficient Ad Monetization platforms.

- SSP & DSP: MoPub’s SSP & DSP integrations broadened AppLovin’s access to both Supply & Demand, providing Devs with a vast network of Ad Inventory: 150+ DSPs for consistent demand.

- Expanded Demand Options: Devs migrating to MAX benefited from MoPub’s diverse auctions, including In-app bidders, Agencies & Advertisers.

Adjust: Mobile Marketing & Attribution

The 2021 acquisition of Adjust added Top-tier Mobile Measurement & MarTech to AppLovin’s portfolio such as:

- ROAS Optimization

- Attribution & Fraud Prevention

- Global Reach & Diverse Clientele

Wurl: Bridging Mobile & Connected TV

AppLovin’s acquisition of Wurl extended its reach beyond mobile devices into the burgeoning CTV market. Big Boost on CTV Advertising & Cross-Channel Reach

By entering CTV through Wurl, AppLovin has become a true cross-platform player.

THEY-HAVE-GAMES. 🕺🏻

AppLovin’s In-House Ecosystem

AppLovin has a portfolio of 10 Mobile Gaming Studios:

Lion Studios, ZenLife, PeopleFun, BELKA, Athena, Clipwire, Magic Tavern, Machine Zone, Zeroo Gravity, and Leyi.

Here are the AppMagic Data:

Lion Studios 🇺🇸

ZenLife Games 🇺🇸

PeopleFun Inc. 🇺🇸

Belka Games 🇨🇾

Athena Studio 🇦🇪

Magic Tavern Inc. 🇺🇸

Machine Zone 🇺🇸

Leyi Games 🇨🇳

Zeroo Gravity 🇭🇰

Clipwire 🇨🇦

There’s more. ⚡️

MAX Mediation: Optimizing Ad Revenue

MAX is AppLovin’s Ad Mediation platform where Devs can control their monetization strategies with detailed insights, enabling data-informed decisions on ad placement.

AppDiscovery: UA & ROAS-Based Campaigns

AppLovin’s AppDiscovery is a powerful tool for UA, allowing studios to acquire high-value users efficiently.

- Event-Based Optimization & Comprehensive ROAS Tracking

ALX: Programmatic Ad Exchange

ALX is designed to maximize Fill Rates & eCPM through Real-time bidding.

- Global Marketplace: ALX connects Devs with Buyers, including major Brands & Agencies.

SparkLabs: Ad Creatives

SparkLabs is AppLovin’s in-house creative studio that develops Ad Creatives for Mobile Games.

Array: Seamless App Management Suite

Array is AppLovin’s end-to-end app management suite, offering Devs a single platform for App insights, user behavior tracking, and engagement optimization.