- arrow_back Home

- keyboard_arrow_right Highlights

Mobile Game Leaders: September 2024

HighlightsJournalReports 276 Ömer Yakabagi October 12

Seasonality hit UA hard.

Most Publishers saw a dip in downloads as UA budgets get slashed in September.

Higher CPI: Competition! E-commerce & Retail brands dominate the market with massive ad budgets, driving CPIs up & up.

Shifting User Attention: Holiday Shopping – yaaay! Black Friday & Amazon Prime Days sound cool, right? There we go with the drop in engagement with gaming ads.

Lower UA Budget: Q4 is mostly the lowest-budget quarter. Gaming advertisers feel the pinch, having to cut back on UA spending as costs peak.

Publisher Response: Many shift focus from new installs to retention and monetization, emphasizing in-game events and promotions.

However, TikTok and Meta have rolled out enhanced probabilistic matching features, and these new models are likely to drive ad spend up on these platforms in the coming months.

Let’s start with New Games & Trendings 🕺🏻

New Games

Trending Games

Top Publishers: Downloads & Grossing

Changes in Downloads (August vs. Sep)

Voodoo had an 8.3 millions increase in downloads, climbing from rank 6 to 4.

Competitors were behind in September.

- SayGames: -15M

- Supersonic: -12.7M

- Outfit7: -8.8M

- ABI Game Studio: -8.6M

- AZUR GAMES: -5.5M

- BabyBus: -5M

- BraveStars: -4.6M

Anything interesting?

In November’22, Voodoo‘s Monthly Revenue was $1.2M , growing to $7M by September’24. For Rollic, the jump is from $1.1M to $10M IAP Revenue. (Nov’23 by Sep’24)

We can see the clear transition from hypercasual to hybridcasual here. However, IAP Revenue has remained stable for AZUR Games over the years.

Top Ad Creatives in August

Based on AppMagic Data out of 400,000 Creatives:

Top Ad Networks:

- AppLovin: 32%

- YouTube: 21%

- Facebook: 19%

- Unity: 16%

- Fyber: 8%

Top GEOs:

- U.S: 16%

- India: 11%

- Brazil: 7%

- Japan: 6%

- France: 5%

- U.K: 5%

Casual Games Leaderboard

Two games showed an increase in downloads. Zupee 2.1M & Block Blast 850K.

Decrease? – YEAP.

- Subway Surfers: -2.6M

- Soccer Superstar: -1.5M

- Avatar World: -1M

- My Talking Tom 2: -850K

- My Talking Angela 2: -800K

- My Supermarket Simulator 3D: -500K

Climbed to Top-30

- Satisroom

- Vita Mahjong

- Stumble Guys

- Traffic Racer Pro

- Subway Princess Runner

- UNO!

- Tile Club

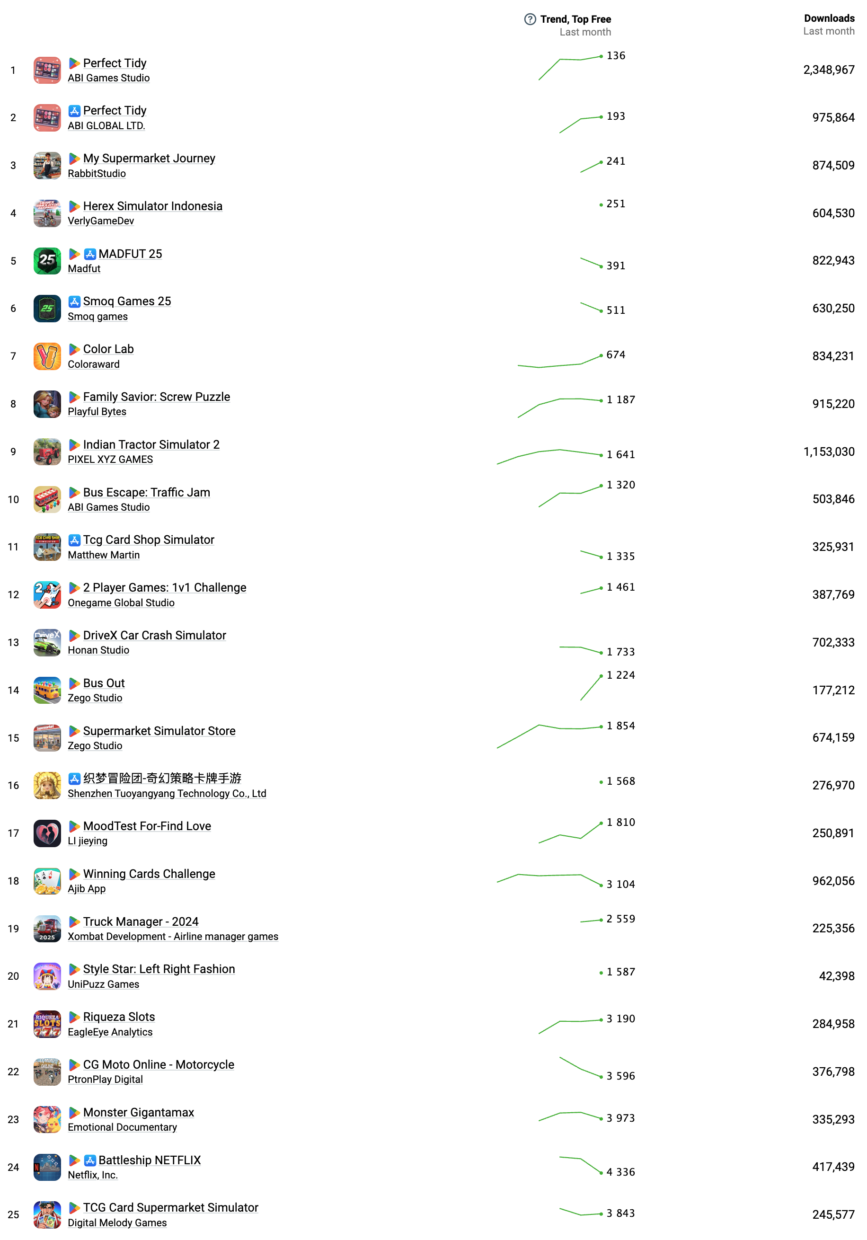

Hypercasual Top Rankings

Changes in Downloads (August vs. September)

3 games showed an increase in downloads. Build A Queen 1.5M, Hole.io 1.2M, and Paper.io 900K.

However, it is mostly -negative.

- Race Master 3D: -2.1M

- My Perfect Hotel: -2M

- Wood Screw Puzzle: -1.5M

- Car Race 3D: -1.3M

- Magic Tiles 3: -1.3M

- Bridge Race: -1.1M

- Going Balls: -1M

- Brain Test: -1M

- Snake Clash: -800K

New in Top-30

- Count Masters

- Archery Clash

- Bus Mania

- The Superhero League 2

- Brain Test: All-Star: IQ Boost

- Snow Race 3D

- Rush To Home

More?