Incentivized Advertising For F2P Gaming UA: 101

Journal 10 Paul Bowen August 31

Here is the link to the original article.

Once dismissed as a cheap trick to game App Store rankings, incentivized advertising has transformed into one of the most sophisticated and data-driven strategies in modern user acquisition. Today, it’s not just about installs—it’s about aligning user intent with long-term growth, turning low-intent browsers into high-value players.

Incentivized or rewarded advertising, as people like to rebrand it, has had a bad rap ever since Apple (and Techcrunch) went after early mobile f2p UA innovator Tapjoy in 2011. Incentivized advertising was blamed for sullying the App Store and making the App Store Top Charts something advertisers could buy to enter, not only gain a position because a game was popular. I was at Tapjoy in 2011, and it wasn’t that we were necessarily selling “App Store rankings” to our advertising partners, but it was a happy byproduct, and the advertisers with the deepest pockets knew that. Being out of favor with Apple was a business-ending proposition back in the early 2010s. Every game developer tried to court the iPhone behemoth, hoping they’d secure a sacred “featured” spot in the App Store worth millions. It was in this context many advertisers pulled back from incentivized advertising completely.

Fast-forward 13 years, and the incentivized space has evolved and grown quite a bit. There are many more players now than there were, and how incentivized service providers create their supply has become more advanced. In this article, we’ll dig into the evolution of the space.

Background: The F2P Gaming UA ecosystem

There are a few reasons why the incentivized advertising space has grown over the past few years. I’d suggest there are three main reasons:

- Consolidation in Ad Platforms: As header bidding has become the dominant mediation method in mobile in-app advertising, consolidation within standard ad format platforms has led to slower innovation

- Impact of IDFA Removal: Ad platforms with access to first-party data are seeing increased budgets and share of wallet. OEMs and incentivized advertising ad platforms are the beneficiaries of Apple’s move.

- Innovation in incentivized campaign setup: Incentivized ad platforms have learned from advertiser feedback on how to set up a campaign to hit long-term ROAS goals effectively

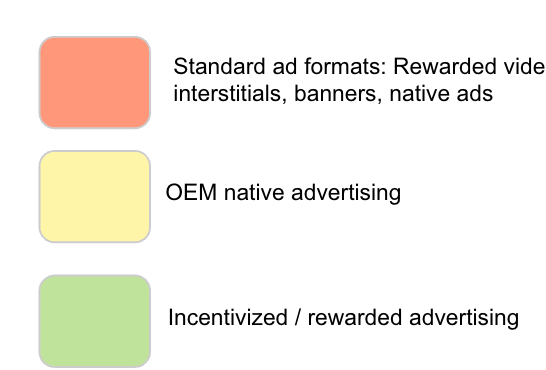

Definition of rewarded/incentivized advertising

Before we delve deeper into incentivized advertising, let’s first agree on a definition.

- Incentivized/Rewarded Advertising: A type of advertising where users receive rewards for completing specific actions or tasks

- Types of Rewards: typically users can earn in-game currency, premium content, or gift cards as incentives

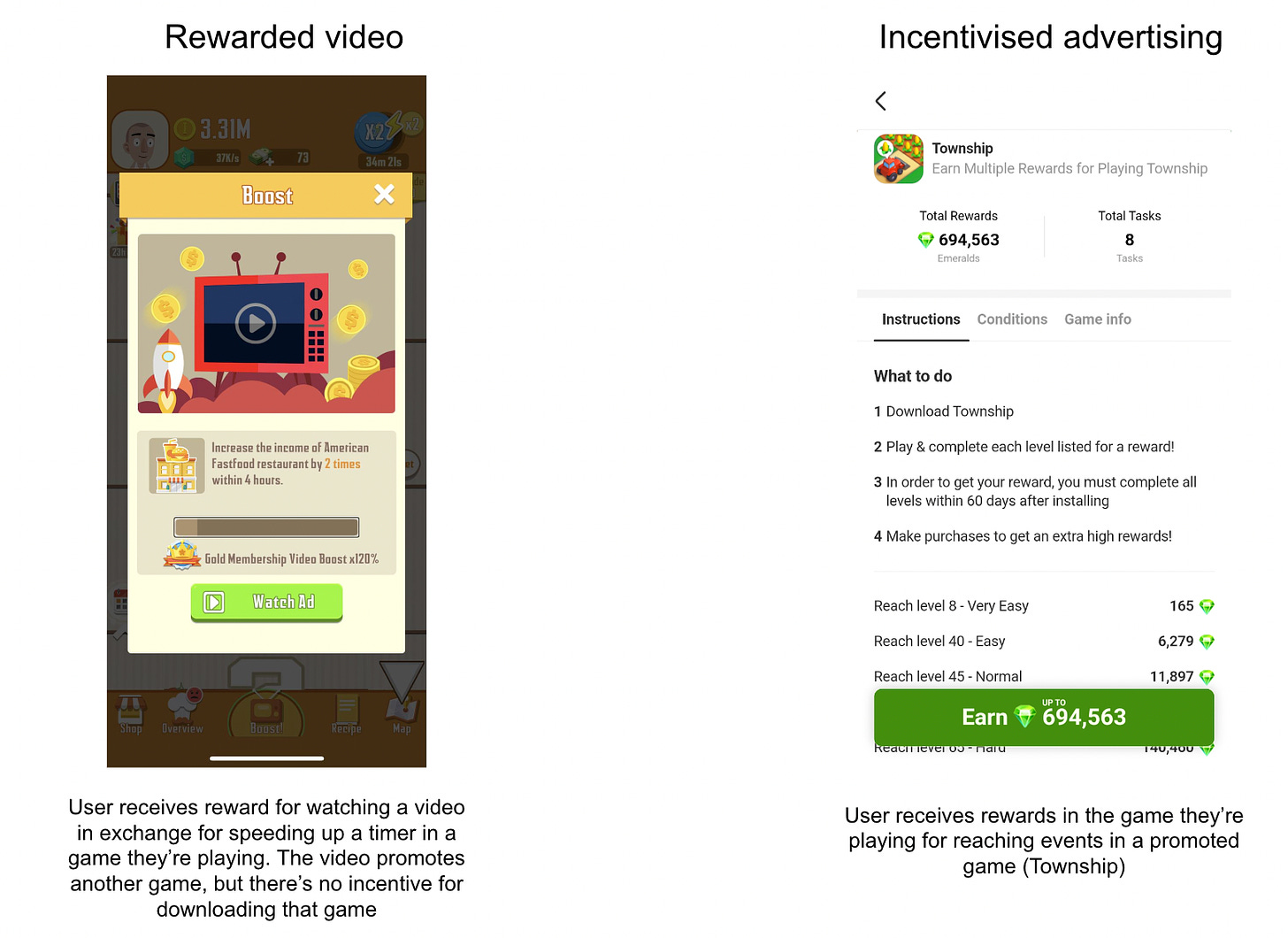

- Display Format: Rewarded ads are typically shown through an offer wall, where users can choose from a list of campaigns to earn rewards

In this definition, I don’t include the types of advertising where engagement in the ad/creative is incentivized (such as the rewarded video format popularized by Applovin, Unity and others). I’m specifically talking about types of advertising where engagement inside the promoted app is incentivized. I make this differentiation because the approach that user acquisition managers take to analyze the long-term predicted performance of an incentivized channel should differ from how they analyze the performance of a channel where there’s no incentive for the user to engage with the app. We’ll discuss why that is in another post.

Benefits of incentivized advertising

Now we’ve understood that incentivized advertising is a significant and growing part of the UA landscape for F2P gaming, we should understand what some of its benefits are over other channels:

- Guaranteed User Engagement: users are motivated to interact with ads and explore new apps, leading to higher engagement and potentially more effective user acquisition

- Cost-Effective User Acquisition: the performance-based model ensures developers only pay for successful actions (like event completions or retention), reducing costs compared to models like CPM.

- Positive User Experience: because users choose to engage with the ads, they are less likely to feel annoyed, leading to a more positive overall experience towards the advertised game and the game that showed the ad.

- No creative needed: unlike other channels such as TikTok or Facebook that have a fast saturation rate for creative, there are usually no significant creative assets needed to run on a rewarded channel, reducing the ongoing cost of running there

Incentivized advertising can be a win-win-win for advertisers, publishers, and end users. However, it does have its challenges:

Challenges with incentivized traffic

- Limited Audience Scale: The appeal of rewarded advertising is restricted by the dominant type of rewards available and the effort required to earn them

- Types of reward:

- Virtual Currency Rewards: Only 3-5% of a publisher’s game DAU uses offerwalls. While monetization ARPDAU is high for publishers, relatively few publishers want to implement the format until all other revenue growth strategies have failed and their games have started declining already. Therefore, install volumes for advertisers lag behind more visible formats like rewarded video.

- Gift Cards: Mistplay dominates this space and has 500k DAUs on its Android app, which it needs to promote through extensive user acquisition efforts. This is compared to Applovin’s 700m DAU on its MAX exchange.

- Effort required:

- Most incentivized networks require players to complete significant gameplay, which can take 30-60 days to achieve the highest rewards. This can limit the pool of people willing to engage with ads.

- Types of reward:

- iOS: Apple’s Appstore rules prohibit incentivizing installs from within an iOS app. Ad platforms position themselves as communities to QA games to avoid this prohibition.

- Fraud: Like all ad networks, incentivized advertising platforms, including bot usage and fake accounts, are vulnerable to fraud. Ongoing cohort analysis is crucial for detection and management.

- Lower intent users: Reward-driven players can have poor retention, dropping off after claiming their last valuable reward

Lower intent users

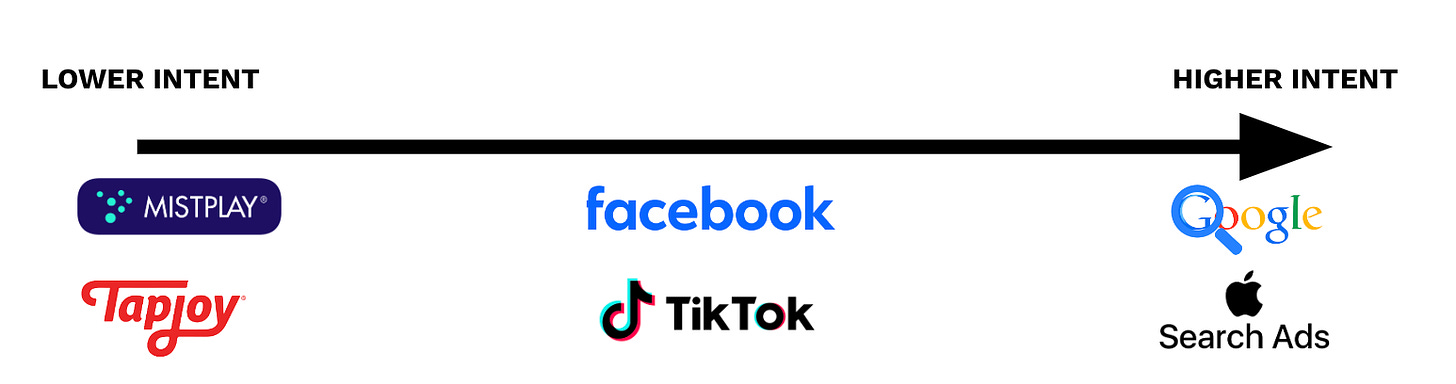

What is intent when it’s related to incentivized advertising?

- Intent refers to the mindset of users when an ad network serves them an ad

- High-Intent Users: The highest-intent users who interact with digital advertising actively search for advertised products, like on Google or the iOS App Store. These platforms require minimal targeting capabilities because users’ search terms directly indicate their interests. For example, Apple’s ad platform relies on basic keyword targeting with no complex targeting algorithms.

- Low-Intent Users: These users aren’t necessarily looking to engage or acquire a product. Rewarded ad networks can attract users who download games without genuine interest, requiring additional strategies to address low intent.

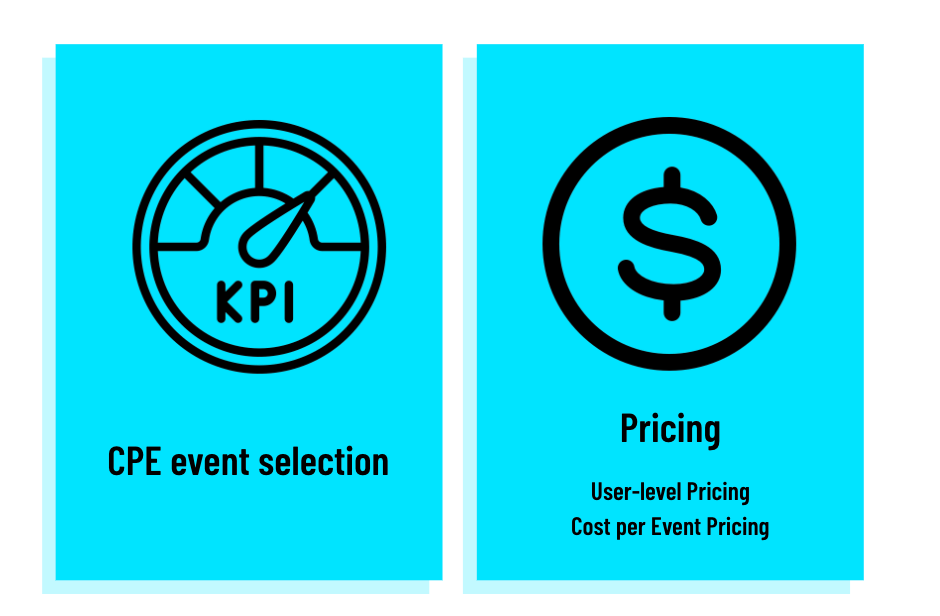

How Do Rewarded Ad Networks Solve for Lower Intent?

Rewarded ad networks face the challenge of attracting users who may engage primarily for rewards rather than genuine interest in the promoted app or game.

To address this, networks have developed sophisticated strategies that align user incentives with advertiser goals, ensuring that user acquisition campaigns are cost-effective and performance-driven.

- CPE Event SelectionCost-per-engagement (CPE) event selection allows advertisers to set specific in-app actions that users must complete to earn rewards. Originally when Tapjoy and others innovated on this model, advertisers paid only for an install event. This worked well for driving the volume of installs, but it was not useful to drive retained installs who monetize – the goal of most advertisers is to scaleably grow their game. Instead of paying only for an install, incentivized ad platforms asked players to complete more and deeper events such as levels—this forced retention. Additionally, users were rewarded for making in-app purchases. This drove a monetization behavior that was key for long-term ROAS. This more complex CPE event selection helps filter out users with minimal intent and only looking to claim rewards. Incentivized ad platforms aim to build a campaign design that is best predictive of LTV whilst offering reasonable goals for the players to complete, ensuring a campaign setup that delivers a scaleable volume of installs.

- Publisher-Level/User-Level PricingRewarded ad networks often employ publisher-level and user-level pricing models to optimize performance and manage user intent. These models adjust the pricing of rewards dynamically based on historical performance data from specific publishers or individual users. For example:

- Publisher-Level Pricing: Adjusts the price advertisers pay based on the quality of traffic from specific publishers. Publishers who consistently deliver high-intent users receive better pricing, incentivizing them to maintain high standards of user acquisition quality.

- User-Level Pricing: Utilizes machine learning algorithms to assess each user’s likelihood of completing high-value actions (predictive of high LTV) within a game. Networks can tailor reward values or campaign offers to each user’s predicted behavior, ensuring that the incentives align with the user’s engagement level. This granularity allows advertisers to target users who are more likely to convert, even within a low-intent environment.

- Cost Per Event (CPE) PricingAd platforms use pricing to directly address the issue of low intent by shifting the risk from the advertiser to the ad network. Advertisers are charged minimal or nothing for users who merely install an app; higher costs are incurred only when users achieve events within the game that signal higher engagement and intent. This ensures better ROI and discourages networks from driving low-quality, reward-seeking users who don’t provide long-term value.

Solving for low-quality users

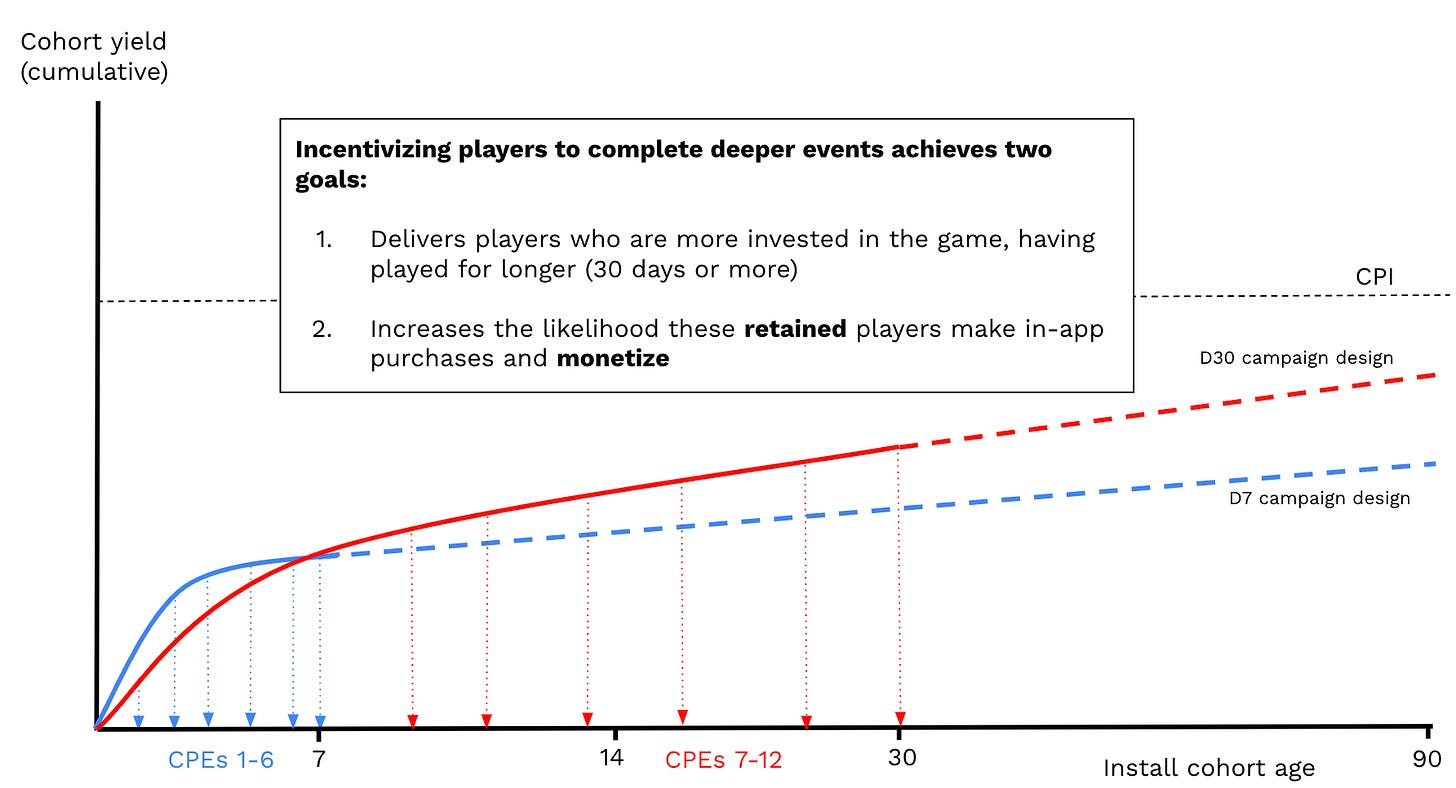

The graph below illustrates why it’s so important for incentivized ad platforms to ensure optimal event selection and pricing to deliver competitive ROAS for their advertiser partners.

Analyzing the blue D7 campaign design, we can see that the 6 CPE events in the campaign setup lead to a flatter average cumulative cohort yield. This is likely because many of the players in this cohort of installs stopped playing after receiving the last reward. However, this happened before the player decided it was a game they wanted to invest real time (and money into).

We can compare that to the red D30 campaign design. That campaign had 12 events for the player to complete and be rewarded for, which could take up to 30 days to complete. This campaign design gives players a longer incentive to continue playing the game, making it more likely they’ll decide it’s something they want to play for the long term.

Innovation in campaign design

Now we’ve understood how important optimizing retention and monetization is in designing an incentivized advertising campaign, let’s look at how some networks use different progression and retention mechanics to optimize long-term engagement.

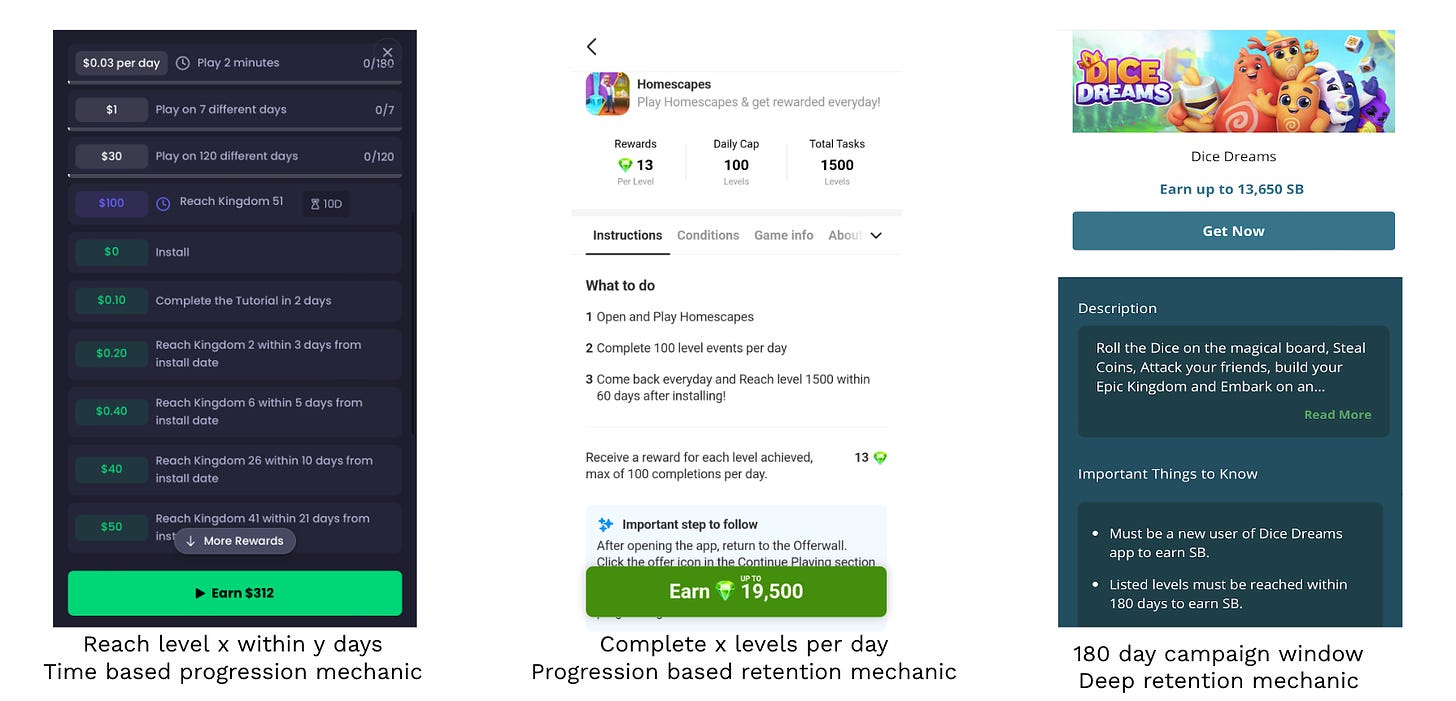

Below are 3 examples:

- FreeCash.com – Reach level x within y daysThis time-based progression mechanic incentivizes quick progression, let’s call it “binge play”, in the promoted game. Applied to a game where it’s possible to pay to progress faster, this incentive aims to increase the likelihood of the player monetizing, making an in-app purchase to speed up their ability to complete levels quickly.

- Tapjoy – Complete x levels per dayThis progression-based retention mechanic aims to create a daily behavior of playing the promoted game. Rather than incentivizing binge play, this mechanic tries to extend the number of days the player is likely to log in and then progress the required amount. This mechanic aims to optimize retention in the hope that it leads to monetization.

- Swagbucks.com – 180-day campaign windowThis campaign design has extremely deep in-game level events that reward players for reaching. These can take up to 180 days to complete. Driving deep retention in the game through rewards increases the player’s likelihood of becoming a payer.

The future of incentivized traffic for F2P Gaming UA

Where does incentivized traffic go next? Well, on this site, I intend to go much deeper into many of the topics raised in this article on its current state, but it’s interesting to predict where we can expect these ad platforms in the coming years:

New Reward Types:

- Gift cards and virtual currency are the most common rewards today, but we can expect ad platforms to innovate, offering new types of rewards to drive engagement

Innovation in Campaign Designs:

- Longer Campaign Windows: extend campaigns to build deeper player engagement

- ML-Driven Pricing and Event Selection: Use machine learning to adjust event offerings and reward values based on early player behavior, optimizing for retention and monetization.

- LiveOps Integration: Sync rewarded events with LiveOps events to create time-sensitive, relevant offers

Sufficed to say, it will be an exciting couple of years in this space. We can expect to see hyper-growth, innovation, and consolidation as it continues to mature.