About the author

Joakim Achren

General Partner @ F4 Fund, Co-Founder @ Next Games (acquired by Netflix), the most helpful investor on your cap table 🫡

HighlightsJournal 7 Joakim Achren March 14

I had been a founder for over 15 years and in 2019, I felt like I wanted to take the leap into the startup investing side. Inspired by Jason Calacanis’s book “Angel,” I wrote my first check to a game studio founded by former Next Games colleagues of mine. After starting with small $5K investments, I eventually created an angel syndicate with 200+ gaming professionals before launching F4 Fund in 2024.

Between 2019-2023, I made 34 angel investments. Note that I’ve stopped doing new angel investments after we started F4 Fund.

Currently, in March 2025, the portfolio looks something like this.

In this newsletter piece, I’ll share the key patterns and lessons I’ve identified from these investments and how they’re shaping my approach moving forward.

Here’s a simple breakdown of each mention on this bulleted list.

I don’t want to name any companies here, but in this case, I want to mention that the single exit I’ve had was from Miska Katkoff’s Savage Game Studios, which was also my angel syndicate’s first investment in 2020, and scoring the exit two years later. Hopefully, there will be more of these coming soon.

Why only one exit so far? First, there are no quick wins in startups, and second, the games industry hasn’t seen much M&A and liquidity for the past three years. Zynga stopped buying companies, as did the Swedish conglomerates. Exits will likely come when market conditions improve.

Some companies in my portfolio have maintained steady growth for years, and when you’re compounding at 10–20% annually, those gains eventually become substantial. Building big startups is a long game, lasting typically 5–10 years. Quick one to two year exits are very rare.

Over 90% of my angel portfolio is games industry based and we have had some tough times in the industry at scaling games, especially mobile free-to-play games, as Apple’s privacy changes made it harder to do targeted paid user acquisition. But now, the industry has figured out some ways to do better UA again, and growth is happening again.

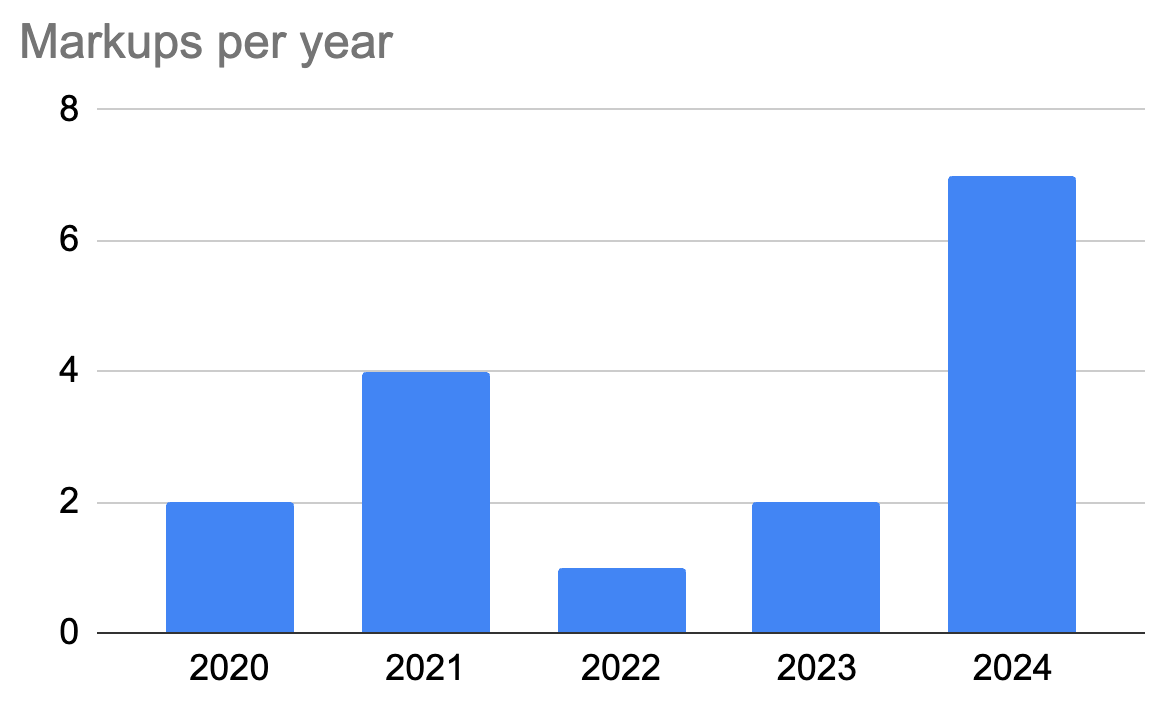

A markup means that the valuation of the investment has increased based on a new funding round and my stake in the company is now worth more than when I originally invested. Most of these happened during the ZIRP era, with only one or two in 2023, and then a bunch more in 2024.

7 companies that went to $0.

The main commonality with the companies that went bust is that they couldn’t find product market fit for their product before they were in the spot where further funding wasn’t available.

Additionally, I noticed these failed startups often had longer dev cycles than planned, burning through capital while chasing features rather than early market validation. Some teams were slow to pivot when initial concepts didn’t resonate, while others expanded headcount too quickly before proving PMF.

In several cases, founders didn’t recognize changing market conditions quickly enough, particularly as gaming industry dynamics shifted, web3 became a thing as quickly as it went away, and Apple’s IDFA changes made UA somewhat impossible for many.

These companies have cut their staff to the minimum and are rebooting their operations. It remains to be seen if they can get back on the venture-backed path and raise another round some time soon. For now, they are in bootstrapping mode.

To get back on the venture path, they need to demonstrate meaningful traction with this new approach. Since they already raised funding pre-PMF, securing another round at this stage would typically require significant progress and de-risking the investment for the investors. That said, it is possible, as others have successfully returned to venture backing from similar situations.

There are basically three lessons that I’d take away from angel investing.

If you have questions about angel investing, please hit me up with questions on LinkedIn DMs, I’m happy to reply to those.

About the author

General Partner @ F4 Fund, Co-Founder @ Next Games (acquired by Netflix), the most helpful investor on your cap table 🫡

Please login or subscribe to continue.

No account? Register | Lost password

✖✖

Are you sure you want to cancel your subscription? You will lose your Premium access and stored playlists.

✖