Written by our partner, InvestGame.

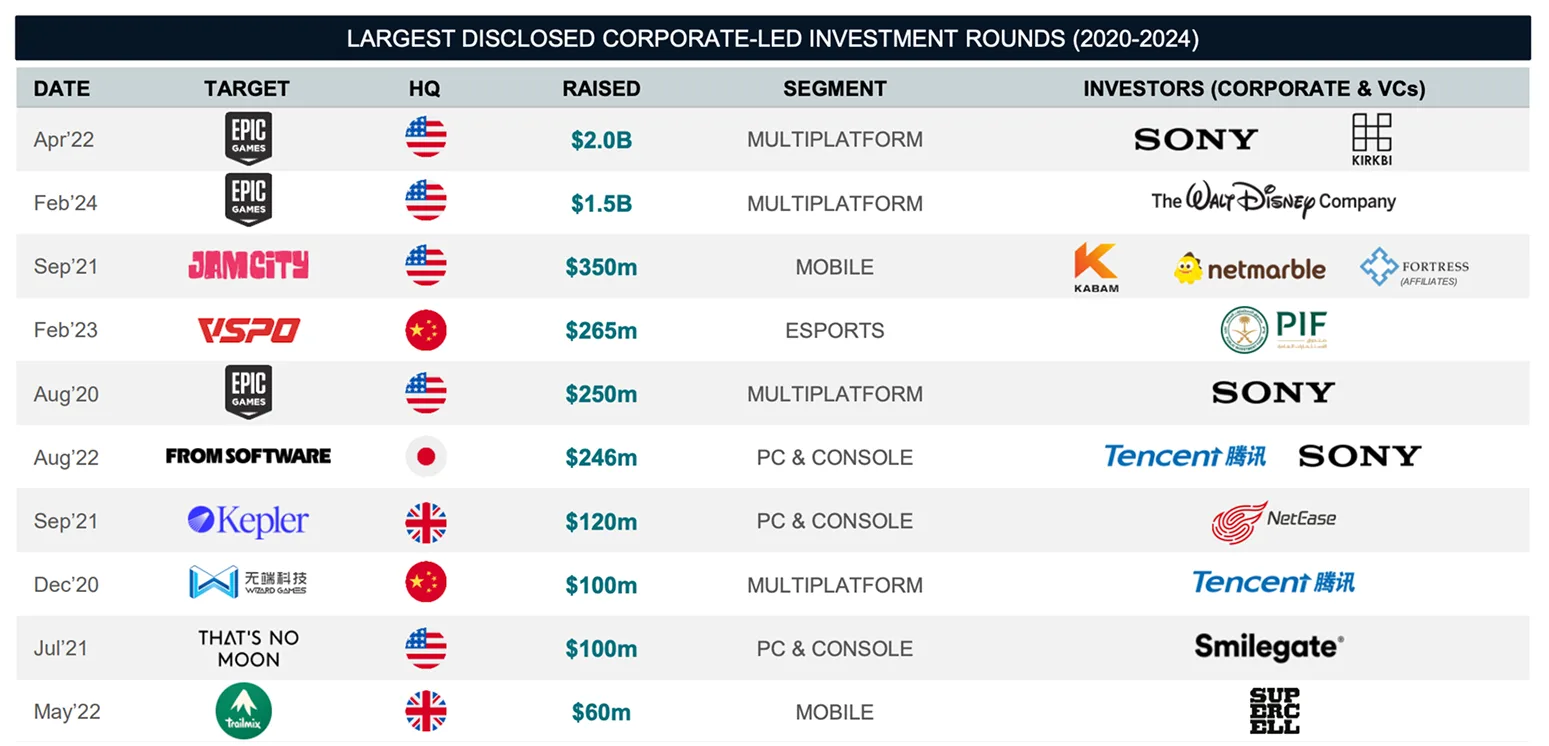

Lately, with financial investors less keen on backing gaming studios, many studios are exploring alternative options—returning to the industry’s roots with publishing partnerships and strategic investors taking the lead. Corporate-led transactions aren’t just funding studios; they’re shaping the industry’s future. Look no further than Epic Games: Disney’s $1.5B investment made headlines, but it wasn’t the only one—Sony and Kirkbi led another massive $2B round. And consider FromSoftware, the creator of the souls-like genre (Elden Ring, Dark Souls series), which has been backed by Sony and Tencent. These deals aren’t just capital injections; they represent strategic, long-term bets on the future of gaming.

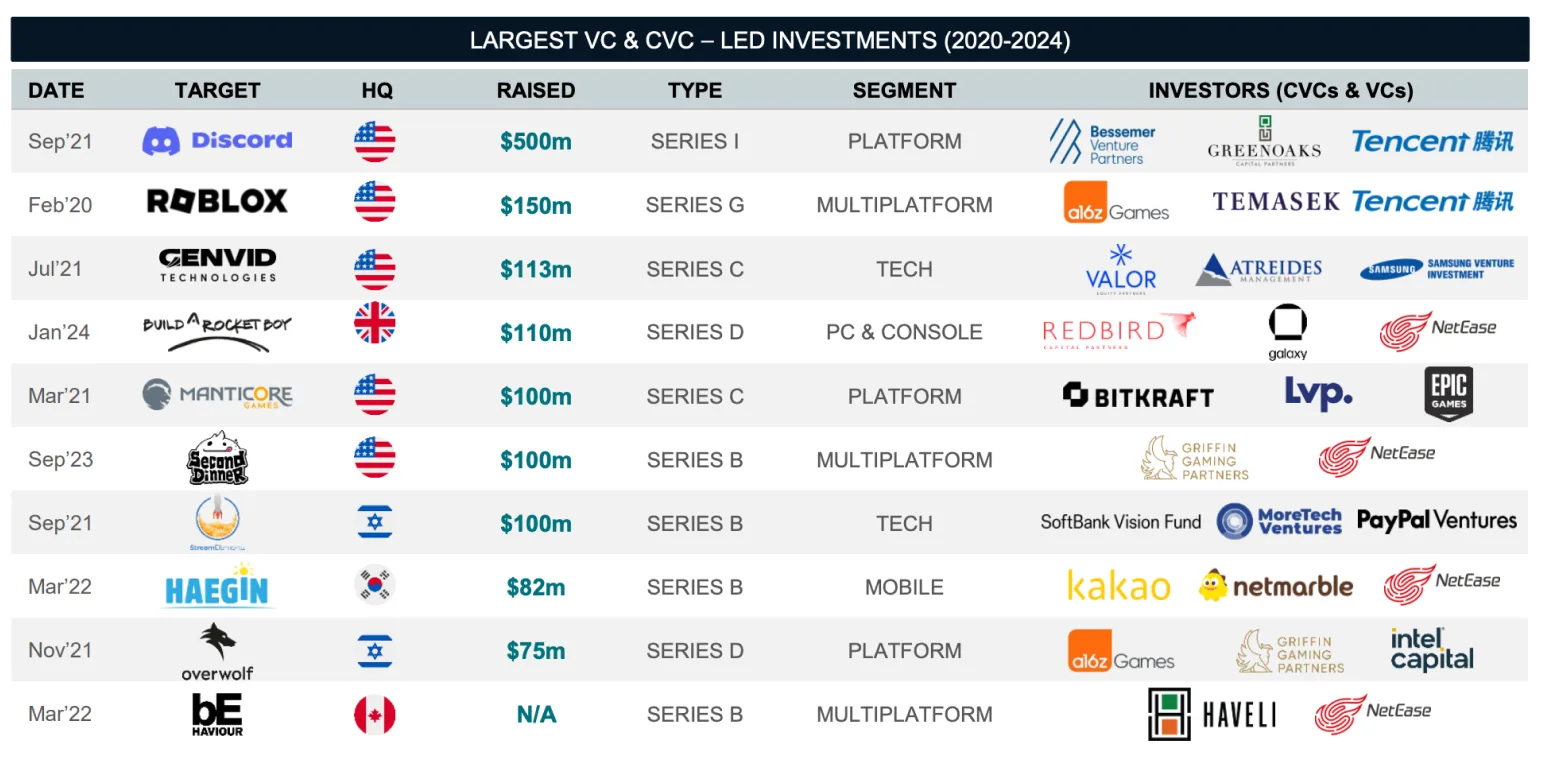

We’ve tracked this shift for years, but 2024 made one thing clear: corporate-led transactions aren’t just creeping in—they’re taking over private investments in gaming. Over 40% of gaming’s nine-figure deals are now corporate-backed, and we predict that corporate influence will continue growing in 2025. Studios that once thrived independently with financial investors’ backing are now increasingly partnering with corporations—driven by a shortage of readily available capital and the robust expertise of strategic investors.

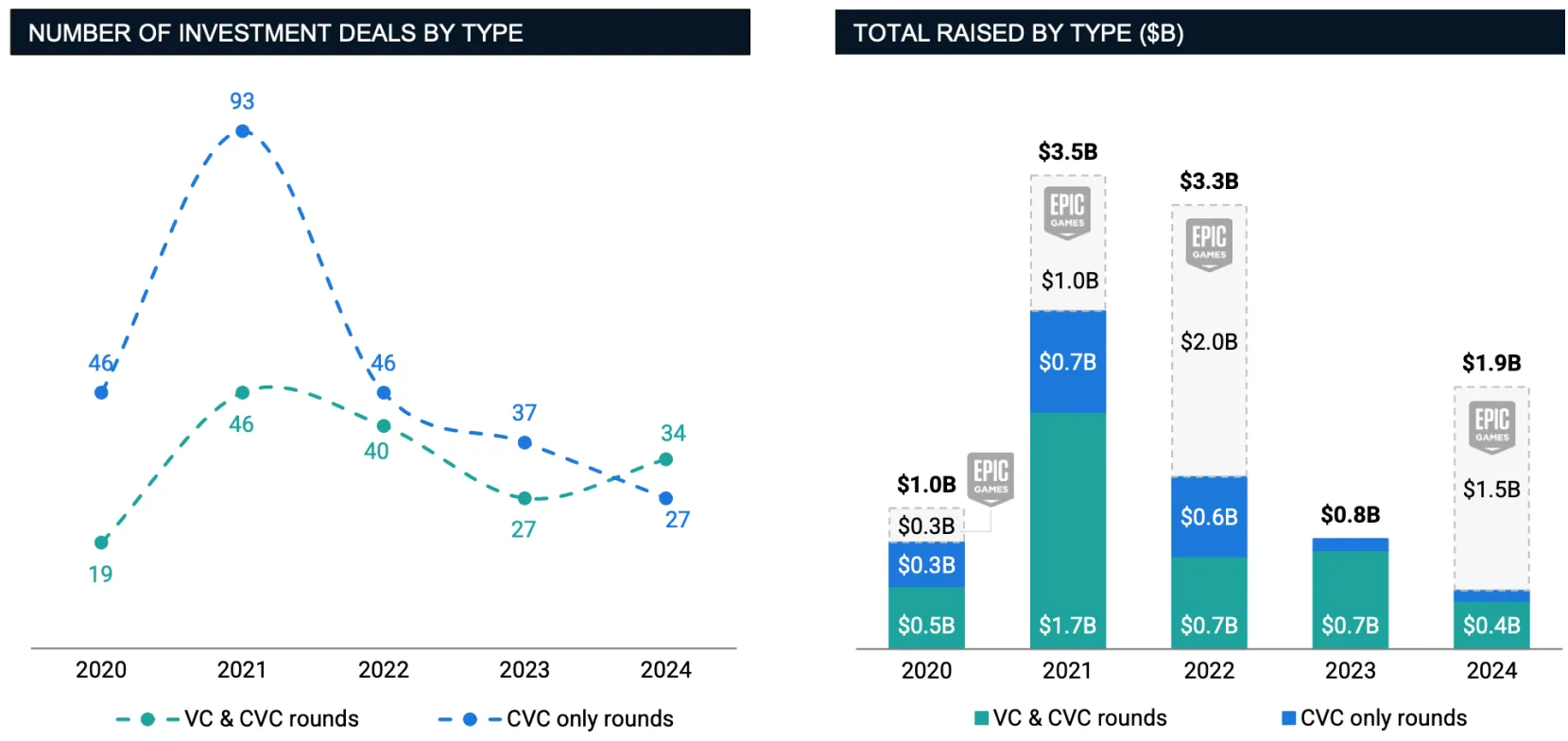

To get the complete picture, we reviewed every fundraising round that involved strategic investors—both corporate-led rounds (with strategics being only investors) and deals involving both VCs and CVCs (corporate venture capital), abbreviated as VC+CVC deals. We examined how often corporate investors deploy funds, whether they lead rounds or partner with gaming VCs, and where the money goes. We’ve also reviewed the largest deals and the most active players to identify trends that will shape gaming over the next decade.

For a detailed analysis, check out the accompanying report:

GDEV x InvestGame — Feature #8

CVC vs. VC: Who’s Really Calling the Shots?

Post-COVID modest financial results have forced many corporations to rethink their approach. To name a few challenges: Krafton suffered losses after The Callisto Protocol underperformed; NetEase faced weak results from its studios and had to shut down the Operation Apocalypse project, while Frozen Giant Studios failed to meet players’ expectations despite raising $35m from VCs and Corporations. All of this pushed strategics to seek safer investment strategies.

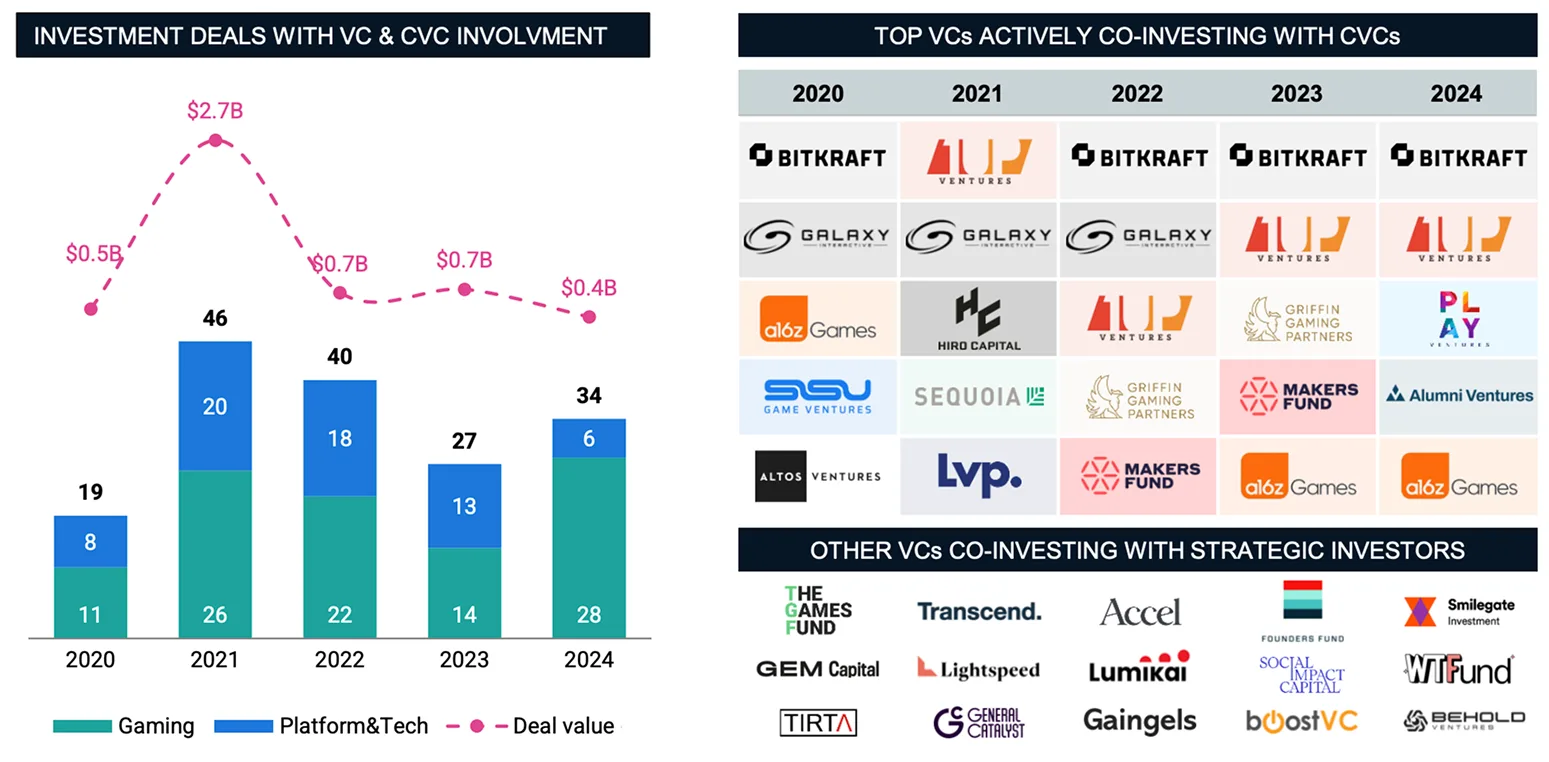

In response, many strategic investors are co-investing with VCs instead of solo investments, and this collaborative approach brings several benefits:

- Sharing financial risk: by co-investing, strategics share development costs with VC.

- Faster innovation: speeds up testing for new genres and audiences—essentially outsourcing R&D while avoiding potential negative headlines.

- Boosted team motivation: VC support keeps teams motivated and disciplined, potentially increasing the odds of launching a hit game, and providing a bigger slice of the upside compared to traditional in-house development.

- Improved public market perception: unlike internal development, such investments don’t burden the P&L, which can raise R&D costs or lead to large CapEx write-offs.

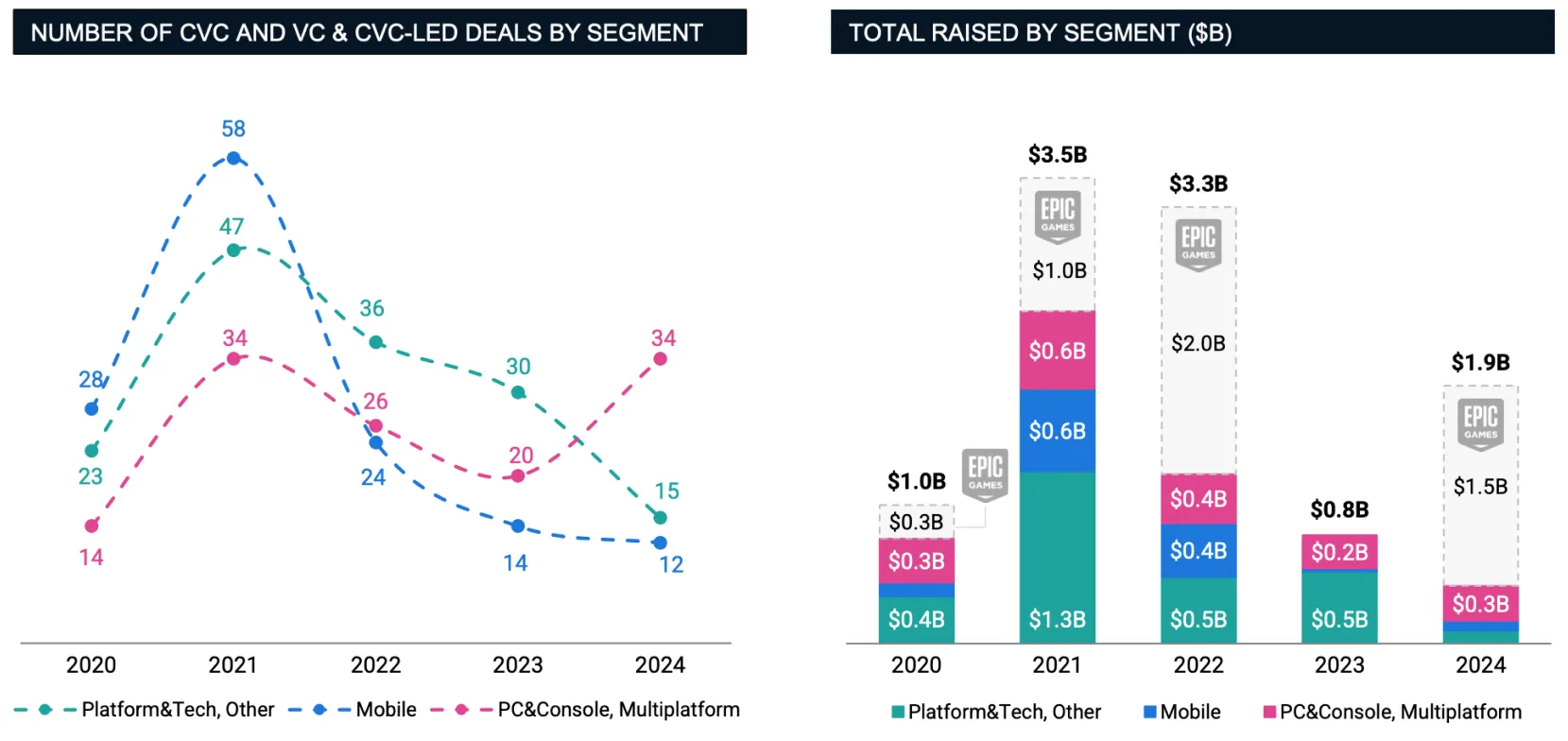

Platform Shift: Mobile Fades, PC & Multiplatform Rise

The mobile gaming boom has lost its luster for investors, dropping its share from 42% in 2021 to just 20% in 2024. The post-IDFA mobile market has faced significant challenges, including heightened competition in user acquisition, rising marketing costs, and increasing pressure to improve revenue and profit margins rather than prioritizing revenue growth alone. Many publicly listed companies report negative organic growth and declining valuations. It’s not surprising that many mobile gaming studios have struggled to scale their portfolios after the peak periods, making this area less attractive for investment.

In contrast, the PC & Consoles market has maintained momentum post-COVID. The PC platform is leading the way, consistently breaking all-time high records on Steam. This trend has sparked a surge in investments across PC, console, and multiplatform projects—their share doubling from 26% to 56% during the same period. Not only have established titles thrived thanks to a loyal user base and strong brand/IP recognition compared to mobile peers, but we’ve also seen a wave of innovative indie hits emerging—a welcome breath of fresh air after a crowded slate of AAA blockbusters.

Global Power Reordering: China Slows, Korea & Japan Rise

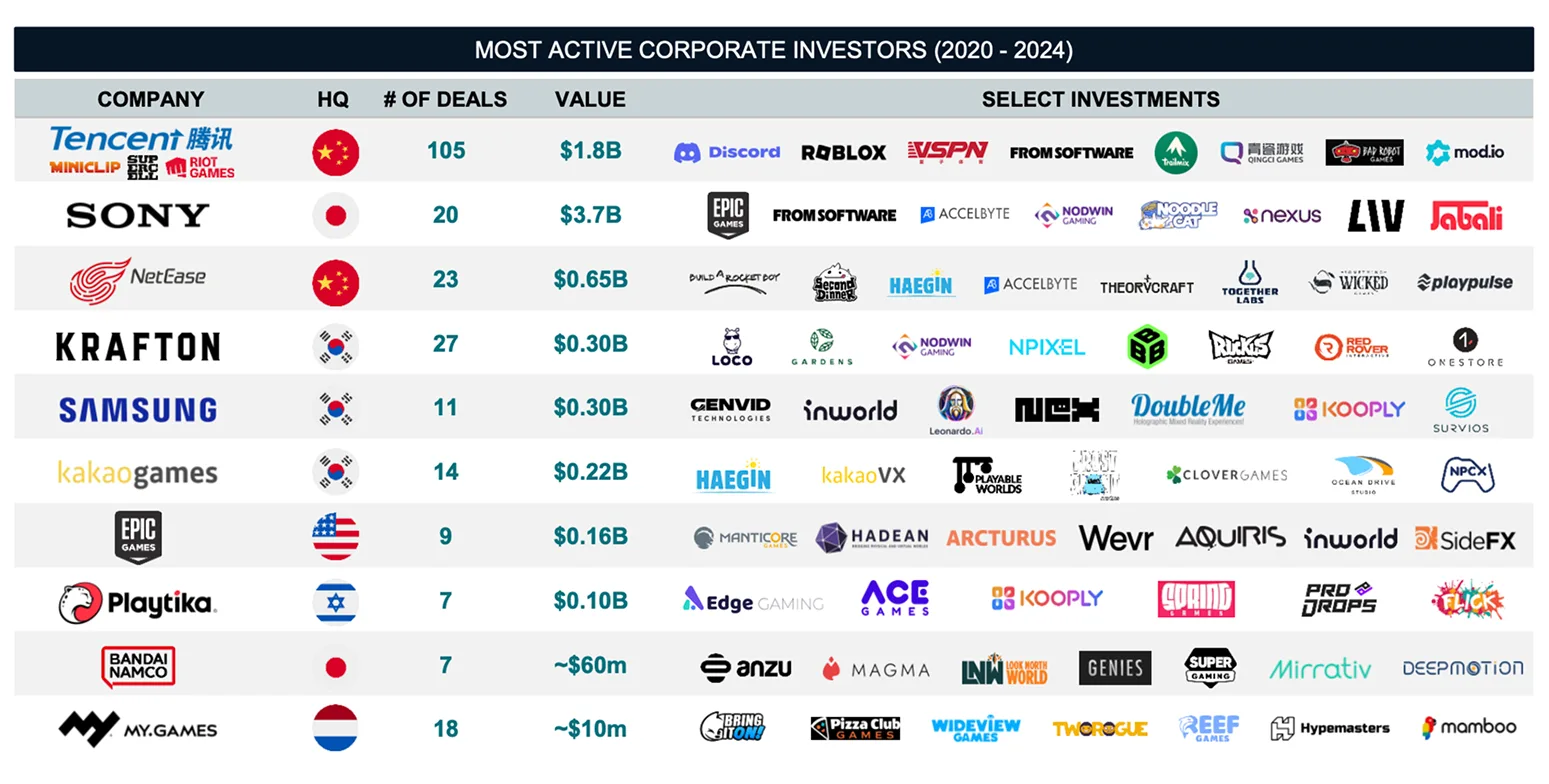

Tencent remains dominant in the gaming industry, maintaining investments in a vast network of studios worldwide and investing across all levels—from mega-M&A public takeovers to minority investments in smaller studios. The company continues its global expansion, deploying $1.8B across 100 deals. In contrast, fellow Chinese giant NetEase reportedly plans to exit all international investments and holdings, including wholly-owned studios.

However, new players are stepping up as China’s and the US’s geopolitical relationship recalibrates. South Korea’s Krafton, the creators of PUBG, has deployed over $300m in nearly 30 investment rounds—placing early bets on innovative products and IPs, with roughly 70% of its deals announced in 2023-2024. Meanwhile, Kakao Games have participated in at least 3 deals annually since 2022.

The subtext? Gaming remains an internal chessboard, yet players have reshuffled: while some retrench, Korea rolls up its sleeves. Corporate investors aren’t just chasing returns—they’re fortifying their focus on IP, ecosystems, and regional influence.

We can observe that 9 out of 10 largest corporate-led deals target gaming developers and publishers—not as passion projects but as strategic beachheads. Why? Games aren’t just products; they’re scalable IP platforms with a whole ecosystem. For example, Fortnite—created by Epic Games—attracted major investors and emerged as the most significant investment target, raising $6.3B from 2020 to 2024. Of this, $3.8B came from corporate investors, including Sony, Kirkbi (LEGO), and The Walt Disney Company.

At the same time, hybrid corporate-VC deals are extending beyond gaming, with the Platform & Tech segment capturing 4 of the 10 largest transactions. Investors are funding not just content but also the underlying infrastructure and technology—particularly companies with established products, a portfolio of clients, and the potential to support the future of interactive entertainment.

CVC and VC: A New Balance of the Force

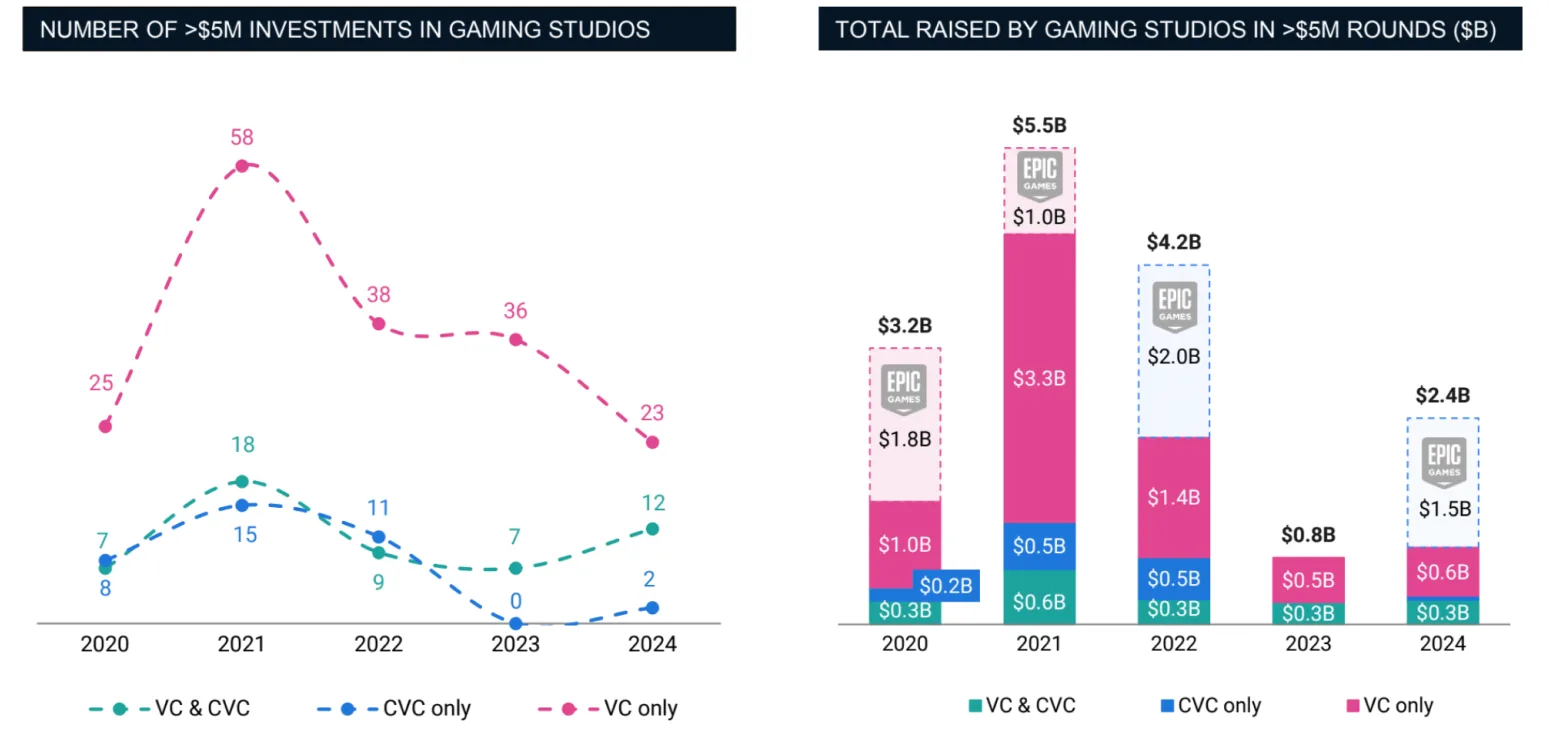

For $5m+ rounds, the gaming investment scene is shifting noticeably. Corporations are sticking with their tried-and-true strategy of directly backing gaming studios—either leading or jumping in on deals—while venture capital firms focus on tech and platform startups, the “picks and shovels” powering the industry. At the same time, corporate investors are getting more cautious, often choosing to co-invest with VCs.

Interestingly, the VC funds partnering with corporates—like BITKRAFT and a16z—are also at the forefront of gaming investments overall. In today’s challenging fundraising climate, many independent VC-backed studios are securing follow-on rounds from strategic investors, and even VCs are exploring this route to weather the storm.

What Is Next?

The gaming investment landscape is shifting, but one thing is clear: Corporate investors play a much more prominent role than ever in private investments. While traditional VC firms focus more on Platform & Tech startups, corporate-backed deals take over private gaming investments. With over 40% of nine-figure gaming transactions now backed by corporate funds, strategic investors are increasingly scaling studios and integrating them into broader ecosystems.

Meanwhile, hybrid corporate-VC partnerships are becoming the norm. Corporations seek VC expertise to manage risks, while VCs tap into corporate resources to scale their bets. In the mobile gaming segment, strategic investors prioritize mature companies with scaled revenues, sustainable cash flows, and established IPs—for example, the potential acquisition of Niantic by Scopely, MTG’s acquisition of Plarium, or Miniclip’s bet on Easybrain. At the same time, strategic investors remain highly active in private investments within the PC & Console and multiplatform segments, where game budgets are lower than those for traditional AAA productions yet more financially efficient for publicly traded companies. Even without $100m+ budgets, these games can achieve financial outcomes comparable to large-scale AAA franchises, with product quality emerging as a more decisive competitive advantage than marketing efficiency.

Looking ahead, the balance of power in gaming investments will keep evolving. As the industry consolidates and capital becomes more selective, the biggest deals won’t just be about funding games—they’ll be about securing strategic footholds in an increasingly competitive landscape.