- arrow_back Home

- keyboard_arrow_right Highlights

Unity Q4 2024: A Rocky Reset with a 25% Loss

HighlightsJournal 43 Ömer Yakabagi February 20

Source: StockTitan

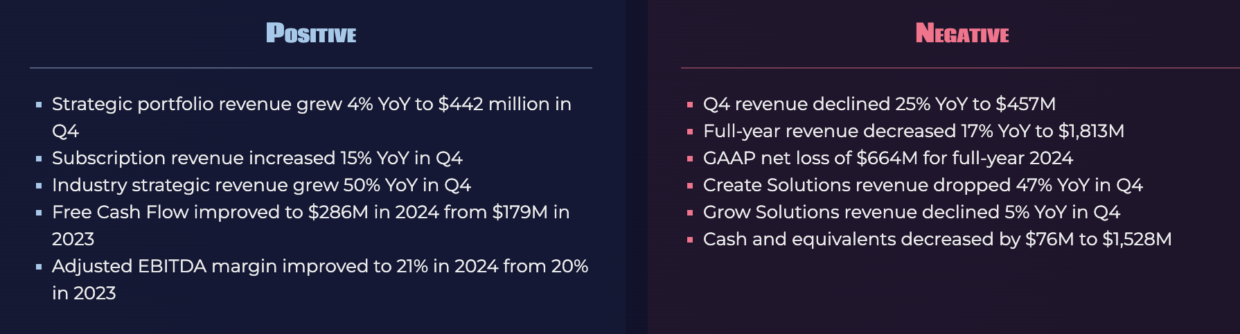

Unity (NYSE: U) reported Q4 2024 revenue of $457 million, down 25% year-over-year, as the gaming and ad tech giant navigates a major portfolio reset. Despite the decline, the company sees momentum in AI-driven advertising solutions, mobile game development tools, and strategic growth areas.

Weirdly, Unity Stocks jumped from 18,3 to 25,3 (38%) while AppLovin went to 440 from 490. (-10%)

AppLovin Empire: Monopoly in Mobile Gaming?

AppLovin to Sell Its Gaming Division for $900M to Strengthen Its Ad Tech Focus

Key Financials (Q4 2024)

- Create Solutions (Game Engine & Dev Tools): $152M, down 47% Y/Y.

- Without the $99M Weta FX contract termination, the decline would have been 20% Y/Y.

- Grow Solutions (Ad Tech & Monetization): $305M, down 5% Y/Y.

- Excluding pre-merger IronSource incentives, revenue would have risen 2% Y/Y, supported by strong seasonal ad demand.

- Strategic Portfolio Revenue: $442M, up 4% Y/Y, driven by gaming industry adoption and new monetization models.

Despite revenue headwinds, cost-cutting and restructuring helped reduce net loss to $123M, down from $254M in Q4 2023. Adjusted EBITDA was $106M (23% margin), though down from $186M a year prior.

Full-Year 2024 Overview

- Total Revenue: $1.81B, down 17% Y/Y, reflecting shifts in gaming engine licensing, mobile monetization, and advertising strategies.

- Create Solutions: $614M, down 29% Y/Y, with subscription revenue up 15% Y/Y.

- Grow Solutions (Mobile Ads & Ad Tech): $1.2B, down 10% Y/Y, but poised for AI-driven improvements in 2025.

- GAAP Net Loss: $664M, (37% margin).

- Adjusted EBITDA: $390M (21% margin).

- Free Cash Flow: $286M, up from $179M in 2023, signaling improved monetization of mobile and in-game ads.

Looking Ahead: Q1 2025 Guidance

Unity forecasts $405M–$415M in revenue and $60M–$65M Adjusted EBITDA as it leans on Unity 6, an overhauled pricing model, and AI-powered advertising to drive mobile game development and ad tech innovation.

CEO’s Take

“Our Q4 results exceeded expectations on both revenue and profit, showing our progress in building a new Unity,” said CEO Matt Bromberg.

With AI-driven ad targeting, in-game monetization, and evolving mobile game engine solutions, Unity is positioning itself for a stronger 2025 despite its 25% revenue decline.