AI App Wars: Deep Dive in a Heated Race

Journal 4 Julie Tonna January 15

On our laptops, on our phones. Artificial Intelligence has become a part of daily life. From removing the background of a photo to generating lyrics for a new song or making an email more friendly, there are endless use cases, and even more apps to choose from.

But the AI app space is changing, and fast. With the category growing so quickly, we’re seeing both exciting opportunities and major challenges, like rising competition in regional markets. This article looks at ChatGPT’s revenue boom, the competition bringing challenges in specific regions, and the advertising strategies these apps are using to keep up.

Insights shared in this article come from the Sensor Tower report “ChatGPT Maintains US Lead; Share Weakens in Emerging Markets”, with graphs and additional insights & analysis sourced from Mobile Action.

The Rise of ChatGPT

No need to introduce ChatGPT anymore. When OpenAI released the GPT-3 model, it disrupted everything. AI became the buzzword of the moment, and since then, AI chatbot apps have been popping up everywhere. Big players entered the space, like Google with Gemini and Microsoft with Copilot, while underdogs like Claude (Anthropic) and Perplexity found their own niches.

But ChatGPT’s growth stands out as the most impressive. Sensor Tower data shows that ChatGPT reached 160 million MAUs in Q3 2024. It was also the third-fastest app in recent years to hit 50 million MAUs globally, reaching this milestone just five months after launch.

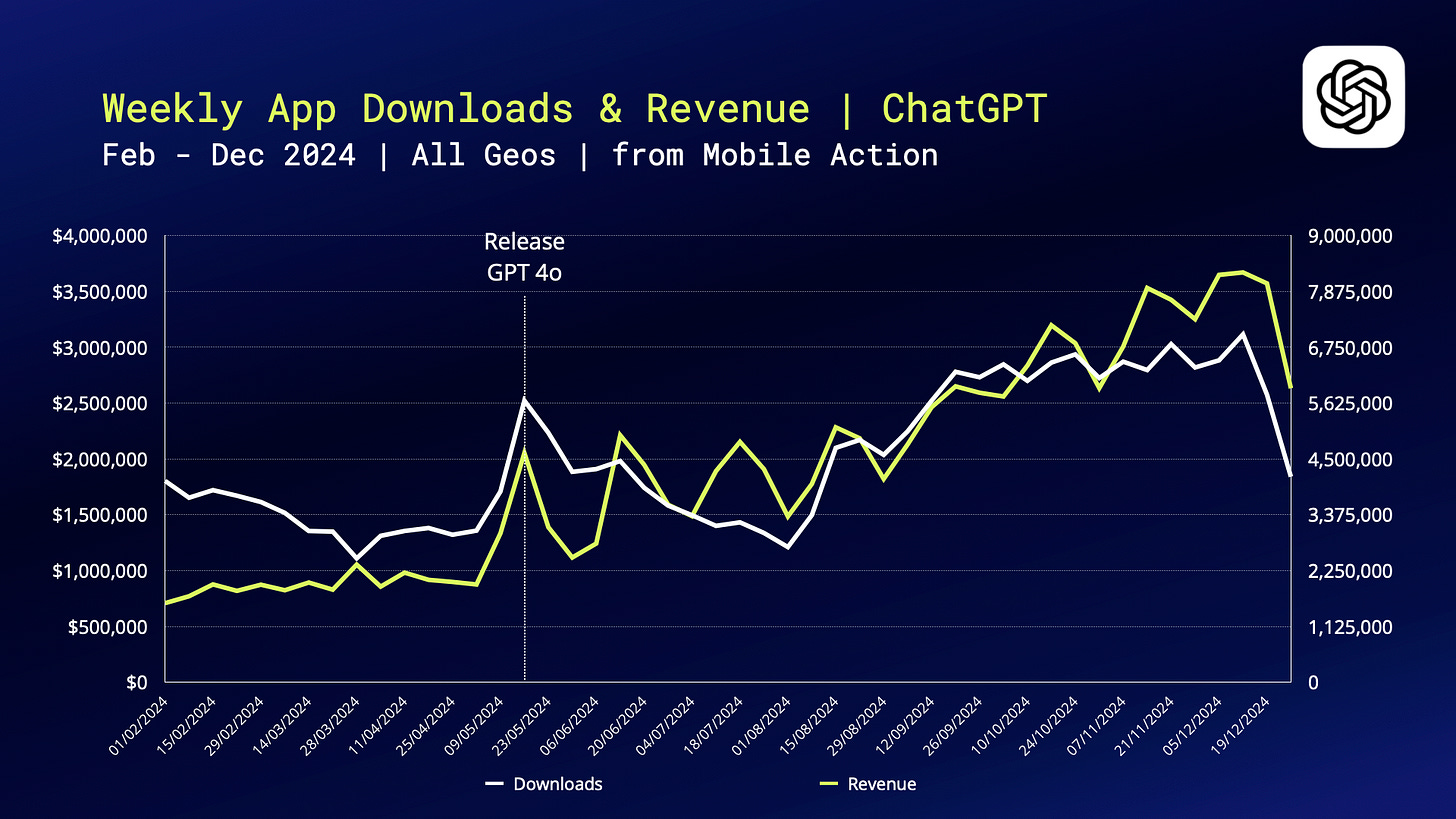

Revenue growth has followed the same upward trajectory. The release of GPT-4 accelerated everything, with downloads and revenue peaking in May 2024. This brought ChatGPT’s US revenue market share to an incredible 60%, as shown in the graph below.

A Shifting Regional Landscape

While ChatGPT is the most popular AI chatbot globally, dominating most markets, its competitors haven’t given up—and in some regions, they’re catching up fast.

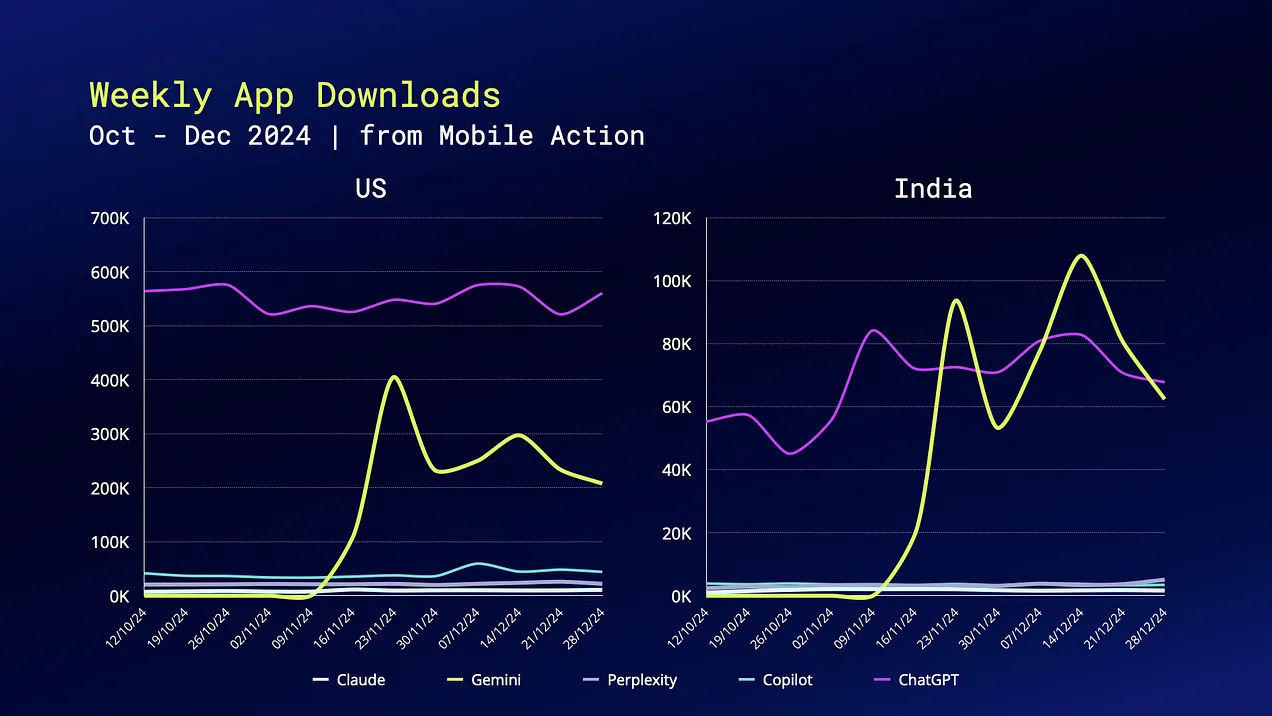

In the US and Europe, ChatGPT still leads in downloads, though Gemini is closing the gap since its launch in November 2024. But if you look at other markets, it’s a different story.

In India, Gemini has taken off, now holding around 50% market share and surpassing ChatGPT in weekly downloads. Meanwhile, in LATAM, smaller apps like Nova AI Chatbot are growing quickly, now reaching 10% of total downloads (compared to just 3% in the US).

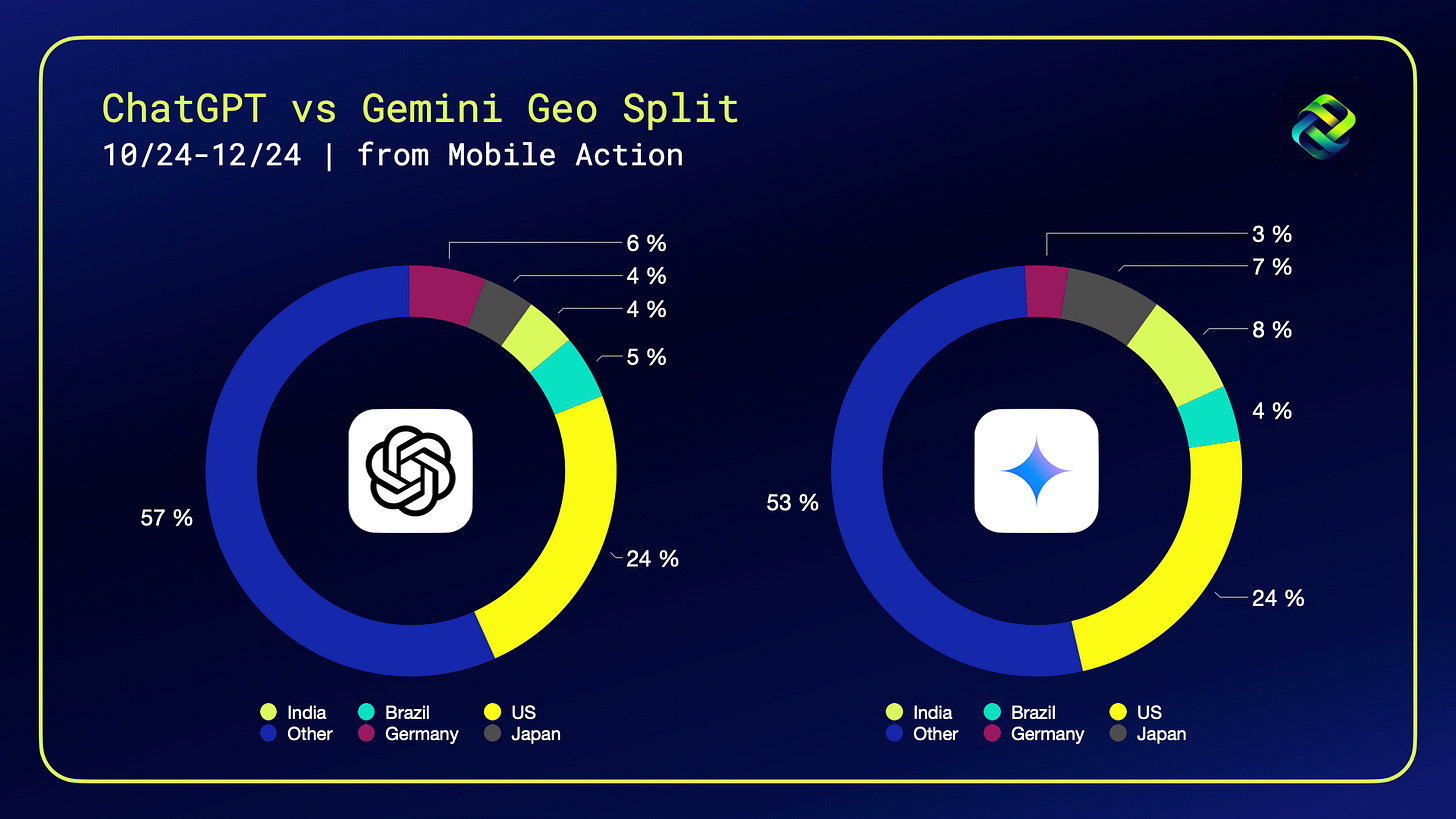

These shifts are largely driven by cultural and economic factors. In emerging markets like India, affordable subscription pricing is a big draw for smaller apps. Google also benefits from its global brand recognition, which plays a huge role in Gemini’s rapid success. As you can see from the geo-split chart below, Gemini’s performance in India is especially strong, making up almost 8% of all downloads in the market.

iOS Organic Rankings

In terms of App Store Optimization, AI apps are getting incredibly creative in how they rank, acquire, and retain users.

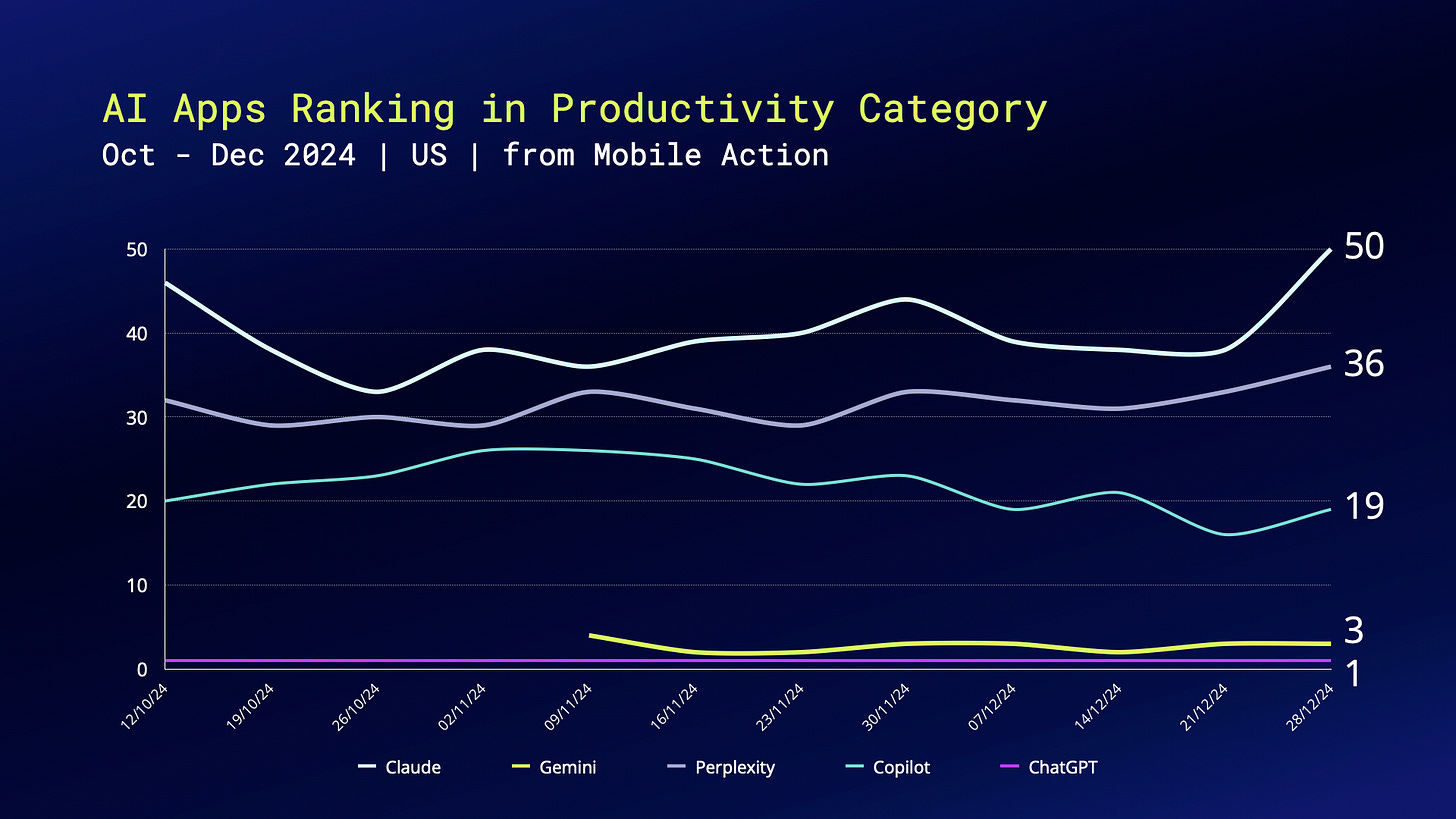

Let’s start with rankings. In the US Productivity category at the end of 2024, ChatGPT holds the #1 spot, with Gemini in third. Microsoft’s Copilot is down at #19, Perplexity at #36, and Claude at #50.

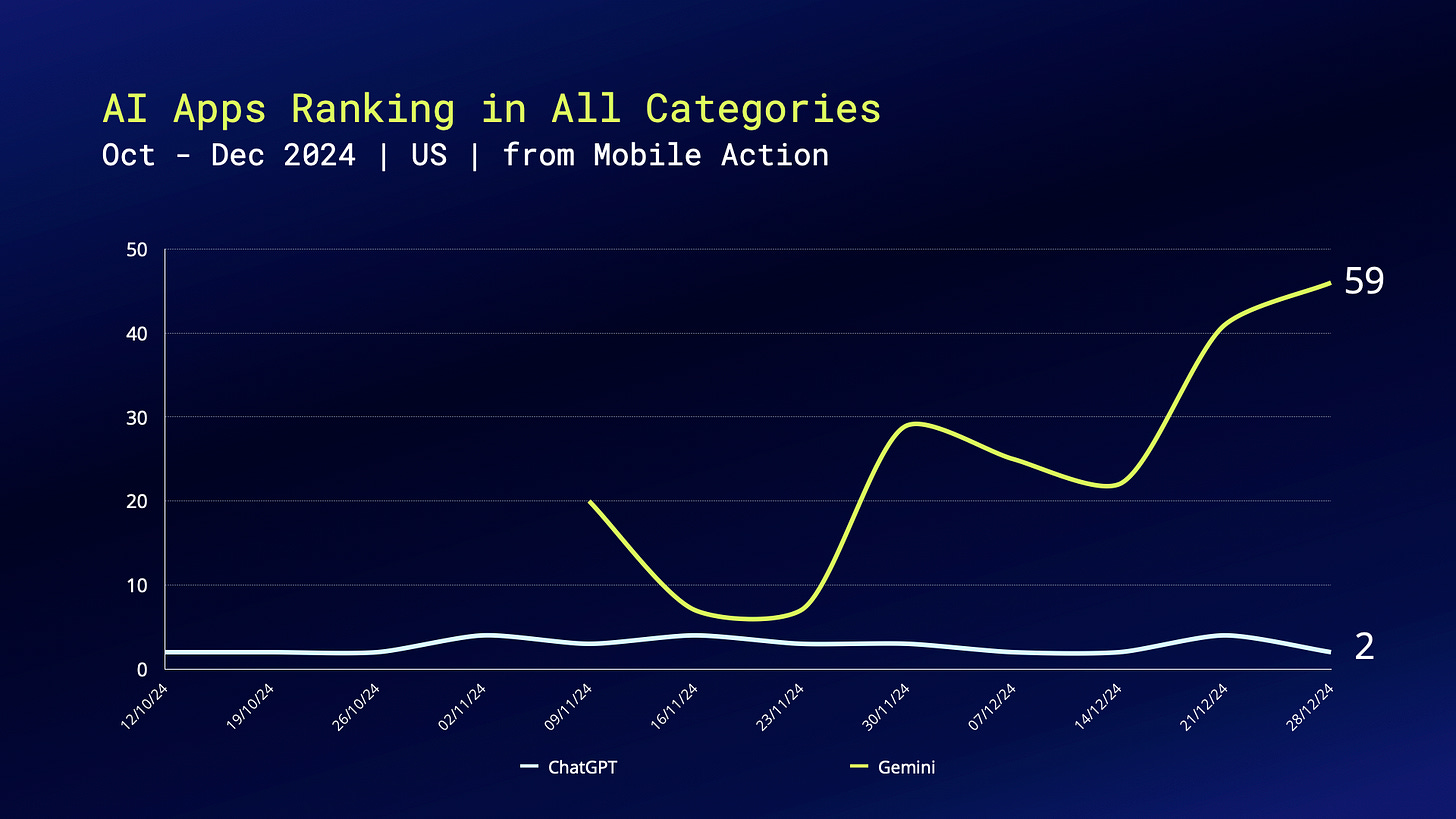

When we look at the All Categories rankings, most apps disappear entirely, with only ChatGPT and Gemini staying visible. ChatGPT has been holding steady in the top 5 for several months now, showing no sign of slowing down.

ASO, User Acquisition & Advertising Strategies

Each app is trying to stand out by leaning into its strengths and crafting unique UA strategies.

ChatGPT seems to rely entirely on organic growth. There haven’t been many ads seen from them—they’re banking on great PR and a well-known name to keep the momentum going. But I’ve seen big apps and games try this strategy before, and the reality is that UA becomes inevitable once competition heats up and virality slows down.

Other apps are more aggressive. Perplexity, for example, targets urban professionals with strategic partnerships like its deal with Uber One, offering members a free year of Perplexity Pro.

Microsoft’s Copilot takes advantage of its ecosystem, cross-promoting the app through Outlook, OneDrive, and Authenticator. This strategy works well for Microsoft users who are already deeply embedded in their ecosystem. They’ve also gone big on YouTube and OTT ads, reaching users during high-attention moments.

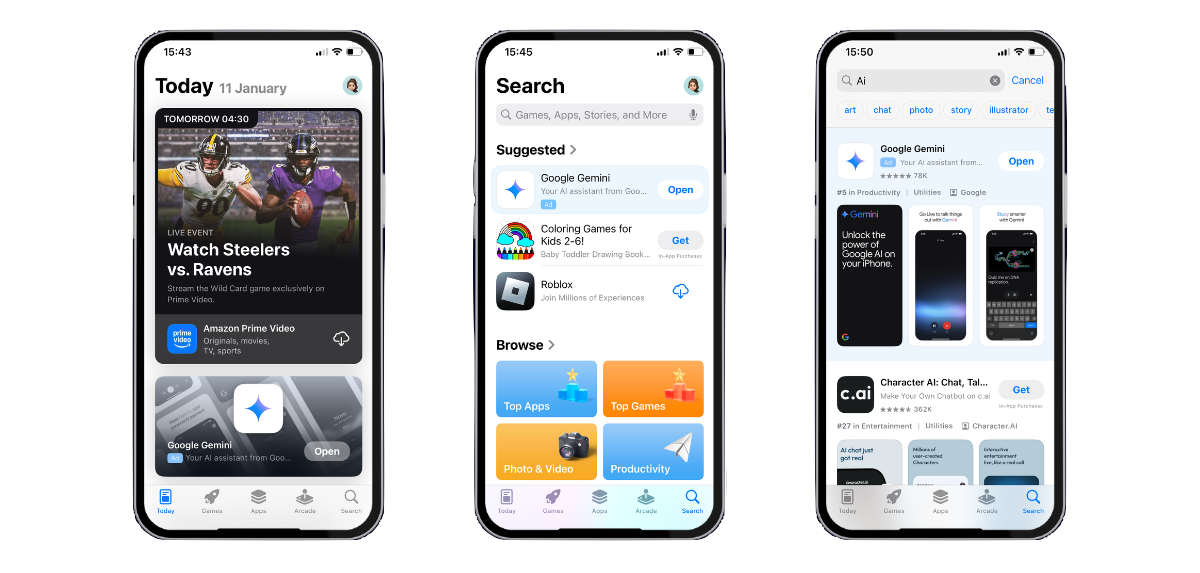

Google has gone all-in on promoting Gemini. They’ve invested in ads on premium publications like The Washington Post and Forbes, as well as prominent placements on the App Store. This strategy is all about generating awareness at the end of the funnel, where high-value users convert.

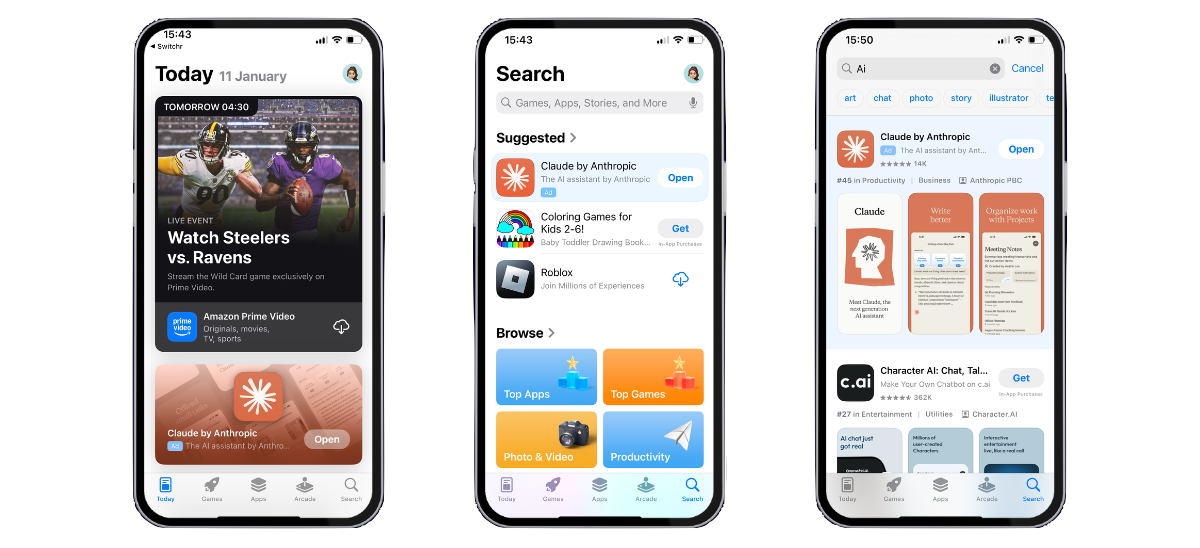

Anthropic has taken a similar approach for Claude, heavily promoting it on the App Store with placements in the Today tab, Search tab, and Search Results.

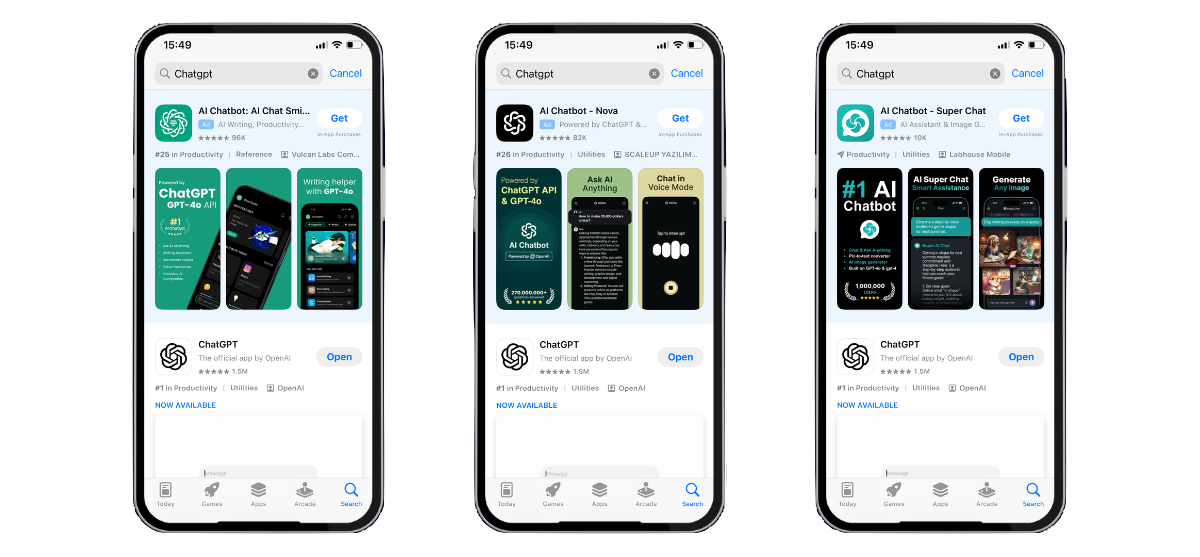

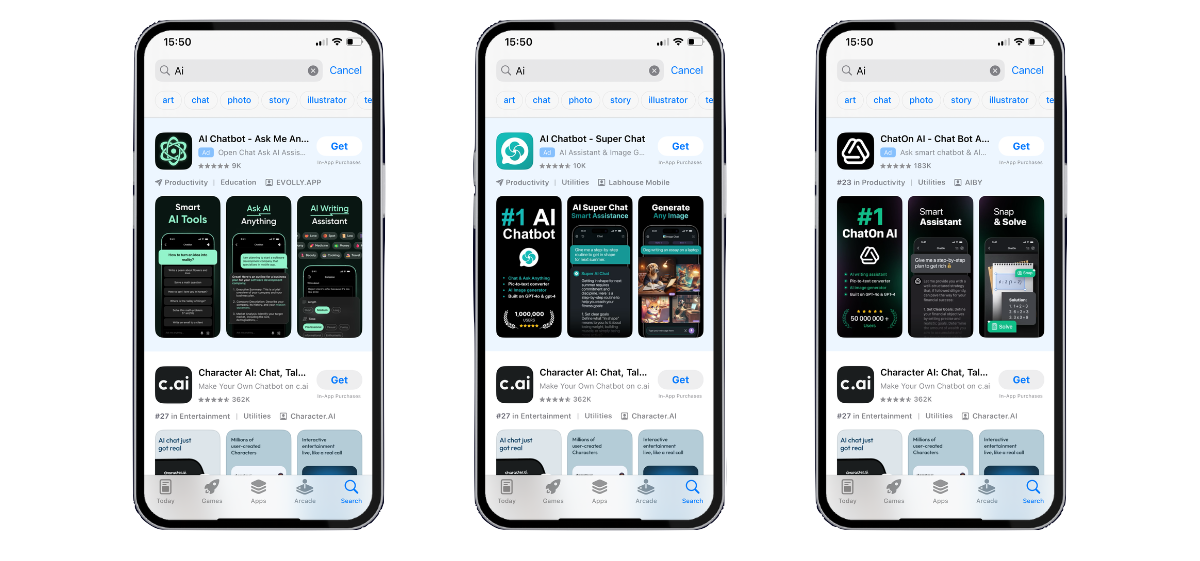

Meanwhile, smaller apps are competing in the App Store by bidding on keywords like “chatGPT” and “AI.” Surprisingly, OpenAI hasn’t protected its brand term, giving these apps a chance to ride ChatGPT’s wave of popularity.

The AI App War Continues

While ChatGPT dominates globally, markets like India and LATAM are proving there’s room for other players to grow. New apps, like X’s Grok, are also entering the scene, keeping the category in constant motion.

The importance of regional strategies, user engagement, and tailored advertising will only grow in the months ahead. Relying solely on organic growth might work for now, but it’s not a sustainable strategy in such a competitive space.

The big questions are: will apps like Gemini or Perplexity find global traction? And will OpenAI eventually invest in UA to maintain its lead?

One thing’s for sure: the AI app wars are just getting started.