About the author

Antti Kananen

Seasoned entrepreneur, executive, director, general manager & project/product lead bringing innovation, technology, startups and games to life!

Journal 49 Antti Kananen November 20

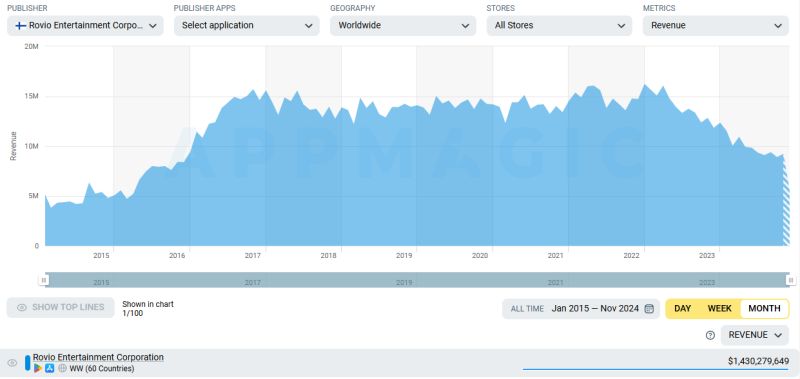

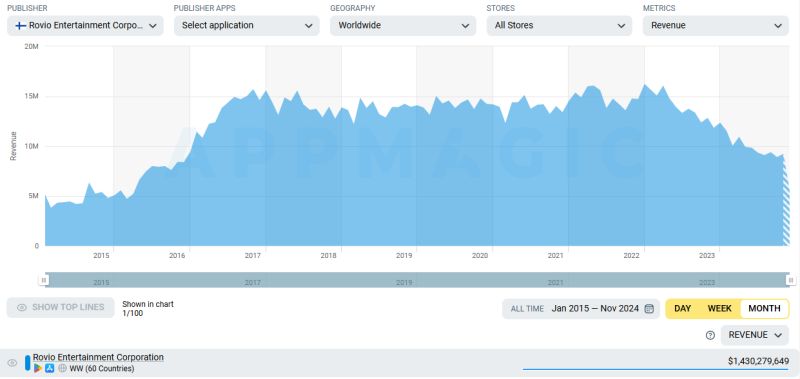

Rovio’s golden days with Angry Birds are gone. A look at AppMagic reveals the story: churning downloads, revenue, and MAUs. Latest bets on high-risk, high-cost titles—e.g., Angry Birds Journey and Bloom City Match—are poorly positioned to catch emerging trends or gain traction in competitive genres like puzzles.

The Problem: Stuck in the Past.

Rovio is slow to adapt to fast-paced mobile games market. They aren’t leaning on commercial or scientific processes to evaluate opportunities in new, high-potential genres. Instead, they continue to 2x on categories where e.g., King, Playrix, and Dream Games dominate.

Take Bloom City Match. It’s dropped into the most competitive puzzle games segment, crowded with competition. It’s a high-risk bet in a category with high CPIs, churned-out cohorts, and a shrinking ROAS profile. And while Angry Birds Friends is one of the rare titles still performing, there’s a fun thing: the title’s game lead position seems to open up every 6-12 (or so) months. Why isn’t someone sticking to capitalize on its tail and potential? 🤔

The Fix: Think Smart, Not Hard!

If Rovio and SEGA truly want long-term success, they need short- and mid-term wins, e.g.,:

1. Hybrid Casual Games with Long Tails:

Rovio could focus on hybrid casuals blending accessibility with depthful and investable meta and monetization, e.g.,:

🧩 Emerging Puzzles with IP: Imagine AB-themed Nuts & Bolts puzzle where players solve AB’s level pieces with island building and management meta (narratives and world-building to play and stay).

🏗️ Simulation/Tycoon wave: Titles like My Perfect Hotel have shown the potential; and Rovio has the expertise and power of IP to create unique twists. Though, this wave could be late already; but it’s a good reference.

2. Trend Identification and Validation:

Task forces to spot emerging trends and validate them quickly. Rovio has the talent, IP and brand strength to lead in these spaces if they move fast.

3. Leveraging IP Power for Marketability:

One advantage lies in IPs. By bringing IPs (own and SEGA’s) into new genres, they could open new depth of marketability—tapping into vectors competitors lack.

What SEGA Should Demand?

While SEGA and Rovio seem to be aiming for the long-term, they’re missing a critical point: the long-term is built on short- and mid-term wins. Faster and cost-effective bets in e.g., hybrid casuals or other rising segments could deliver results, lower risks, and more profitability. If Rovio starts prioritizing these, SEGA’s acquisition could actually pay off; and everyone wins! Continuing down the current path? That’s a tough road to walk.

About the author

Seasoned entrepreneur, executive, director, general manager & project/product lead bringing innovation, technology, startups and games to life!

Please login or subscribe to continue.

No account? Register | Lost password

✖✖

Are you sure you want to cancel your subscription? You will lose your Premium access and stored playlists.

✖