- arrow_back Home

- keyboard_arrow_right Highlights

20% Drop: AppLovin is in Trouble?

HighlightsJournal 200 Gamigion March 28

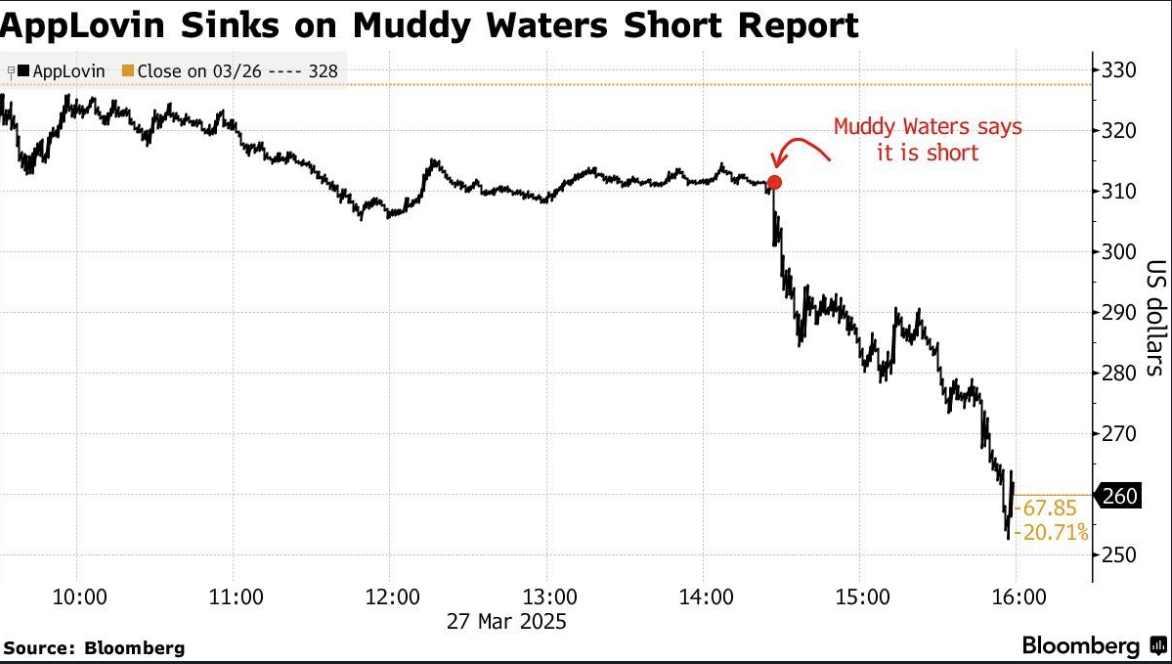

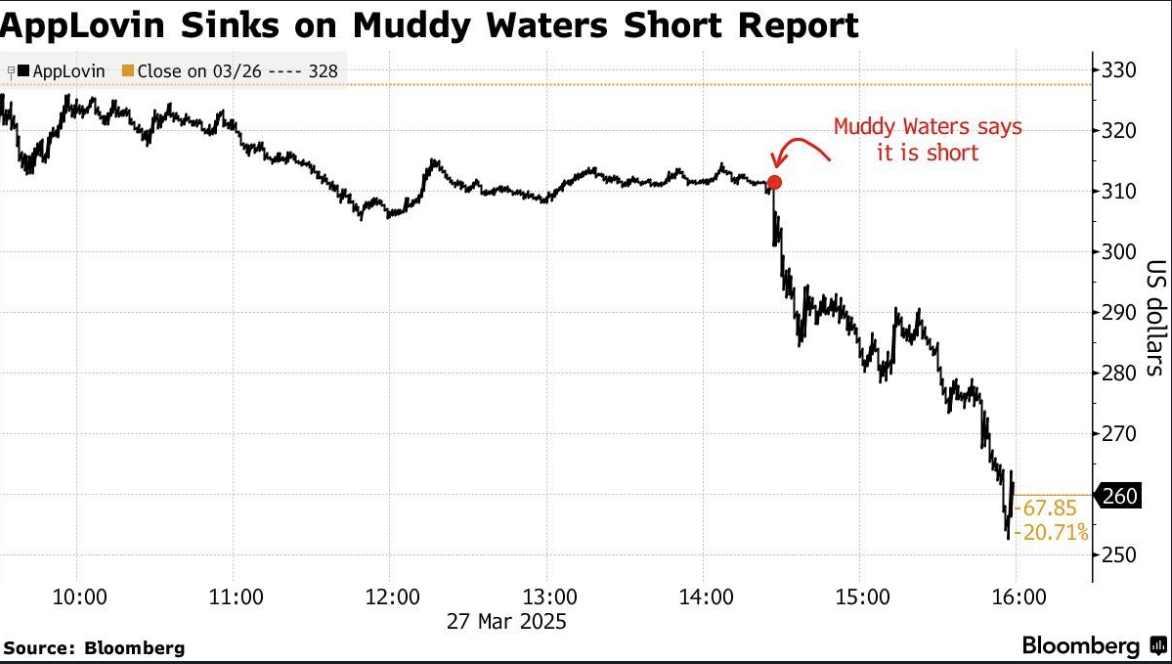

Ad tech titan AppLovin took a beating on Wall Street, with its stock plunging 20% after infamous short-seller Muddy Waters claimed the company could be violating Apple and Google’s platform rules.

- AppLovin, the tech star of 2024 with a jaw-dropping 700% climb, just hit a major wall. Its stock dropped over 20% in a single day after short-seller Muddy Waters fired a shot.

- The firm says AppLovin’s ad game breaks the rules, accusing it of pulling user data in ways that go against app store policies. In their words, it “systematically” crosses the line.

- This isn’t the first warning either—Muddy Waters is now the third short-seller raising the alarm. What looked like a rocket ship might be heading back to Earth.

It’s not that new. We had the first shot on the 26th Feb week.

AppLovin Scandal: New Target of Short Sellers?

What?

“Systematically” skirting App Store rules by secretly pulling proprietary user IDs from platforms like Meta, Snap, TikTok, Reddit, and Google. The goal? Powering targeted ads, without user consent.

The firm warns that if AppLovin isn’t deplatformed, copycats will follow. “There’s little tech involved,” they say, “so what’s stopping others from doing the same?”

But this isn’t the first time AppLovin’s in the crosshairs.

Industry’s Take?

Just weeks ago, Fuzzy Panda Research and Culper Research fired their own shots, accusing the company of inflating key metrics and even tracking users, including children, without consent. That led to a previous 20% stock tumble and fueled a class-action lawsuit.

Now, Muddy Waters is doubling down, warning of potential deplatforming risk and alleging AppLovin’s methods are not only questionable but also easy to copy, raising concerns about a looming industry-wide ripple effect.

AppLovin CEO Adam Foroughi? Unfazed.

He’s fighting fire with fire.

In a sharp rebuttal, Foroughi blasted the latest short report as “easily discredited”, arguing their tech is anything but simple to replicate:

“If our stack is so easy to copy, why hasn’t anyone else done it? We scaled to a billion-dollar web business in months while competitors with decades of head starts still trail.”

He chalked up the skepticism to a misunderstanding of AppLovin’s cutting-edge AI advertising model, dismissing critics as those grasping for a simpler narrative to explain the company’s dominance.

His message to investors? “Dig deeper.”

With tensions escalating and shares tumbling, one thing is clear:

AppLovin is at the center of an ad tech war—and the fight’s far from over.